Table of Contents

Data as of November 17, 2025

World Liberty Financial's $WLFI token functions as a governance and utility asset within a DeFi platform connected to the Trump family, offering staking rewards and platform access across multiple blockchains while carrying significant concentration risk, with insiders controlling roughly 60% of the 100 billion token supply.

The token launched in early 2025 after raising $550 million through a public sale, quickly listing on over 155 exchanges, including Binance. $WLFI operates primarily on Ethereum but expanded to Solana and $BNB Chain through Chainlink's Cross-Chain Interoperability Protocol. The token has since declined approximately 45% from its September peak as initial speculation cooled.

What Is the $WLFI Token Used For?

$WLFI serves as the core asset within World Liberty Financial's ecosystem, which aims to bridge traditional finance withDeFi through lending, borrowing, and stablecoin services.

The token provides governance rights that allow holders to submit and vote on proposals affecting platform development and protocol parameters. This community-driven model depends heavily on how tokens are actually distributed, since voting power follows token holdings.

$WLFI also enables staking for rewards, which supports liquidity and encourages long-term participation. Users who stake tokens contribute to ecosystem stability while earning returns.

Platform Access and Transaction Utility

Token holders can use $WLFI to pay transaction fees within the WLF platform and access advanced DeFi modules, including yield strategies, liquidity farms, and lending markets. The token also facilitates bridging services involving $USD1, the project's USD-pegged stablecoin.

The integration with WLF's stablecoin and lending framework takes inspiration from established DeFi protocols like Aave, positioning $WLFI as a gateway for participating in the ecosystem's core financial products.

How Are $WLFI Tokens Distributed?

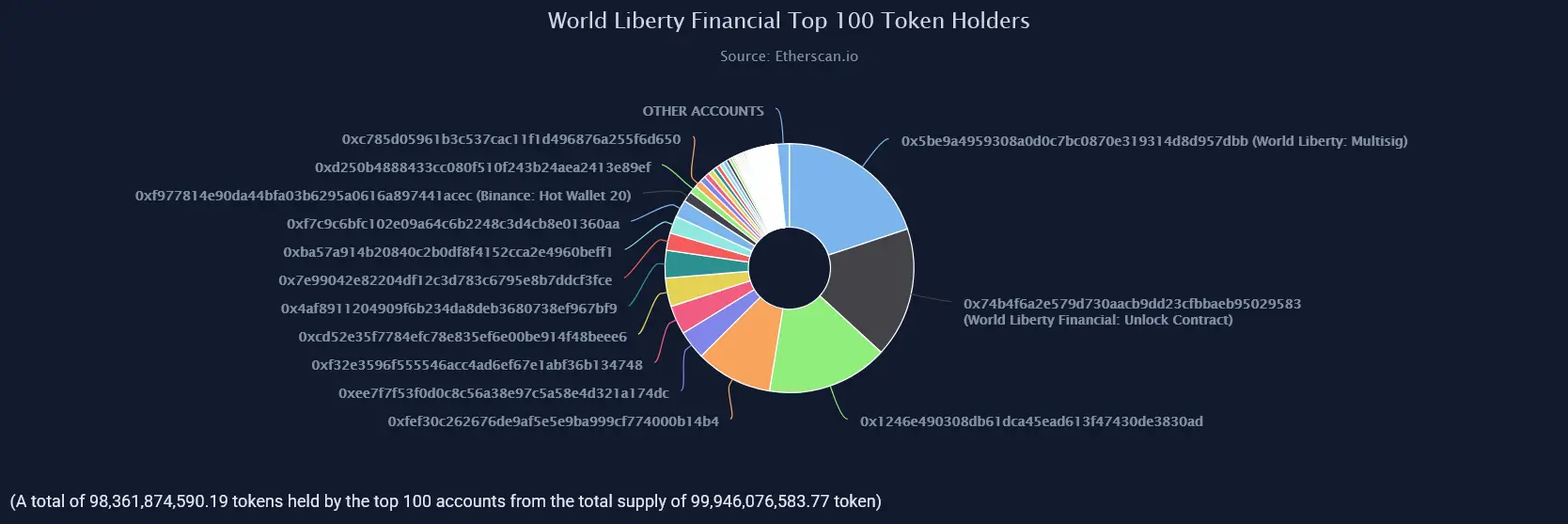

$WLFI has a total supply close to 100 billion tokens with approximately 24.6 billion currently circulating.

The allocation breaks down as 63% for public sale, 17% for user rewards, including staking incentives, and 20% for team and advisors. This team allocation includes significant holdings by Trump family members, with Donald Trump reportedly holding 22.5 billion $WLFI, representing about 22.5% of the total supply.

