At the start of the third week of January, total market-wide liquidations reached nearly $900 million. Negative volatility driven by Trump’s tariff impact on the EU caused the spike. The figure could rise further as several altcoins show warning signs.

$XRP, Axie Infinity ($AXS), and Dusk ($DUSK) are attracting capital and leveraging this week for different reasons. However, they could become traps for investors without strict risk management plans.

1. $XRP

On January 19, $XRP dropped to $1.85 before rebounding to $1.95. The decline erased most of the recovery effort since the start of the year.

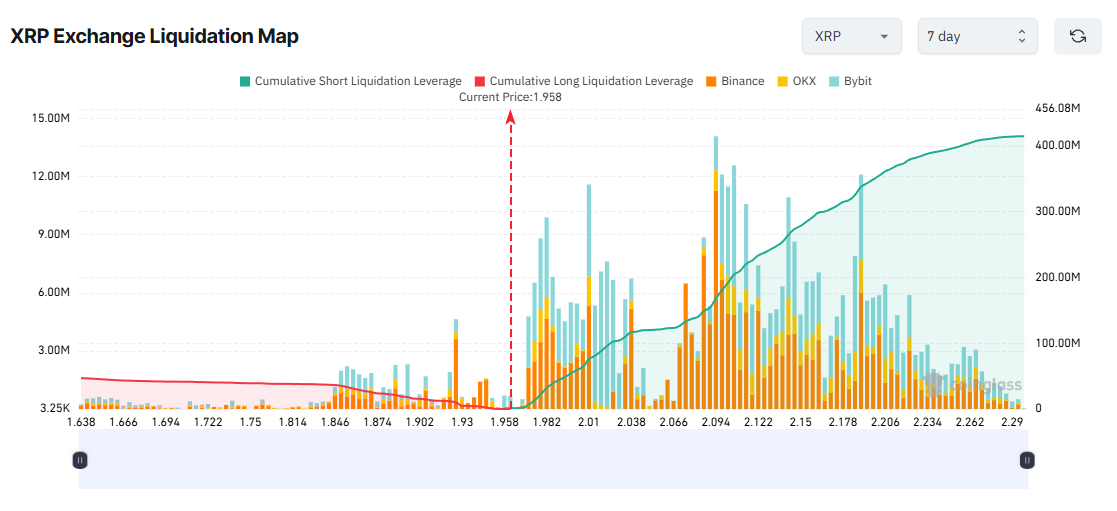

Short-term traders appear increasingly bearish. Many are betting on further downside. The 7-day liquidation map shows potential Short liquidations outweighing Long positions.

$XRP Exchange Liquidation Map. Source: Coinglass">

$XRP Exchange Liquidation Map. Source: Coinglass">

Liquidation data indicates that if $XRP rebounds to $2.29 this week, Short positions could face more than $600 million in liquidations.

This scenario could unfold if concerns over Trump’s new tariffs fade quickly. Strong buying demand around the $1.8 level would also support a rebound.

