-

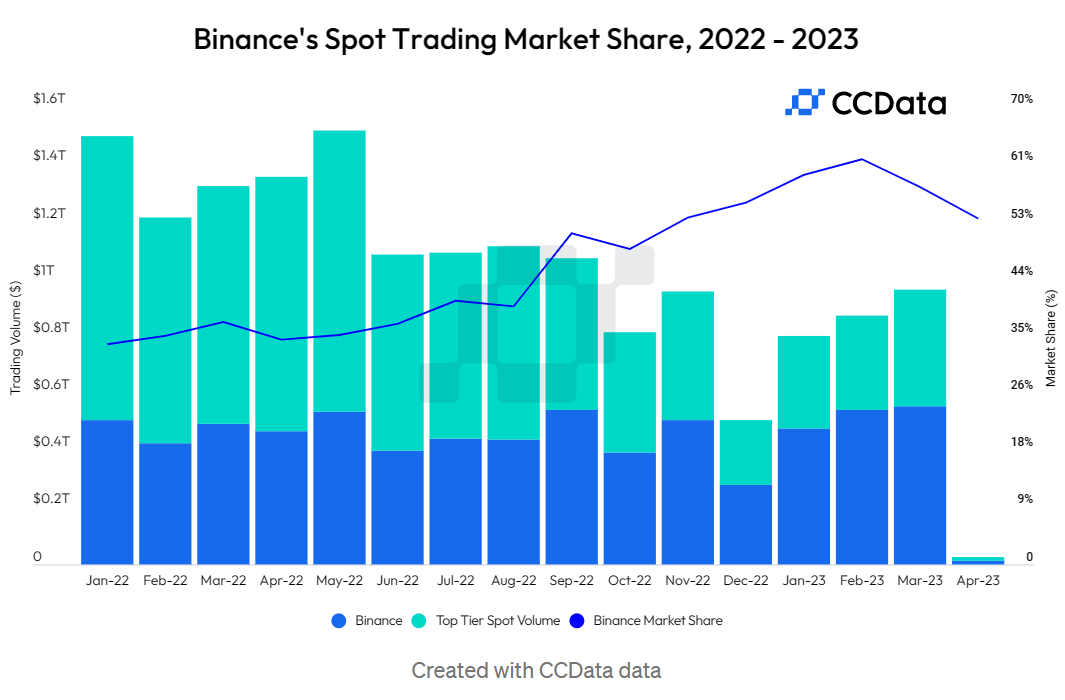

Binance's market share has plummeted to approximately 50% amid changes to its trading-fee structure and increased regulatory scrutiny.

-

Despite the significant decrease in spot trading volume, Binance maintains its position as the largest exchange by volume

Binance finds itself embroiled in a battle to maintain its dominance as its market share takes a dramatic hit. The company, renowned for its global influence now commands a mere 50% of the spot market – a steep decline from the heights it enjoyed since April 2022. This startling revelation comes from Dessislava Ianeva, a seasoned research analyst at Kaiko.

“We have to wait and see whether this is temporary or a more sustainable shift in trading patterns. Volume is also down, but the decline was mainly driven by the removal of BTC’s zero fees on March 22” Ianeva said

The market share of Binance is shrinking, Why?

A primary culprit behind Binance’s shrinking market share is the recent restructuring of its trading-fee policy. A year ago, the digital trading behemoth shook up the crypto world with a daring strategy, introducing zero-fee trading on several market pairs.

This aggressive move fueled a market share surge of over 20%, creating waves in the industry. However, the tide turned in March this year when Binance retracted this offer on 13 Bitcoin trading pairs, triggering a significant market retreat.

Our Latest Exchange Review is now live!🚀

— CCData (@CCData_io) May 10, 2023

April highlights:

✔ @binance's spot trading vol. fell 48.1% to $287bn

✔ $BTC – $TUSD vol. soared 851% to $34bn

✔ @upbitglobal's market share hit an all-time high of 4.77%

Discover more in our Exchange Review👇 https://t.co/KrvA9MVrEX

Increasing Scrutiny After FTX’s Fall

Binance’s position took another hit as it found itself grappling with the fallout from the spectacular collapse of its rival, FTX, last November. The company’s spot trading volume spiraled down by a staggering 48% to $287 billion in April, according to CCData, marking its second-lowest monthly trading volume since 2021. Yet, amidst the turmoil, Binance’s derivatives market share managed to climb to an all-time high of 64.0% in March.

The shifting sands of the regulatory landscape are speculated to be driving many investors and institutions into a cautious retreat. The aftermath of FTX’s downfall, coupled with the growing stringency of U.S. regulations, has ignited a retreat from the crypto markets, leading to a significant plunge in trading volumes and liquidity.

A Silver Lining for Binance?

Noelle Acheson, the author of the “Crypto Is Macro Now” newsletter, offers a fascinating perspective. She asserts that the rapid decline in Bitcoin spot volumes on Binance serves as a litmus test, revealing the speculative nature of much of the exchange’s volumes. However, she presents a silver lining, noting, “While a drop in volumes is usually not a good sign for a market, in this case, it signals less speculative churn, which is healthier.”

Despite the tumultuous events, Binance’s throne remains unclaimed, holding its position as the largest exchange by volume. Its nearest rivals, Coinbase and OKX, trail far behind, capturing a mere 5.60% and 5.39% of total spot trading, respectively.

Can Binance beat the increased regulation and maintain its unrivalled dominance in the face of its recent strategic changes? Only time will tell.

coinpedia.org

coinpedia.org