MicroStrategy has confirmed its commitments to Bitcoin as its CEO has integrated the Lightning Network into his corporate email structure.

On April 18, MicroStrategy CEO Michael Saylor revealed that he converted his corporate email address into a Lightning address. “People keep sending me 21 sats [satoshis],” he added.

The integration means that anyone can send the executive BTC using his company email address as an identifier.

Furthermore, the Lightning Address protocol enables users to replace a payment request with an identifier such as an email address. This makes sending and receiving payments easier than using long crypto wallet addresses or QR codes.

It is a little similar to the Ethereum Name Service (ENS) protocol which facilitates the same thing using internet addresses on the Ethereum network.

Whether Saylor will integrate the Lightning Network into all corporate email addresses remains unclear. However, the firm is currently pushing a “Bitcoin and Lightning for Corps” initiative at its company event in Florida in early May to spur adoption.

Lightning Network Adoption Slowed … Or Has It?

The Lightning Network is Bitcoin’s layer-2 scaling solution which can process up to a million transactions per second.

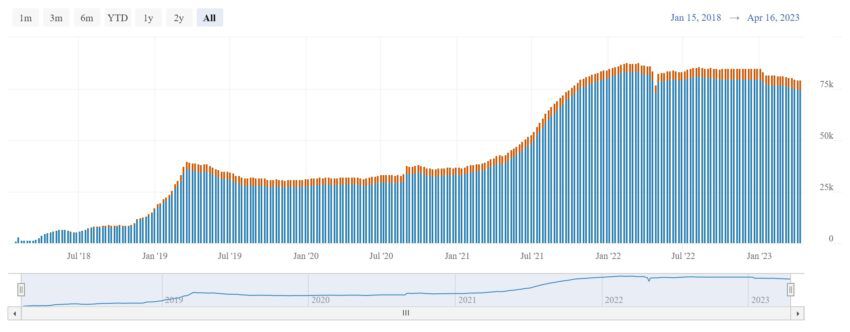

According to Bitcoin Visuals, the number of Lightning Network channels has declined by 6.5% this year. Total channels hit a peak of around 88,000 in March 2022 but have fallen back to roughly 79,000 by April 2023.

Furthermore, the number of Lightning nodes topped 20,000 in March 2022 but is currently around 18,000. This suggests a slight decrease in network activity during the current bear market.

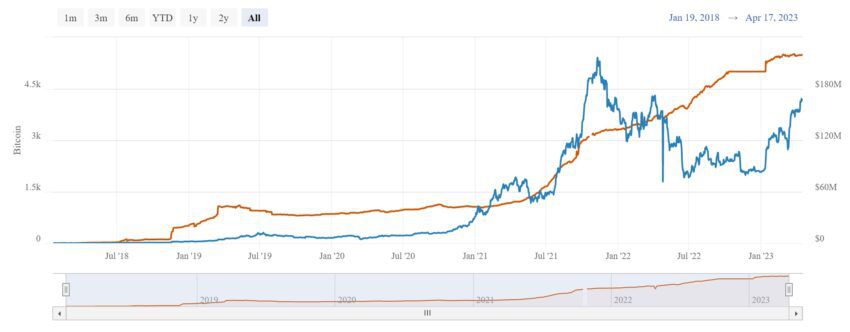

However, the current Lightning Network capacity is 5,490 BTC, around $165 million, according to Bitcoin Visuals. This metric is at an all-time high in terms of BTC having gained 50% over the past 12 months. This metric suggests the opposite as more BTC is flowing into the payments network.

MicroStrategy Back in the Black (Just Barely)

MicroStrategy is back in the black with its Bitcoin holdings following the recent rally to $30,000.

According to Bitcoin Treasuries, the software firm holds 140,000 BTC and is the largest corporate holder of the asset. At current BTC prices, the stash is worth $4.1 billion.

However, if Bitcoin markets start to correct as they appear to be today, MicroStrategy will slip back into the red again.

At the time of writing, BTC was down 1.5% on the day and changing hands for $29,530, according to BeInCrypto.

beincrypto.com

beincrypto.com