Quant ($QNT) market bearishness has increased in the previous 24 hours, with prices ranging between $132.96 and $137.33. As a byproduct of the bearishness, market participants have grown more cautious in their judgments, and traders have taken a wait-and-see strategy. At press time, the bears’ hand had reduced the $QNT price to $133.37, a 2.81% drop.

This drop had contributed to the market’s general bearishness, with traders now apprehensive of investing in $QNT, causing a 2.79% and 18.11% drop in market capitalization and 24-hour trading volume, respectively, to $1,610,310,082 and $22,025,409. Nonetheless, despite the bearishness in the $QNT market, long-term holders have remained firm, refusing to be rocked by the volatility.

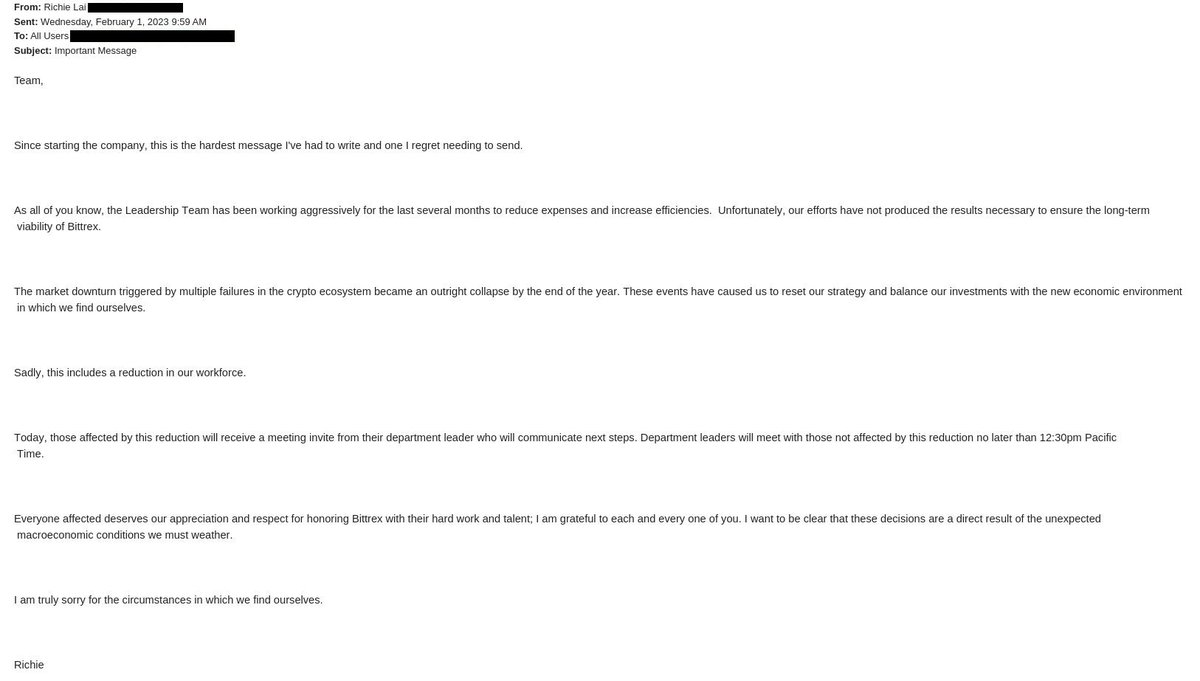

The bearish trend in $QNT remains apparent as the Keltner Channel bands move linearly, with the top band at 138.014687 and the bottom bar at 131.471048. Although the negative trend is clear, a breakout in $QNT is probable if the price rises above 138.014687 or falls below 131.471048. Since the price movement has moved below the middle band, there is a good chance that the negative trend will continue in the near term.

Although in the negative zone with a value of -10.8968, the Know Sure Thing (KST) moves north and above its signal line. This move suggests that the bearish trend in $QNT may end, and a breach of the Keltner Channel bands may offer confirmation.

With a value of 44.61, the Relative Strength Index (RSI) is trending below its signal line, indicating that the bearish trend is gaining momentum. As a result, despite the KST’s northward trend and the RSI’s negative bias, $QNT will probably continue to suffer a bearish trend soon. But, if a bullish breakthrough of the Keltner Channel bands emerges, the negative trend may reverse.

With a value of 28.56, the stochastic RSI is trending below the signal line, implying that the $QNT market is oversold and might be ready for a reversal soon. As a result, while trading in the $QNT market, investors and traders should be aware of this trend and seek prospective chances to profit from the potential upsurge.

The TRIX reading of -6.99 indicates that the negative trend in $QNT may continue in the immediate term. Still, increased purchasing pressure might trigger a reversal and a move to positive market momentum. As a result, investors and traders should keep an eye on the present negative trend while bracing for a possible positive turn soon.

coinedition.com

coinedition.com