Bitcoin and gold dominate discussions as alternative investments, representing the clash of modern and traditional stores of value. But both have very little in common. Gold has been revered as a store of value since ancient times, whereas Bitcoin was born less than two decades ago.

Bitcoin recently surpassed silver in market value, highlighting its growing adoption as a decentralized, scarce, and inflation-resistant digital asset, positioning it as a modern alternative to traditional precious metals.

With its fixed supply, transparent ledger, and increasing institutional acceptance, Bitcoin is being increasingly viewed by investors as the “next gold. ” It offers similar benefits of wealth preservation and diversification while embracing the advantages of the global digital economy.

The numbers back this up, with Bitcoin seeing a staggering 10,000% return over the last decade compared to gold’s more modest 117% and a 2,500% return over the past five years versus gold’s 102%.

However, gold remains the time-tested king of wealth preservation, revered for its long history as a haven during economic uncertainty. For thousands of years, it has been a reliable hedge against inflation, currency devaluation, and economic crises.

Universally recognized and valued, gold’s intrinsic properties—such as scarcity and durability—contribute to its stability as an asset. It is also a key tool for diversifying investment portfolios, offering stability when other markets are volatile, making it an essential asset for many investors. Gold’s proven track record in both value retention and diversification solidifies its role as a cornerstone of wealth preservation.

A more thorough comparison is necessary to determine which of these heavyweights provides the best long-term investment opportunity. Let’s dive in:

Bitcoin’s Performance Over the Years

Source | The height of peaks is decreasing, indicating that BTC is stabilizing as an asset.

Launched in 2009, Bitcoin (BTC) is a decentralized digital currency free from government control. In 2010, it was worth only a fraction of a cent ($0.003), and currently, it has crossed $97,000! Experts predict it could touch $100k by the end of 2024.

Despite its previous volatility, Bitcoin is stabilizing as an asset. This trend is largely due to increasing institutional involvement, regulatory clarity in key markets like the U.S. and Europe, and growing acceptance as a digital store of value. Technological upgrades, including the Taproot enhancement, have also improved Bitcoin’s scalability and privacy, reinforcing its long-term prospects.

Additionally, the introduction of Bitcoin Spot ETFs, such as those filed by firms like BlackRock, has made it easier for institutional investors to gain exposure to Bitcoin without directly holding the asset.

With President-elect Donald Trump’s pro-crypto stance, Bitcoin’s position as a mainstream asset appears solidified.

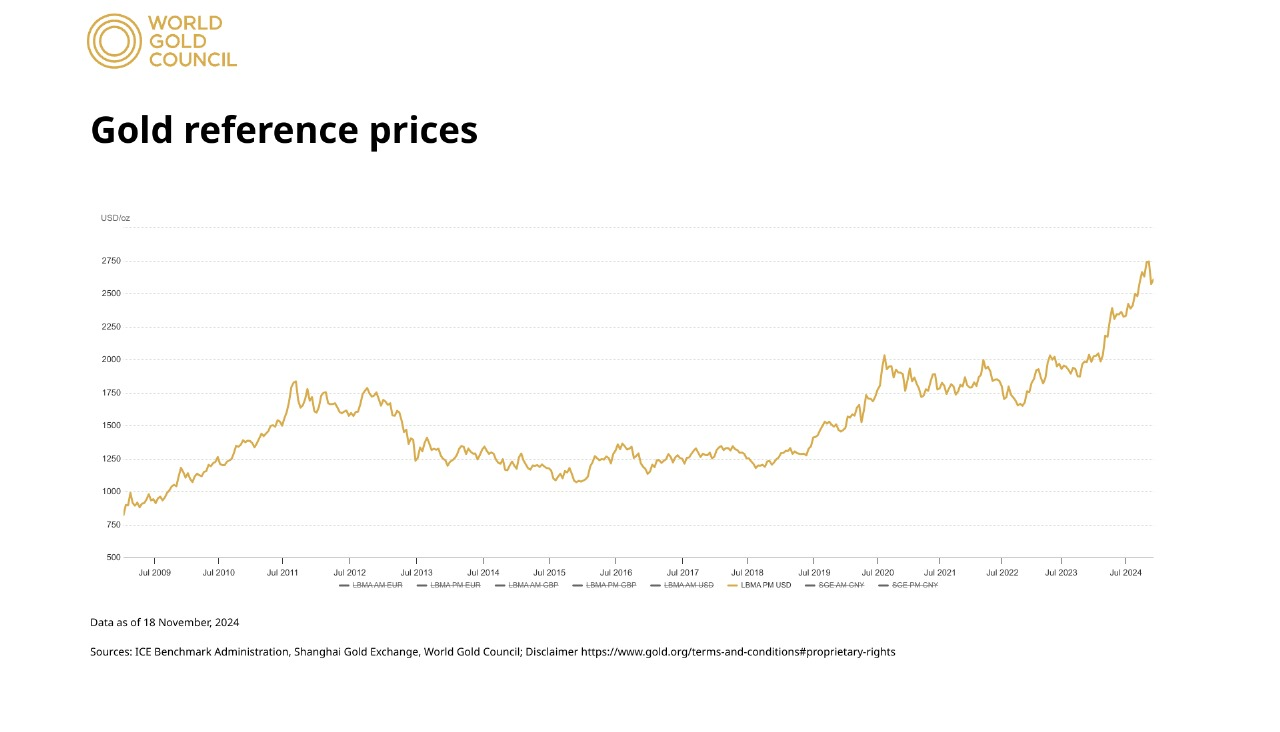

Gold’s Performance Over the Years

Source | Gold demonstrates steady, gradual growth with little volatility.

