- ApeCoin price noted a drawdown of more than 10% in the past 24 hours, trading at $1.82, nearing record lows of $1.78.

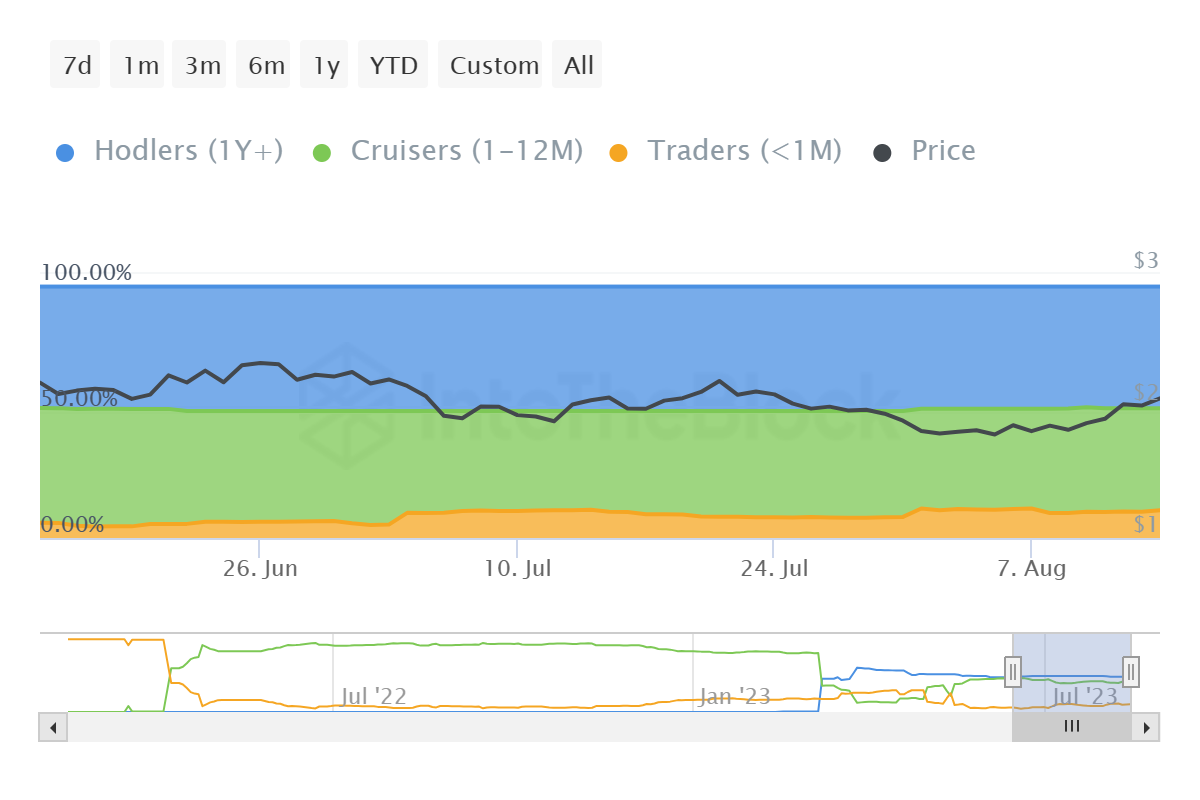

- The concentration of short-term holders has increased in Q3 from 5.8% to 11.0%.

