The leading automated market maker (AMM) and decentralized exchange (DEX) liquidity pool, Curve Finance, launched Harmony Protocol. The integration will further Curve Finance growth and help it achieve its vision of creating deep on-chain liquidity.

Curve Finance doesn’t seem to be slowing down as the partnership boosts the decentralized finance protocol. With over USD 15 billion total value locked (TVL) in DeFi, Curve Finance is currently the most extensive protocol on DeFi.

Harmony Protocol, which announced the integration via its official Twitter handle, noted that the collaboration would benefit both platforms. According to the announcement, Curve Finance will leverage Harmony’s interoperability solutions to develop deep on-chain liquidity.

Harmony further revealed that the integration would enable Curve to utilize its bridges to Ethereum and Binance Smart Chain (BSC). This will essentially boost Curve Finance’s ability to support stablecoin swapping across multiple chains.

We've just launched on @harmonyprotocol with some $ONE rewards.https://t.co/n4Fu5C0lNm pic.twitter.com/ytu8sFkE1w

— Charlie Watkins (@charlie_eth) October 12, 2021

As a result of the partnership, Curve Finance will also extend its stablecoin swapping solutions to the Harmony ecosystem. Also, USD 2 million in $ONE tokens incentives have been announced by Harmony to help the decentralized exchange protocol promote its launch.

Meanwhile, in the first 12 hours of its launch on Harmony blockchain, Curve already recorded over USD 16 million TVL. According to Giv Parvaneh, a senior blockchain engineer at Harmony, the DEX platform recorded remarkable growth on its launch.

Total Value Locked in Defi Surpasses USD 200 Billion

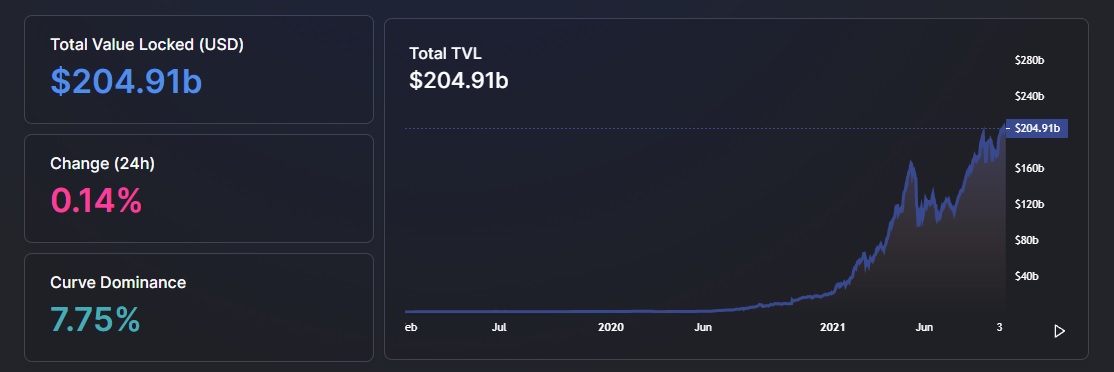

DefiLlama, a DeFi TVL aggregator, has disclosed that TVL in DeFi protocols has surpassed the USD 200 billion mark for the first time.

According to the picture above, the total value locked in DeFi has grown by nearly ten percent since the beginning of this year.

Also, Curve has a TVL of USD 15.87 billion, representing the most extensive dominance on DeFi. On the other hand, Curve interacts with seven different crypto networks, including Avalanche (USD 5.87 bn), Ethereum (USD 140.4 bn), Polygon (USD 4.2 bn), among others.

Source: DeFiLlama

Meanwhile, Aave, Makerdao, and Wrapped Bitcoin (WBTC) are significant contributors to the DeFi TVL growth. Aave represents a whopping USD 14.7 billion, Makerdao holds USD 13.6 billion, and WBTC captures $11.5 billion in TVL.

It is also worth noting that the entire DeFi TVL is spread across blockchain protocols like Ethereum, Harmony, Solana, and Polygon. Others include Avalanche, Fantom, Terra, Arbitrum, Binance, Celo, and Harmony.

$CRV and $ONE Price Update

Currently, Curve Finance’s DAO Token,$CRV, prices are increasing, having gained 2.1% over the past 24 hours to reach USD 2.7. It currently has a marketcap of USD 1,044,087,339 with a 24-hour trading volume of USD 164,964,677.

Meanwhile, Harmony native token,$ONE, was also experiencing a bullish run as it gained 6.8% in the last 24 hours. The token traded at USD 0.238 with a 24-hour trading volume of USD 393,345,592 and a marketcap of USD 2,566,248,157.

altcoinbuzz.io

altcoinbuzz.io