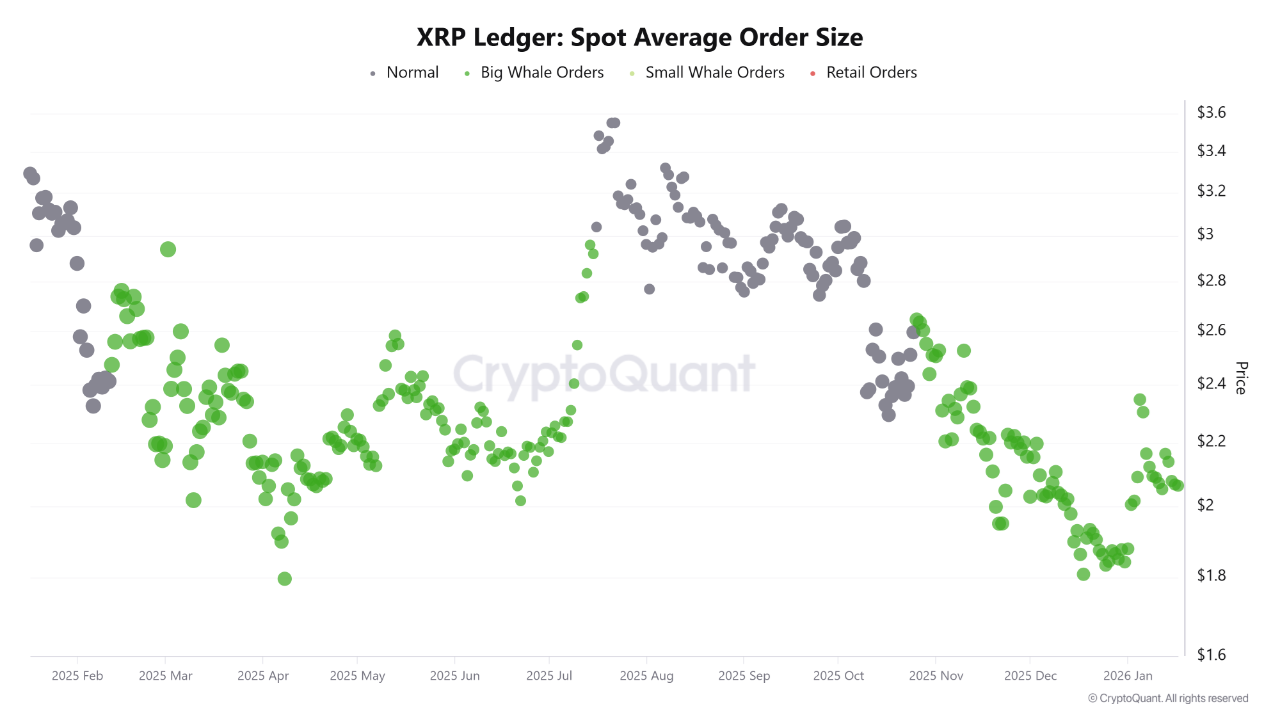

Another key metric is $XRP’s spot average order size. CryptoQuant data shows that when $XRP trades below $2.4, large whale orders appear frequently. This pattern reflects strong whale demand at lower price levels.

$XRP Spot Average Order Size. Source: CryptoQuant.">

$XRP Spot Average Order Size. Source: CryptoQuant.">

“Whale interest is at a 2026 high. Large orders are dominating the tapes, suggesting the “Smart Money” is front-running the next leg up.” – An analyst from CryptoQuant commented.

If whale accumulation surpasses the market’s temporary fears, $XRP could recover swiftly. Such a move would compel short traders into liquidation.

2. Axie Infinity ($AXS)

Axie Infinity ($AXS) unexpectedly returned to the top trending list in the third week of January. The token has gained more than 120% year-to-date.

The January rally is driven by the Axie founders’ plan to convert rewards into a new utility token called bAXS. This change is part of a broader tokenomics overhaul scheduled for 2026.

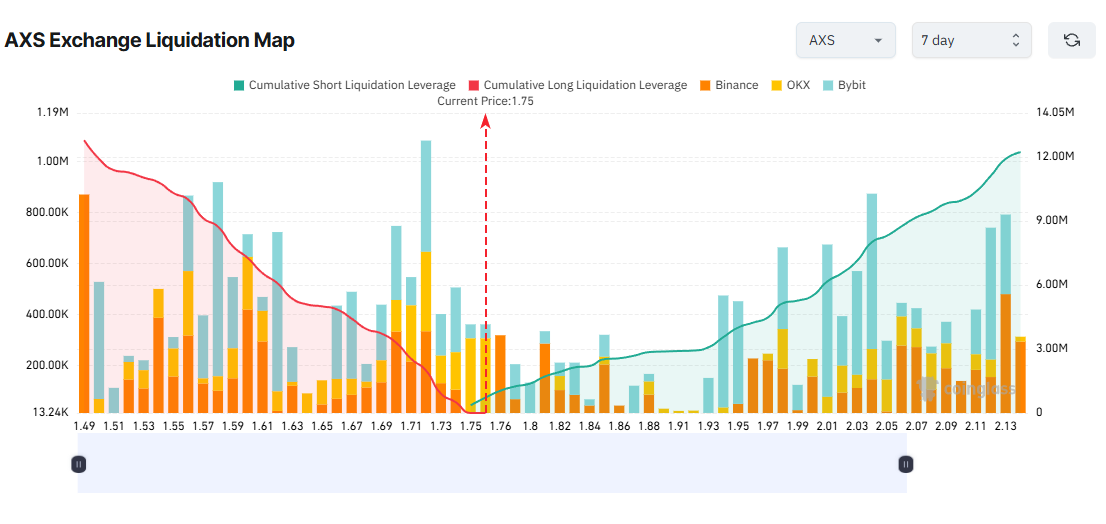

The 7-day liquidation map for $AXS shows a similar potential liquidation volume of around $12 million. However, the price range needed to liquidate Long positions is narrower than for Shorts. This suggests many traders still expect further upside in the short term.

