- Acala is integrating Chainlink Oracle Pallet.

- Polkadot is launching many parachains soon.

- Acala is one of the first to go live.

The Polkadot network is almost set to launch parachains that will establish its interoperable blockchain ecosystem. Acala will be one of the first parachains to go live. Hence, it is preparing to offer a full multi-chain DeFi hub service on Polkadot.

A successful launch will ensure that Acala is fully integrated with key infrastructure and tooling. This will bring rapid development and enhanced security for all user funds. One of the key infrastructures on Acala’s DeFi parachain is oracles.

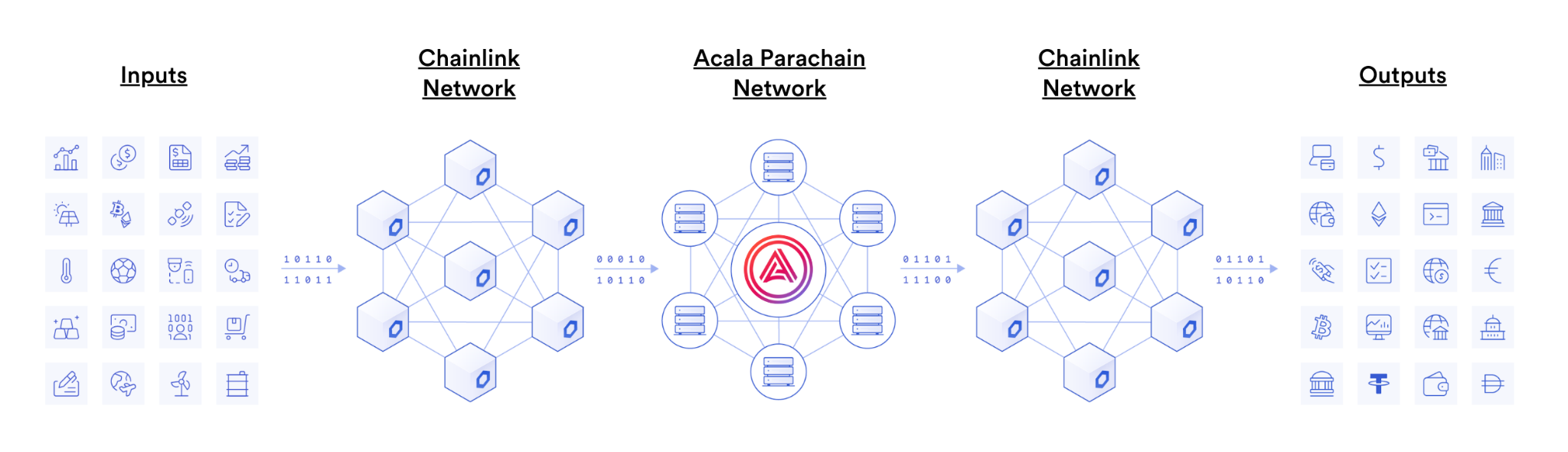

Oracles come with key inputs such as asset prices and market information that are critical to executing core functions. This is why Acala actively integrates Chainlink Price Feeds to create a resolute foundation for its DeFi ecosystem. This gives developers direct access to the industry’s most time-tested decentralized oracle solutions right from the date of launch.

Meanwhile, with Chainlink, developers can tap into decentralized price oracles to gain a wide range of asset prices. These are backed by low latency updates, high-quality data, and robust underlying infrastructure optimized for availability and tamper resistance.

As one can imagine, both teams have been working tirelessly in the past few months to ensure a secure integration, including the completion of a security audit. Since the launch of the Chainlink Oracle Pallet, the progress has only accelerated.

In detail, the Chainlink Oracle Pallet is a runtime module that can be easily plugged into Acala. It provides a straightforward approach for accessing Chainlink Price Feeds. To add on, Acala has also integrated Chainlink Price Feeds into Karura, where extensive stress testing is always taking place to prep for Acala’s launch on Polkadot.

To highlight, Acala is a multi-chain DeFi platform that exists in the Polkadot ecosystem. It allows users to stake, swap, lend, borrow, earn, and otherwise put their tokens to work with minimal network fees. It is also a highly scalable, EVM-compatible network optimized to power a wide diversity of DeFi applications.

Thus, developers can deploy innovative financial use cases that will benefit from Acala’s ability to blend the best of the EVM and Substrate worlds. Moreover, Acala’s layer-1 chain offers a broad suite of DeFi primitives to developers building on the platform.

This includes a trustless staking derivative called Liquid DOT (LDOT). LDOT is a multi-collateralized stablecoin backed by cross-chain assets called aUSD. It is also backed by an AMM DEX called Acala Swap where fees can be covered by any token.

In order to power Acala’s planned DeFi DApps as well as launch the many other DeFi products and markets, the Acala parachain will need the industry’s best oracles. For instance, DeFi apps like futures/options contracts, lending/borrowing markets, and even algorithmic stablecoins need external data.

This could be current asset prices or market information like Consumer Price Index (CPI) or total market cap. There are a limitless number of external data feeds users may need, which do not natively exist on the blockchain.

However, getting external data on the blockchain requires an oracle to fetch data, aggregate it, validate it, and then deliver it on-chain. Although, if DeFi applications are to retain the trust assumptions of the blockchain, then the oracles they rely on must provide similar guarantees on their services to ensure end-to-end security and reliability.

This is why Acala chose to integrate Chainlink to power the launch of the Acala parachain. Mostly because its decentralized oracle solutions are built to the highest standards and proven to help secure tens of billions in value across the DeFi economy.

Here are some of the notable features of Chainlink Price Feeds:

- High-Quality Data — Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that are aggregated from hundreds of exchanges, weighted by volume, and cleaned from outliers and suspicious volumes. Chainlink’s data aggregation model generates accurate global market prices that are resistant to flash crash outliers, API downtime, and data manipulation attacks like flash loans.

- Secure Node Operators — Chainlink Price Feeds are secured by independent, security-reviewed, and Sybil-resistant oracle nodes run by leading blockchain DevOps teams, traditional enterprises, and data providers. Chainlink nodes have a strong track record for reliability, even during extreme network congestion and high gas prices.

- Decentralized Network — Chainlink Price Feeds are decentralized at the data source, oracle network levels, and oracle node, generating strong protections against downtime and tampering by either the oracle network or the data provider.

- Economies of Scale — Chainlink Price Feeds benefit from the economies of scale effect, where increasing adoption allows multiple projects to collectively fund and use shared oracle networks to fetch commonly required datasets (e.g. DOT/USD). This allows DeFi projects to get robust oracle security and premium data quality for a fraction of the total cost.

All in all, the Chainlink Oracle Pallet will set developers on Acala up for early success. To specify, it will eliminate go-to-market time, reduce costs, and forgo unnecessary risks around deploying one’s own oracle solutions.

It is Acala’s mission to make building DeFi applications easy and secure. This is why Acala is excited to work with the experienced team at Chainlink Labs. Together they will provide developers on Acala with proven prebuilt oracle solutions. It will also assist in building customizable oracle solutions to fit their unique needs. The firm encourages development teams building on Acala to reach out if they need assistance with their oracle solutions.