- Tokenized asset issuance platform Synthetix to get a $20M investment.

- Through a partnership with Web3 investment firm DWF.

Synthetix, a tokenized asset issuance platform, received $20 million via a partnership with DWF Labs, a Web3 investment and quantitative trading firm. Synthetix, a decentralized asset insurance protocol, allows users to mint, hold and trade various derivatives. Digital Wave Finance (DWF) is a Singapore-based global digital asset market maker and a multi-stage web3 investment firm.

Synthetix has raised $20M in a token sale round from DWF LABS@synthetix_io Perpetual Protocol will be integrated into @DwfLabs' trading business to increase the trading volume of the protocol. The current $SNX fully diluted valuation is $970M.

— TOP 7 ICO | #StandWithUkraine🇺🇦 (@top7ico) March 20, 2023

👉 https://t.co/0rgI67Zrue pic.twitter.com/qxABMcFgYB

Synthetix Meets DWF

The algorithmic and market-making company recently acquired $15 million worth of SNX, a native token of Synthetix paid for USDC in March 2023. DWF Labs will now be tasked to increase the token liquidity and market-making throughout centralized and decentralized exchanges.

Perpetual futures of Synthetix will now be integrated into the trading business of DWF Labs as part of the deal. At the same time, the latter has also committed to purchasing more SNX worth $5 million after the integration of services of Synthetix are completed.

More on Synthetix and DWF

Synthetix offers the facility to tokenize real-world assets into a derivative known as Synths, thereby providing users with the exposure to a wide range of assets. SNX holders can lock their tokens in a smart contract for mining Synths against the corresponding value.

Users can also trade Synths using Synthetix’s pooled collateral model. The trades between the Synths generate fees which are then provided for SNX collateral. The value of real-world assets is tracked by creating on-chain synthetic assets. These include a synthetic version of fiat currencies or certain commodities like Gold, or they could also be for equity indices.

Managing partner at DWF Labs, Andrei Grachev, said that this crucial partnership would facilitate the streamlined trading mechanism in the Decentralized Fiance (DeFi) realm. By taking advantage of Synthetix’s deep liquidity and composability, platforms can deliver lower slippage trades, further facilitating the transformation of hedging strategies and unique use cases.

Synthetix – A Brief History

In March 2023, the V2 platform of Synthetix crossed the $400 million mark in perpetual swap daily trade volume. The derivatives liquidity protocol also surged in daily fees in June 2022, post their collaboration with liquidity provider Curve Finance to create Curve pools.

These Curve pools were used for Synthetic Ether (sETH)/ETH, Synthetic USD/3CRV, and Synthetic Bitcoin (sBTC)/BTC. This partnership facilitated the seamless conversion of Synths such as sETH to ETH and increased the SNX token value by 100%.

Where Does Synthetix Stand Now?

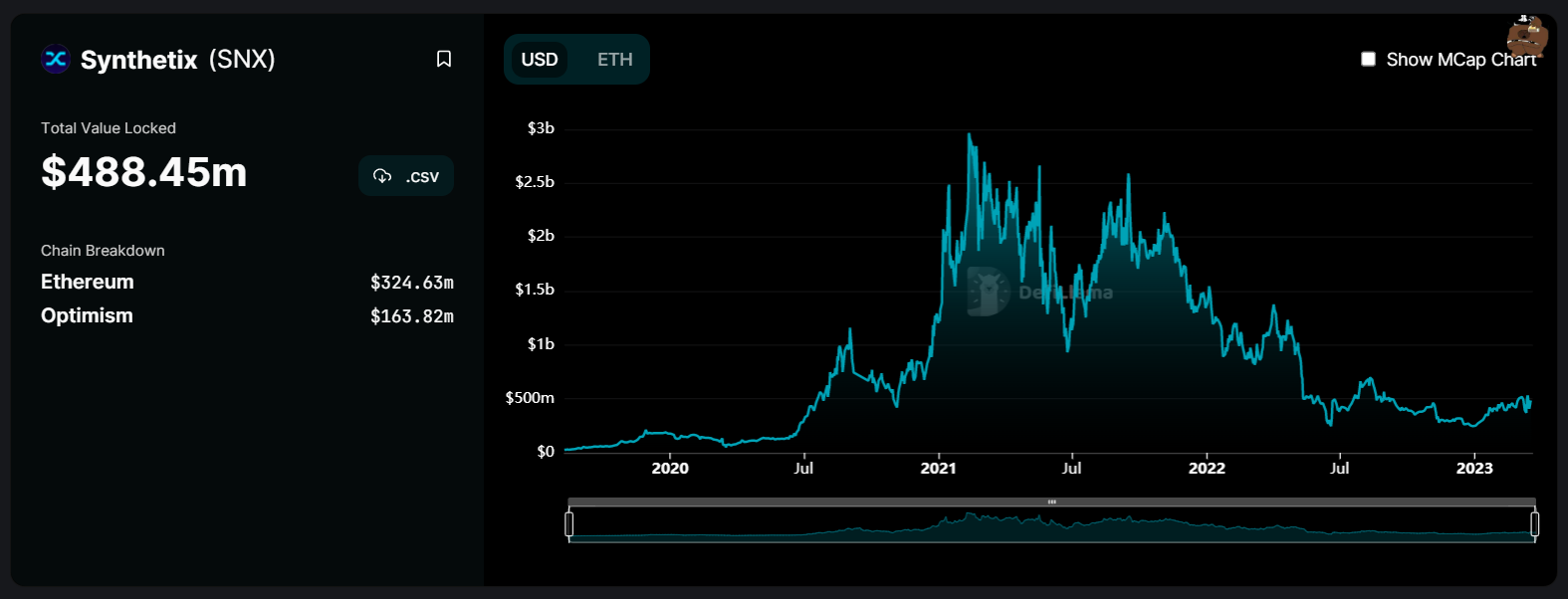

According to data from Defillama, the Total Value Locked (TVL) in the defi protocol is $488.45 million with $324.63 million in Ethereum and Optimism worth $163.82 million.

The chart clearly shows a considerable decline in the protocols TVL. It was at its peak in mid-2021, and it was seemingly suffering long before the start of crypto winter and numerous collapses and bankruptcies that rocked the crypto industry to its core.

This partnership can potentially boost the TVL graph if everything goes as planned. A slight upward movement can be seen around the partnership rumors, and supposedly this trend might continue.

thecoinrepublic.com

thecoinrepublic.com