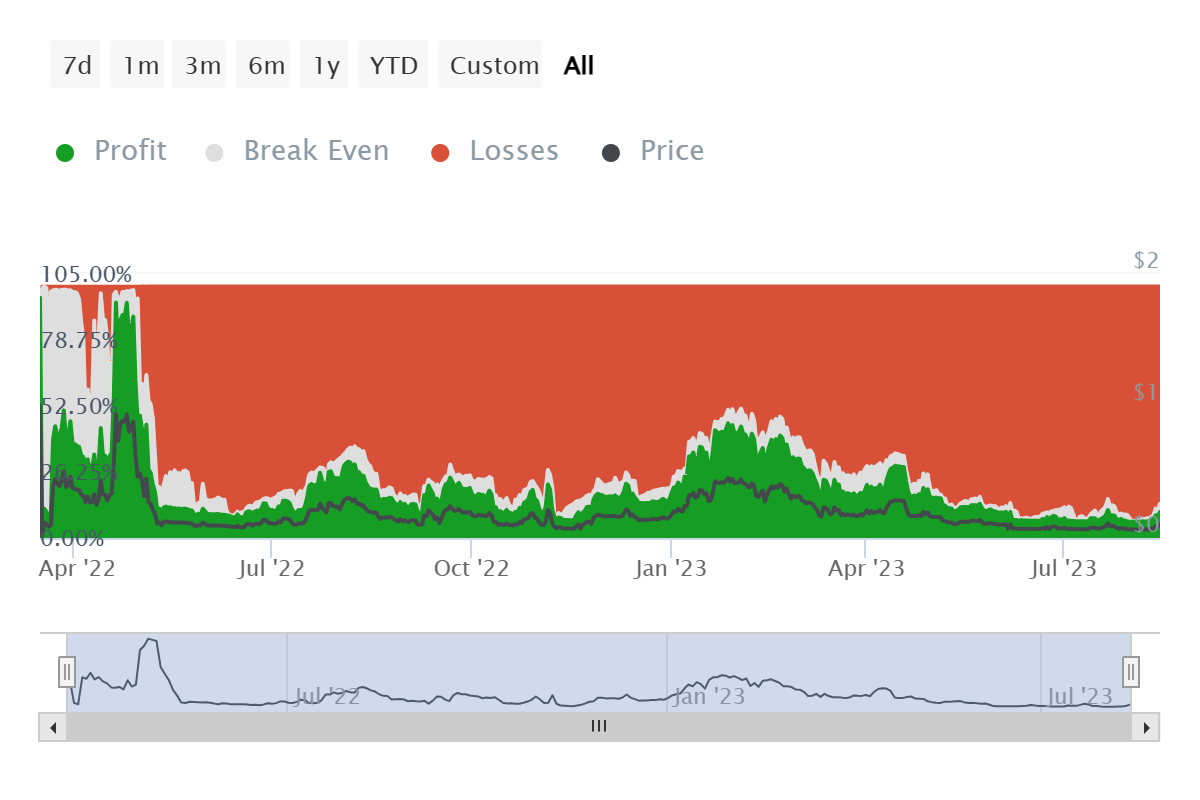

- The majority of APE investors remain underwater, as over 86% of the addresses are currently observing losses.

ApeCoin price was one of the worst-performing assets in the crypto market on August 15 as the broader market bearish woes overtook the optimism of recovery. However, a change in the investors’ behavior might also have a lot to contribute to the fluctuation in price at present and going forward.

ApeCoin price continues to decline

ApeCoin price recently hit an all-time low of $1.78 but managed to mark some recovery over the next couple of days. However, in the past 24 hours, the digital asset wiped out most of this recovery as APE slipped by more than 10% on the daily chart to trade at $1.82 at the time of writing.

The price indicators suggest further decline as the Relative Strength Index (RSI) fell below the neutral line of 50.0. The Moving Average Convergence Divergence (MACD) also exhibits a potential bearish crossover incoming, given the waning bullishness on the histogram.

APE/USD 1-day chart

Although beyond the market conditions, the shift in APE supply from mid-term holders to short-term holders (traders) contributes much to the decline. The traders are known to hold their supply for less than a month on most occasions, which leaves the cryptocurrency vulnerable to sudden selling.

Naturally, before the altcoin can stabilize itself or find a bullish momentum, the price collapses, which has recently been the case with APE. The Traders hold nearly 11% of the entire circulating supply, a stark increase from 5.8% at the beginning of Q3 in July.

ApeCoin supply distribution

This is one of the most significant contributing factors to the investors' losses, which in ApeCoin’s case are excessive. APE holders are some of the biggest losers in the market, with more than 86% of all addresses currently facing losses.

ApeCoin investors’ losses

Since ApeCoin price is relentlessly charting lows, it would not be surprising if the remaining 14% addresses also end up underwater going forward. However, if the market and investors want to prevent such a situation, some steadiness is required from APE holders.

fxstreet.com

fxstreet.com