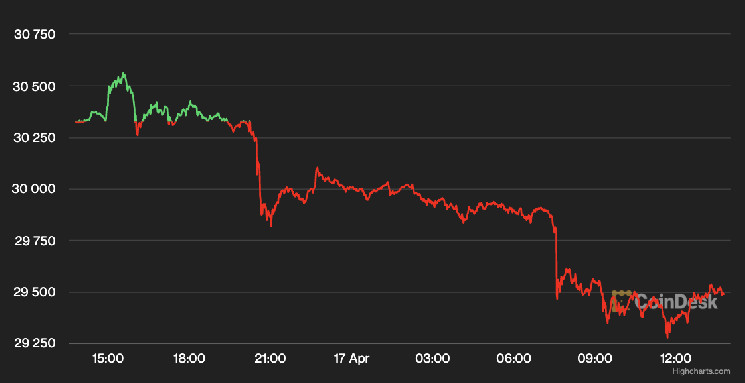

Bitcoin (BTC)’s rally above $30,000 has stalled – at least temporarily.

The largest cryptocurrency by market capitalization was recently trading at around $29,500, off 2.6% over the past 24 hours. BTC began sinking on Sunday and dropped as low as $29,292 before rebounding slightly, according to CoinDesk data.

Encouraged by mildly upbeat inflation data last week, investors sent BTC’s price over $30,000 for the first time since last June. However, the surge from $28,000 was "largely untested," Joe DiPasquale, CEO of crypto asset manager BitBull Capital, wrote in an email to CoinDesk.

“Even though it breached $30,000, the price was likely to look for support on the downside and potentially consolidate before another leg up,” DiPasquale said, adding that with BTC recently sticking around mid-$29,000, most indicators on the hourly time frame, such as Relative Strength Index (RSI) and Stochastic RSI, hint at a spike upward.

“What the bulls will want to see is a strong bounce from between the $28,000 and $29,000 range and a reclaim of $30,000 in the coming days," he said, although he also noted that BTC’s price could decline to $23,000 before rebounding – In this case, “it may take longer for (the) upside to materialize.”

Coinglass data showed that traders who bet on prices’ shifts have liquidated over $32 million worth of BTC long positions since Sunday evening versus some $1 million of BTC short positions. These types of long squeezes tend to send prices lower.

Riyad Carey, research analyst at crypto data firm Kaiko, said that several macroeconomic factors, including Monday’s U.S. dollar jump and a mixed bag of first-quarter earnings results, might have sent BTC’s price downward. The U.S. Dollar Index and BTC's price is negatively-correlated, Carey told CoinDesk, adding that that correlation has decreased since the start of the year.

Elsewhere in markets

Ether (ETH) was recently hovering around $2,084 Monday, down 0.7% from Sunday, same time but holding steady post-Shapella upgrade. Among other altcoins, Avalanche's AVAX token recently rallied over 7% to trade at around $20.7. Perpetuals-focused decentralized exchange dYdX's DYDX token rose by 5% to trade over $3.

The CoinDesk Market Index (CMI), which measures the overall crypto market performance, was down 2% for the day.

After surging late last week, crypto-related stocks also dropped on Monday: Shares of exchange Coinbase (COIN) and bitcoin mining firm Marathon Digital Holdings (MARA) lost over 3%, while business software firm – also known as large BTC holder – MicroStrategy (MSTR) headed south by 5%.

Equity markets were mixed as investors awaited earnings reports from a number of major banks, including Bank of America and Goldman Sachs. The S&P 500 and tech-heavy Nasdaq were down 0.1% and 0.2%, respectively. The Dow Jones Industrial Average (DJIA) was almost flat.

coindesk.com

coindesk.com