Gold has been valued for millennia, not only as a safe-haven asset but also for its physical properties, such as resistance to corrosion and excellent conductivity, which make it indispensable in electronics and technology.

It is widely used in jewelry, contributing to nearly 50% of its global demand, and is a significant component of central bank reserves as a tool for economic stability.

Furthermore, gold’s universal recognition and limited supply enhance its reputation as a reliable store of value.

Gold has long been recognized as a safe-haven asset during times of economic turmoil, geopolitical instability, and market uncertainty. For instance, during the Eurozone Debt Crisis

Similarly, in the 2008 Global Financial Crisis, gold prices soared as stock markets plummeted, underscoring its ability to preserve wealth in times of financial stress. During the COVID-19 pandemic, gold reached record highs above $2,000 per ounce in 2020 as central banks worldwide adopted aggressive monetary policies. Gold’s status as a refuge during global conflicts is further exemplified by historical events such as World War II. Its low correlation with stock markets is largely due to gold being influenced by macroeconomic factors—such as inflation, currency stability, and central bank demand—rather than corporate earnings or investor sentiment.

Notably, Warren Buffett’s surprising investment in Barrick Gold in 2020 highlighted how even long-time skeptics of gold recognize its value during economic uncertainty.

Whether during crises or as a portfolio diversifier, gold’s resilience makes it a cornerstone of financial stability. Gold is known for its low correlation with traditional assets, making it a valuable hedge during market corrections or geopolitical events, such as the Eurozone Debt Crisis from 2010 to 2012. Its ability to maintain or increase value in such scenarios has solidified its role as a tool for wealth preservation during global financial downturns.

Bitcoin vs Gold: Key Differences

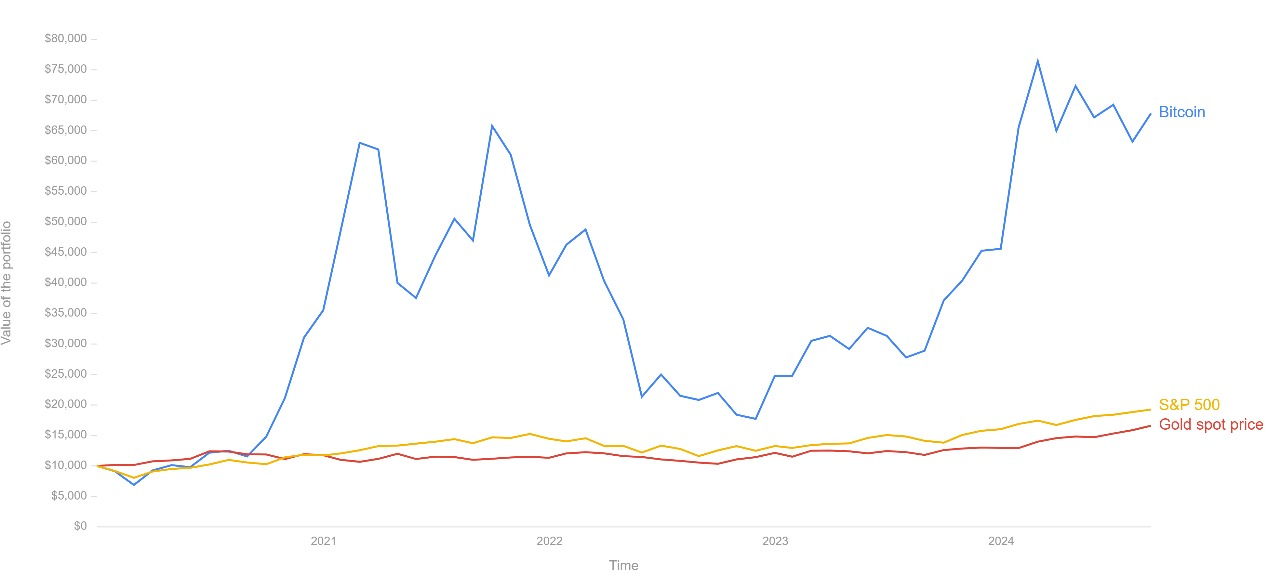

Let’s compare the returns of BTC and gold:

|

Time frame |

Gold |

Bitcoin |

||||

|

ROI |

Annualized Return |

ROI |

Annualized Return |

|||

|

|

33.0% |

33.0% |

124% |

124% |

||

|

|

55.51% |

15.67% |

154% |

34.22% |

||

|

|

87.03% |

13.26% |

1343% |

144.61% |

||

|

|

147.0% |

9.46% |

39929.51% |

57.43% |

||

Over the short term (1 to 3 years), Bitcoin outperforms gold with impressive growth, especially in 2023. In contrast, gold shows more consistent, steady growth.

