The $XRP Ledger now hosts over $150 million worth of tokenized U.S. Treasury Debt amid a rapid increase in RWA value over the past year.

Real-world asset (RWA) tokenization, a growing narrative that has captured the attention of industry leaders such as BlackRock’s Larry Fink and SEC Chair Paul Atkins, has continued to see rapid expansion, and the $XRP Ledger (XRPL) is already capturing a good portion of this expansion.

Data confirms that tokenized U.S. Treasury Debt on the XRPL has grown in value to $150 million at press time, with leading tokenization platforms like Ondo, Zeconomy, and OpenEden contributing to this figure. While $150 million appears modest, it represents a 2,900% increase from the figures reported exactly a year ago.

Key Points

- The $XRP Ledger is now home to $150 million worth of tokenized U.S. Treasury Debt as RWA value sees a rapid spike over the past year.

- Popular tokenization platforms OpenEden Digital, Zeconomy, and Ondo contribute the most to the current figure.

- The total value of tokenized U.S. Treasury currently sits at $10 billion across all blockchain networks.

- While the $150 million share from the XRPL appears modest compared to other platforms, it represents a 2,900% rise over the last year.

$XRP Ledger Now Hosts $150M in Tokenized U.S. Treasury Debt

This is according to on-chain data provided by RWA.xyz, the lead platform on tokenized RWA market data. Specifically, the XRPL boasts over $1 billion worth of total tokenized RWA, including distributed and represented assets. The Crypto Basic confirmed this milestone in a recent report.

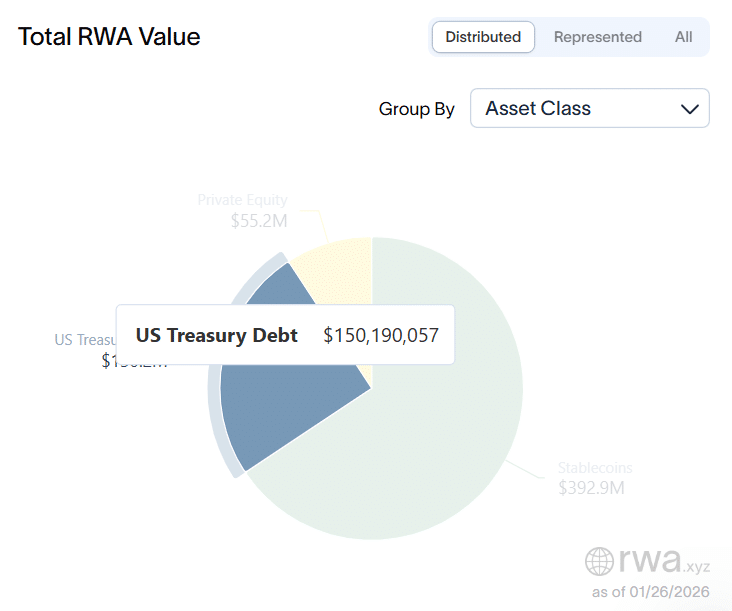

Of the $1 billion figure, distributed RWA makes up $598 million. Meanwhile, according to the classification from RWA.xyz, distributed assets include U.S. Treasury Debt, Private Equity, and Stablecoins. Notably, U.S. Treasury Debt accounts for $150.2 million, much higher than Private Equity ($55.2 million) but less than half of Stablecoins ($392.9 million).

However, the XRPL is dwarfed by other networks in terms of tokenized U.S. Treasury value. Notably, the total worth of on-chain U.S. Treasuries sits at $10.13 billion, indicating that the XRPL only hosts 1.4% of all tokenized U.S. Treasuries. Despite this, the current $150 million figure represents a 2,900% increase from the $5 million worth of U.S. Treasuries on the XRPL exactly a year ago.

Platforms Tokenizing U.S. Treasuries on the XRPL

Meanwhile, most of the U.S. Treasury Debt value on the $XRP Ledger is accounted for by just three platforms. Notably, OpenEden Digital, a subsidiary of the OpenEden Group, hosts $61.6 million worth of U.S. Treasuries on the XRPL with its OpenEden TBILL Vault product. This represents 41% of the total value of XRPL-based U.S. Treasuries.

Ondo accounts for $40.8 million worth of U.S. Treasuries on the XRPL with its Ondo Short-Term U.S. Government Bond Fund (OUSG). Zeconomy comes third with $40.039 million in U.S. Treasuries with the Guggenheim Treasury Services DCP product. Meanwhile, Archax boasts $7.712 million worth of U.S. Treasuries on the ledger through its abrdn Liquidity Fund (Lux) – US Dollar Fund.

thecryptobasic.com

thecryptobasic.com