Resurrection ideas for FTX were revealed in a new project that was given the name FTX 2.0. These plans were developed by FTX CEO John Ray III. Documents that were only recently submitted to the United States Bankruptcy Court for the County of Delaware give insight into John Ray III and his team’s detailed planning and execution of the relaunch.

Over $290,000 was included in Ray’s invoices to the company’s bankruptcy estate. Additionally, FTX handed up an additional $1.3 million in compensation to employees who assumed control of the exchange and were accountable for the insolvent division.

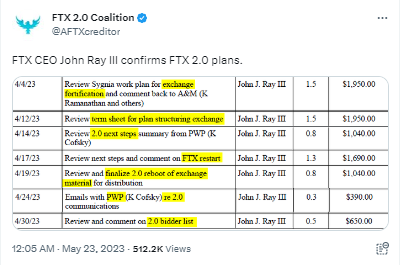

The filing demonstrated that Ray was actively engaged in formulating the strategy for FTX 2.0, despite the fact that he claimed to spend the majority of his time on administrative and legal concerns. This was despite the fact that Ray claimed to spend the most of his time on these things.

The attorneys representing FTX in bankruptcy court, Sullivan & Cromwell, disclosed last month that the CEO had been busy with several projects. These projects included providing cybersecurity company Sygnia with advice on how to improve its global cryptocurrency platform, reviewing the terms sheet for the exchange’s restructuring plan, investigating the steps required to relaunch the platform, and finalizing the FTX 2.0 document for distribution to potential investors.

According to the records filed with the court, John Ray III conducted research on potential purchasers for FTX 2.0. The venture capital firm Tribe Finance has shown an interest in resurrecting the bankrupt cryptocurrency, which is very important.

As the news of FTX’s revival and lofty objectives spread, the native token of FTX, FTT, witnessed an 8% gain to trade at $1.08 as of press time, down from a high of $1.16. This price represents a decrease from the previous high of $1.16. The market has expressed a revitalized conviction in the potential of FTX’s platform, which operates under the new FTX 2.0 design.

FTX wants $240 million back from its contentious purchase of Embed

In the midst of bankruptcy proceedings and comeback romours, cryptocurrency exchange FTX also filed a suit against its former CEO Sam Bankman-Fried and others engaged in the purchase of stock trading platform Embed.

According to court filings filed on May 18 in the US Bankruptcy Court in Wilmington, Delaware, FTX seeks to recover hundreds of millions of dollars to reimburse its creditors and consumers.

Former FTX executives are being sued for allegedly not doing enough research before shelling out a “astronomical” amount of $240 million for Embed, a firm now worth less than $1 million. The top bidder in the bankruptcy is being accused of paying too much for the transaction. At the same time, a new complaint has surfaced against Embed’s chief executive officer, Michael Giles, and the company’s stockholders.

cryptonews.net

cryptonews.net