Over the long term (5 to 10 years), Bitcoin’s returns far exceed those of gold, but its dramatic fluctuations make it a higher-risk investment.

Gold, on the other hand, remains a stable, low-risk asset with a steady, predictable return, which appeals to more conservative investors. But in recent years, BTC has stabilized as an asset.

Now, let’s compare gold and BTC on various parameters:

Store of Value

-

Gold has a

5,000-year history as a store of value, consistently holding its worth through various economic crises. For example, during the 2008 financial crisis, the value of gold surged as investors sought refuge from stock market crashes. -

Bitcoin, often called “digital gold,” shares this store-of-value appeal but has key differences. Its limited supply—capped at 21 million coins—makes it inherently scarce, unlike gold, which does not have a finite supply. This scarcity is reinforced by Bitcoin’s deflationary design, with the last block projected to be mined around 2140. These attributes attract institutional investors like MicroStrategy, which holds billions in Bitcoin to counter inflation risks. However, Bitcoin’s volatility—driven by speculative trading, regulatory changes, and market sentiment—means it lacks the same consistent stability as gold.

Scarcity and Supply Dynamics

-

Gold is scarce but continually mined, with discoveries still being made. However, despite these new mining operations, the world’s gold supply increases only incrementally each year, which provides a natural balance between demand and supply.

-

Bitcoin is unique due to its fixed supply cap of 21 million coins, which has become a key driver for its long-term value proposition.

Portability and Divisibility

-

Gold is less portable and divisible than Bitcoin. Transporting large amounts of gold is costly, and dividing gold can affect its purity and value.

-

Bitcoin is highly portable and divisible. You can send Bitcoin globally in minutes, and it can be divided into tiny fractions (Satoshis), making it accessible to small investors.

Correlation with Traditional Markets

Source | Bitcoin’s direct correlation with the S&P 500, while gold’s price movements remain largely unaffected by broader market trends.

-

Gold typically has a low correlation with stock markets, often rising when equities decline. During the 2008 global financial crisis, gold surged while stock markets crashed.

-

Bitcoin has shown a correlation with tech stocks and the broader market. During the COVID-19-induced market sell-off in March 2020, Bitcoin fell in sync with equities. More recently, Bitcoin’s price movements have mirrored those of the NASDAQ during times of market optimism and risk-taking.

Inclusivity and Accessibility

-

Gold is not as easily accessible for small-scale investors. While central banks and large institutions hold gold, individuals typically need to purchase gold bars, coins, or ETFs, which come with storage and security costs.

-

Bitcoin is highly accessible and can be bought by anyone with an internet connection. Many platforms make Bitcoin purchasing as easy as buying stocks, opening up access to a global audience, particularly in developing countries.

Regulation

-

Gold is well-regulated. Central banks control large reserves, and gold is traded on established exchanges. It has a long history of being integrated into the global financial system.

-

Bitcoin is subject to evolving regulatory frameworks. In 2022, the U.S. government began to introduce more clarity on crypto regulation, while countries like China have banned it. Bitcoin’s decentralized nature makes it harder to regulate, but governments are increasingly focused on how to manage it.

Risks of Bitcoin

Despite all its promise, investing in Bitcoin too has its share of pitfalls, namely:

-

Regulatory uncertainty remains a concern, as governments are still developing rules around its use, taxation, and trading, which could impact its price and adoption.

-

Despite Bitcoin’s robust blockchain, security risks, such as hacking, phishing, and theft from exchanges or wallets, also pose a threat.

Conclusion

Gold remains a reliable store of value, prized for its stability and resilience during economic downturns. With a proven history of holding value during recessions and geopolitical crises, gold continues to be a staple in diversified portfolios, providing investors with safety during uncertain times. While its value rises with inflation and market volatility, gold is generally less prone to rapid fluctuations than more speculative assets.

Bitcoin, on the other hand, has become a more stabilized asset as institutional involvement increases. With growing support from key players like BlackRock, the rise of Bitcoin ETFs, and President Trump’s pro-crypto stance, the market outlook appears bullish.

And despite its risks, Bitcoin continues to evolve. With its fixed supply and decentralized nature, Bitcoin is increasingly viewed as an attractive store of value and a hedge against inflation.

By understanding the risks and rewards of both Bitcoin and gold, investors can tailor their portfolios to align with their risk tolerance and long-term financial goals.

cryptonews.net

cryptonews.net