Fetch.ai Foundation has transferred 10 million FET tokens, worth about $11.8 million, to DWF Labs. Fetch.ai, which struggled in the last quarter, has made significant progress in the evolution to autonomous m2m.

However, its latest decision to transfer a significant portion of its native FET tokens to DWF Labs, a reputed market maker and liquidity provider in the decentralized cryptocurrency world, has raised eyebrows among investors. There is apparent concern as to whether this is a well-thought-out strategy or just a defensive move given the latest market scenario.

DWF Labs(@DWFLabs) received 10M $FET($11.8M) from https://t.co/BJF75TJoRr Foundation 1 hour ago.https://t.co/0aXgL46Tra pic.twitter.com/w5l5m3C3Bv

— Lookonchain (@lookonchain) September 3, 2024

How is Fetch.ai Looking Today?

Inevitable fluctuation has recently accompanied primary operations with FET tokens. According to stats from CoinMarketCap, FET is at $1. 14, marking a down of 4.47% within the last 24 hours.

It is important to note that cryptocurrency’s price has dropped lately. Market speculators and their counterparts in the stock market eye the development aghast at the possibility of a spell of selling that a movement of such a large volume of tokens could trigger.

This is because while both the market capitalization and the trading volume have been lowered, this indicates future market reactions and the impact of these reactions on FET’s near-term future.

Technical Analysis: A Bearish Outlook on the Horizon?

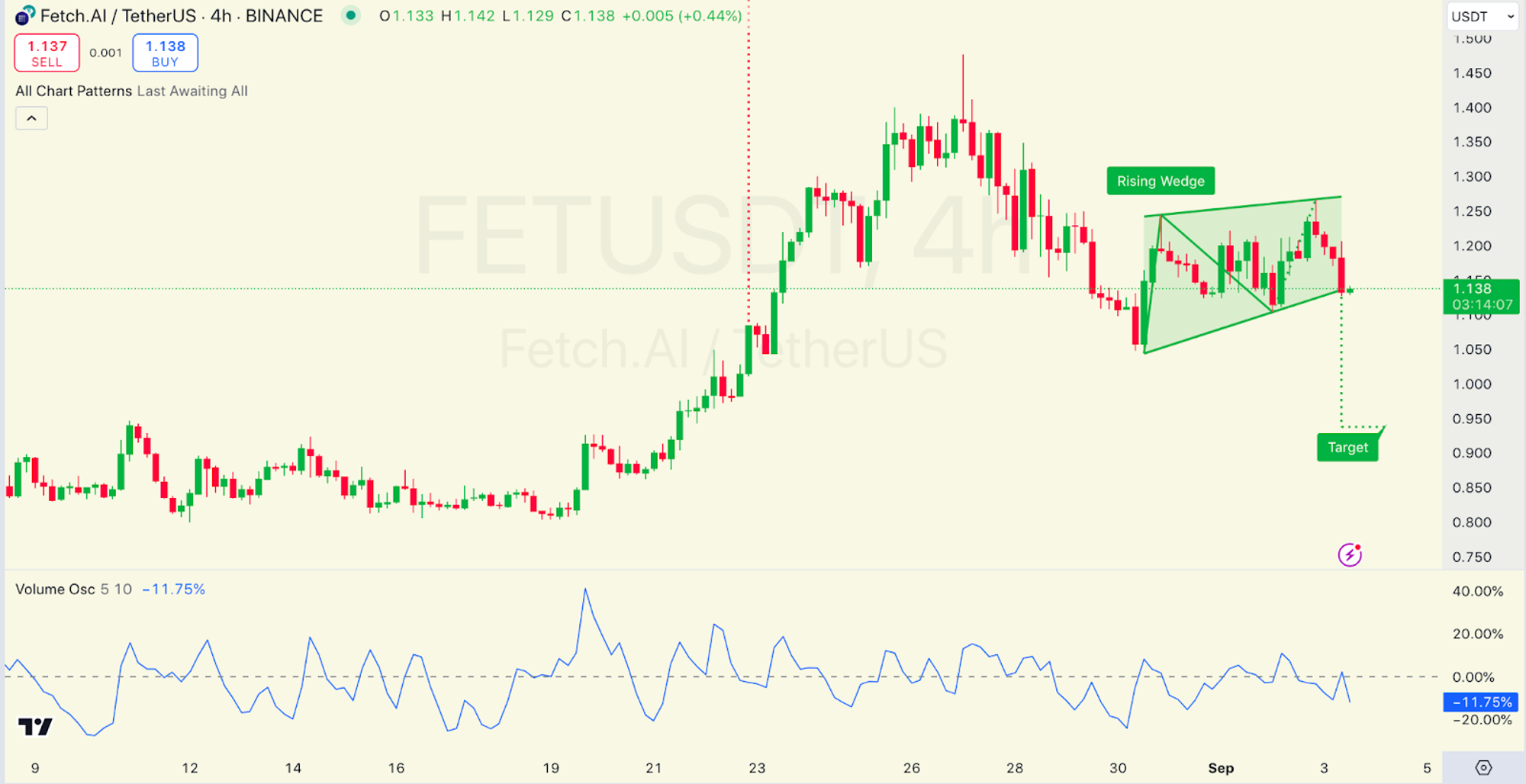

In the technical analysis platform, the fluctuation of prices in the AI token in recent times should be cautiously approached. The arrow from the upper part shows the rising wedge at the 4-hour FET/USDT chart, a bearish pattern by default.

Climbing wedges typically signal a reversal of the price, and this is even so when the volume declines, as in this case. From the pattern viewed, it suggests a further collapse to the low of $1.00 psychological level. 00.

The volume oscillator at 11 further states this, suggesting a very high decrease in volume. 75%, which supports the bearish outlook and reveals dwindling bullish sentiment. Less trading typically occurs in a bearish pattern, and when a deeper bear follows this, it’s enough to trigger concern for those who own FET tokens.

4-hour FET/USDT Chart | Source: TradingView

One speculation that arises from this is that the share transfer could contribute to the so-called ‘liquidity enhancement’ initiative. DWF Labs could contribute to increased FET liquidity as a market maker, improving its offerings and trade ability in various channels.

This would kind of fit with Fetch.ai as it will enhance the utilization and application of its technology to multiple industries as its primary objective. Another theory that has now emerged is that the organization’s foundation might be preparing for an announcement or an affiliation.

The motives of the transfer and magnitude point towards preparatory movements of a large-scale event that may necessitate immediate availability of cash or working capital.

thecoinrepublic.com

thecoinrepublic.com