Synthetix closed above $3 for the first time in 6 months. On-chain data shows that savvy crypto whales have intensified accumulation in the last 30 days.

How much further can SNX price rise?

Synthetix (SNX) is a decentralized liquidity protocol that enables users to mint derivative tokens on the Ethereum network.

Synthetix Social Sentiment Turns Bullish as 2023 Gains Cross 120%

On March 6, SNX reached a 6-month peak of $3.2, which sent its year-to-date performance above 120%. According to recent data compiled by blockchain analytics firm, Santiment, the perception surrounding SNX is largely optimistic.

SNX social sentiment is trending considerably lower at -0.6, compared to the euphoric 6.1 value recorded on Feb. 16 as illustrated in the chart below.

The weighted sentiment metric compares positive and negative mentions of an asset across prominent media channels. Typically, declining values indicate Synthetix network participants are currently dysphoric. Often a bullish signal for investors looking to buy the dip.

Another key indicator of upcoming bullish SNX price action is the buying pattern of crypto whales holding 100,000 to 1 million tokens.

The chart below shows that this cluster of holders has grown increasingly savvy over the past 2 years. Since March 2021, they have often sold just before the market hit a local top and entered accumulation mode when bullish trends hit bottom.

Over the last 30 days, this cluster of crypto whales has added over 5.5 million tokens to their holdings. And considering their history of timing price rallies accurately, SNX holders can expect the recent price upswing to culminate in a sustained bullish trend.

SNX Price Prediction: Is $4 On Sight?

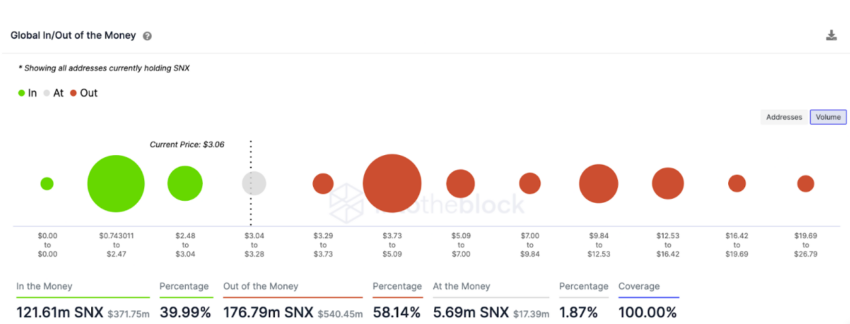

Regarding price projections, the Global In/Out of the Money (GIOM) data compiled by IntoTheBlock provides some insights.

After breaking the $3 resistance, SNX faces a smaller obstacle of 1,540 addresses that bought 3 million SNX tokens at $3.70. If SNX can cross this level, the next stop could be the $4.42 mid-point, where 7,800 addresses are hodling 106 million tokens.

On the flip side, failure to scale the next $3.70 resistance could see SNX retrace towards $2.72, where the GIOMP data shows 1,000 addresses holding 5 million tokens.

If there’s a further decline toward $1.87, approximately 9,300 addresses are holding 98 million tokens that may offer stronger support.

beincrypto.com

beincrypto.com