Cryptocurrencies have been feeling regulatory pressure for a long time. However, in some areas, this pressure has not fully materialized. This is certainly the case for the relatively new categories of NFT and DeFi. Based on the statements made by US regulators, we have been sharing warnings about this for a long time. The DYDX team is already looking for ways to address the future issues.

DYDX: Significant Progress

Among the largest decentralized cryptocurrency exchanges, DYDX can be considered one. The platform, which has made investors earn thousands of dollars through its airdrop, is now preparing for the expected pressure on DeFi. Officials from the SEC and CFTC have stated that platforms disguised as DeFi and utilizing decentralization masks will not be able to escape sanctions.

DeFi protocols managed by companies or foundations constantly offer earning opportunities to core developers. This makes developers liable for sanctions due to the income they receive through foundations or companies. We saw this in the Uniswap case.

However, dYdX Trading can escape these negatives because it has transformed into a non-profit foundation. Moreover, we are not talking about a mere transformation. This change also ensures the exemption from commission fees with version 4.

The Future of dYdX Coin

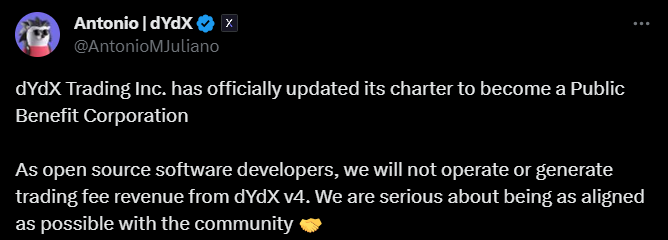

Antonio Juliano, the founder and CEO of dYdX, announced that dYdX Trading Inc’s regulations have been updated to operate as a Public Benefit Corporation. This represented a positive step in the long term for the platform’s native token.

“As open-source software developers, we will not generate or operate fee revenue from dYdX v4. We are serious about being as compatible with the community as possible. This is another step we are taking towards full decentralization. And the biggest step on this path will be taken with the full version of dYdX Chain.”

Juliano stated that with version 4, dYdX Chain will be managed by third-party validators and organizations, and the company will no longer oversee these functions.

If the team truly follows through with what they say, the protocol, supported by open-source developers but not profiting from the project’s success, can become more compliant with regulations. This would prevent it from being blocked by regulatory pressure in the US. While competitors struggle with regulators, if DYDX remains one of the best alternatives, it will increase its market share and see the token price rise.

However, if decentralization remains just a story, there is no reason for institutions such as the SEC and CFTC not to file lawsuits against Juliano and others. At the same time, there is a possibility of regulators filing lawsuits for past violations, if any.