$AXS Exchange Liquidation Map. Source: Coinglass">

$AXS Exchange Liquidation Map. Source: Coinglass">

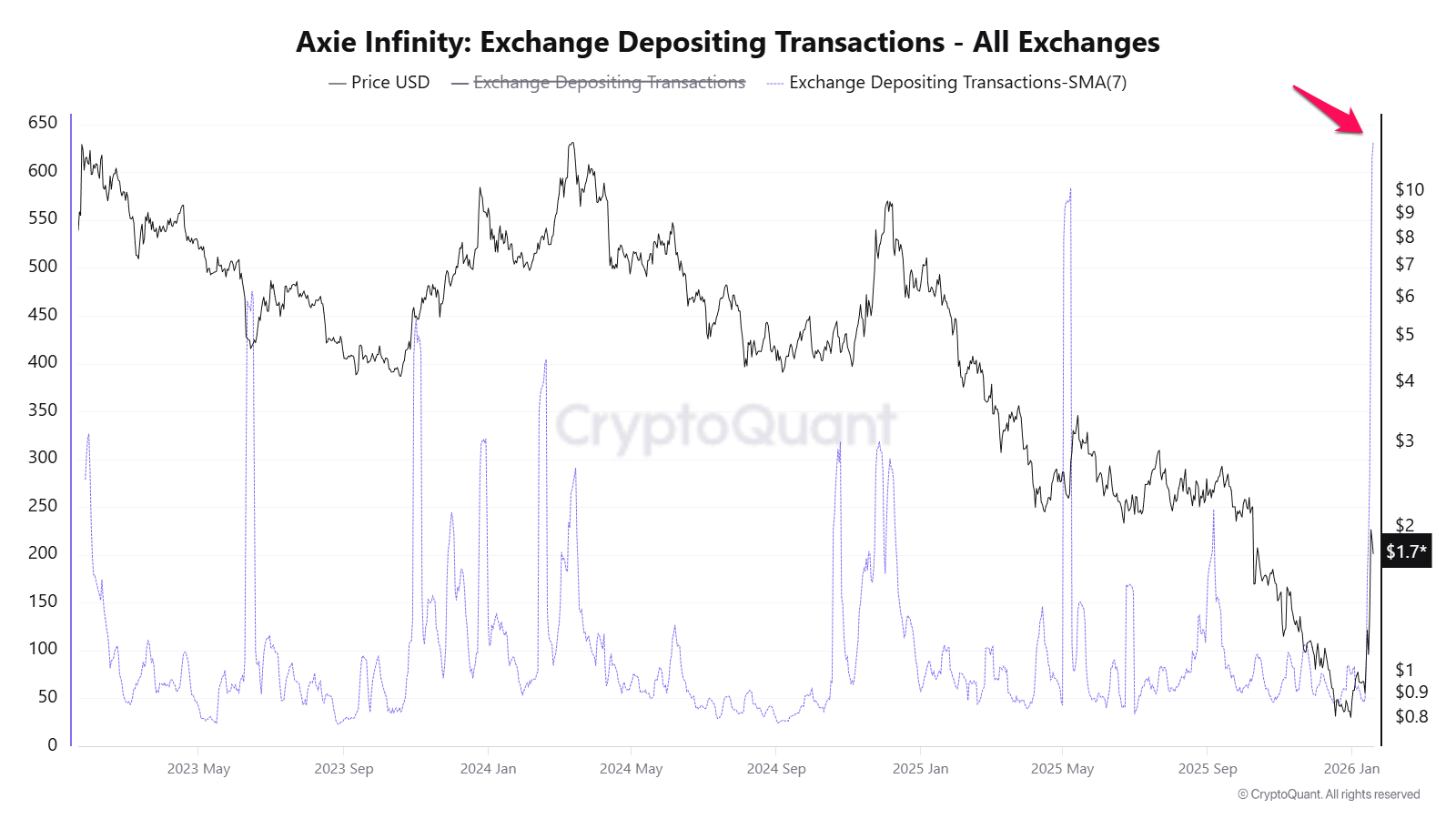

On the other hand, data shows that $AXS’s January rally coincides with a sharp increase in exchange deposits. The 7-day average number of deposit transactions has reached a three-year high.

This trend indicates that many investors are looking to exit as prices recover, potentially leading to selling pressure at any time. Such a development could put long positions at risk.

3. Dusk ($DUSK)

Dusk has emerged as a new standout in the growing interest in privacy coins. The rally reflects capital rotation from large-cap privacy coins to smaller-cap alternatives.

Despite a nearly sixfold increase since the start of the year, $DUSK has already triggered significant Short liquidations over the past four days. Short-term traders continue to add capital and leverage to bullish bets.

$DUSK Exchange Liquidation Map. Source: Coinglass">

$DUSK Exchange Liquidation Map. Source: Coinglass">

$DUSK’s liquidation map shows that potential Long liquidations dominate. If the price corrects this week, Long positions would face serious risk.

A recent BeInCrypto report highlights rising $DUSK inflows to exchanges. This trend reflects potential profit-taking selling pressure. In addition, $DUSK is rallying amid a return of market fear over Trump’s new tariffs on Europe. These factors threaten the sustainability of the uptrend.

In October last year, $DASH surged sixfold after capital rotated from ZEC to lower-cap privacy coins. $DASH then fell by 60% the following week. $DUSK faces the risk of a similar outcome.

If $DUSK’s FOMO fades and the price drops below $0.13, total Long liquidations could reach $12 million.

These three altcoins reflect very different, and even opposing, expectations among short-term traders. This complexity stems from geopolitical pressures clashing with internal market dynamics. Without strict stop-loss strategies, liquidation losses could hit both Long and Short positions.

The post 3 Altcoins That Could Trigger Major Liquidations in the Third Week of January appeared first on BeInCrypto.

beincrypto.com

beincrypto.com