- Solana’s monthly DEX volume reached $109.8 billion in November.

- Daily transaction volume on Solana averages 53 million, showcasing its scalability.

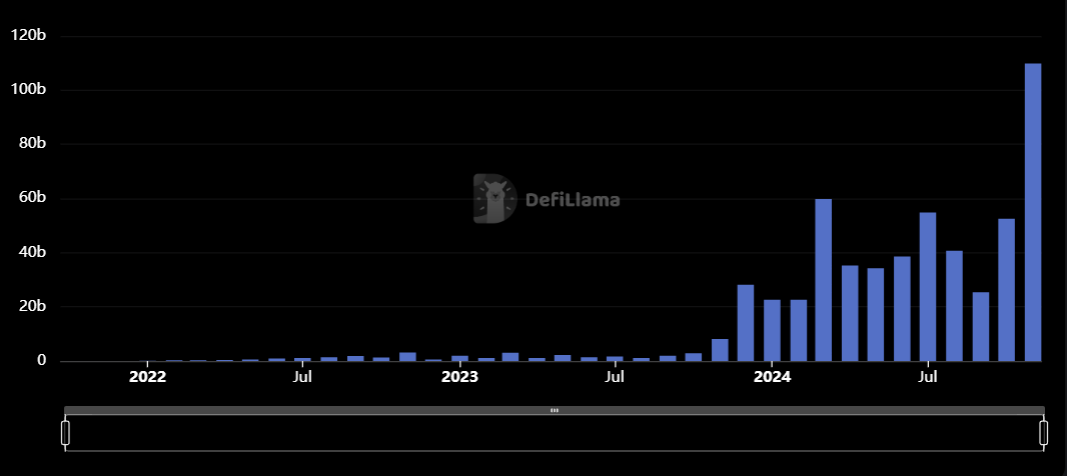

Solana has achieved a major milestone as its decentralized exchange (DEX) volume surpassed $100 billion in November. According to DefiLlama, Solana recorded $109.8 billion in DEX trading volume, doubling Ethereum’s $55 billion. The network also posted a remarkable 100% increase from October’s $52.5 billion, showcasing its dominance in DeFi.

This growth is driven by Solana’s unmatched scalability, memecoin activity and low transaction fees fueling over $5 billion in daily trading volume. Solana processes 53 million daily transactions, far outpacing other blockchains with less than 5 million.

With 107.5 million active addresses in November, Solana might break October’s record of 123 million. These numbers highlight its expanding user base and efficiency in handling high transaction loads.

Token platforms like Pump.fun and Raydium also contributed to this momentum. Both platforms generated record monthly fees of $71.5 million and $182 million, respectively. The ecosystem’s rapid development reflects growing market confidence in Solana’s ability to lead DeFi innovation.

SOL’s Price and Market Overview

Solana (SOL) currently trades at $255.72, up 0.56% in the last 24 hours. Its market cap stands at $121.40 billion, with a circulating supply of 474.73 million SOL. Trading volume surged by 6.03%, reaching $5.51 billion. The volume-to-market cap ratio of 4.55% signals healthy liquidity.

SOL faces resistance at $256.70 and support at $252.25. A breakout above $256.70 could push the price towards $260 or higher. However, a dip below $252.25 may lead to further declines.

The Relative Strength Index (RSI) is at 55.51, near the neutral zone, indicating balanced buying and selling pressure. The RSI average aligns closely, confirming a steady trend. Moving averages (9-day and 21-day) show a bullish crossover, supporting upward momentum.

With strong fundamentals and technical indicators favoring growth, Solana could maintain its DeFi dominance and attract more institutional and retail participants.

thenewscrypto.com

thenewscrypto.com