Multi-Chain Deployment

$WLFI operates as an ERC-20 token on Ethereum under contract address0xda5e1988097297dcdc1f90d4dfe7909e847cbef6. The project integrated Chainlink's Cross-Chain Interoperability Protocol in September 2025, enabling seamless transfers across Ethereum, Solana, and $BNB Chain. This multi-chain approach aims to provide low-cost, high-speed transactions while broadening $WLFI's utility across different DeFi ecosystems.

The $USD1 stablecoin also operates across these chains, with roughly 81% of $USD1 supply currently held on$BNB Chain, making it the dominant network for World Liberty Financial's stablecoin operations.

Token Characteristics and Economics

The token launched as non-transferable to prevent early selling pressure. It includes deflationary elements through fee-burning mechanisms, though around 75% of protocol fees reportedly flow to Trump-linked organizations.

On-chain data shows approximately 82,000 holder addresses on Ethereum, with total holders across all supported chains (Ethereum,Solana, and $BNB Chain) reaching approximately 125,000 unique addresses. While this suggests broad retail participation, cross-referenced analysis indicates that roughly 60% of the total supply remains under the control of Trump-linked entities.

The public sale accounts for 63% of the planned distribution, but on-chain activity shows an uneven distribution. Reward pools and ecosystem wallets hold substantial portions, while whale movement remains relatively quiet, though community trackers warn of potential insider selling after lockup periods expire.

Buyback and Burn Mechanism

A governance-approved mechanism directs 100% of protocol-owned liquidity fees toward open-market $WLFI purchases and permanent token burns acrossEthereum, $BNB Chain, and Solana. Over 7.89 million $WLFI tokens (worth approximately $1.43 million) were burned in the first execution, with additional burns planned as the protocol generates fees.

Where Can You Trade $WLFI?

$WLFI achieved rapid exchange penetration with listings on more than 155 exchanges.

Binance handles the majority of daily volume through its $WLFI/USDT trading pair, while numerous mid-tier centralized exchanges and several decentralized exchanges also offer trading. This broad accessibility increased liquidity and exposure significantly after the token became transferable in early 2025.

Price Performance and Market Metrics

As of November 17, 2025, $WLFI trades at $0.1402 with a market cap around $3.45 billion and fully diluted valuation of approximately $14.02 billion. Trading volume over the past 24 hours reached approximately $198 million.

The token reached a peak of approximately $0.26 in early September 2025, and hit its low of around $0.10 in late October 2025. Recent performance shows a decline of 2.5% over 24 hours but gains of approximately 11.7% over seven days, reflecting continued volatility.

The token has declined approximately 45% from its September peak as initial speculation surrounding the launch cooled.

$WLFI to USD">

$WLFI to USD">

What Drives $WLFI Price Movement?

$WLFI's market performance closely aligns with U.S. political sentiment and Trump-related news cycles rather than typical DeFi fundamentals.

Social media promotion and speculative demand drive much of the trading activity. On-chain transfer activity spikes correlate with political announcements rather than protocol usage or development milestones. Tools like Arkham Intelligence show movement primarily among insider and official addresses rather than decentralized participants.

Recent reports indicate Trump's personal crypto portfolio has experienced significant volatility. His holdings dropped from over $12 million earlier in 2025 to under $1 million by November 2025, largely driven by declines in his $WLFI stake and various memecoins. This pattern mirrors the broader decline in Trump-affiliated crypto assets.

Price forecasts vary widely, with some analysts projecting a range of $0.15 to $0.50 for late 2025 and 2026. More optimistic projections suggest $WLFI could reach $1 if specific catalysts materialize, though these estimates carry significant uncertainty tied to political factors and execution rather than traditional technical analysis.

What Risks Does $WLFI Carry?

$WLFI presents several concerns beyond standard DeFi risks.

The majority of tokens remain held by insiders, giving governance voting power likely controlled by the Trump family. This concentration limits the effectiveness of the community governance model and creates potential for decisions that benefit insiders over broader token holders.

Political and Regulatory Exposure

Sentiment swings tied to political developments may cause extreme volatility that differs from typical crypto market movements. The project is likely to attract regulatory attention due to its political ties and the scale of its fundraising effort.

The Trump family's involvement has sparked debates over conflicts of interest, particularly given Donald Trump's role as President. Critics argue the venture blurs lines between public duty and private gain, though supporters view it as expanding crypto adoption at the highest levels of government.

Liquidity and Ecosystem Health

Most liquidity sits on a handful of centralized exchanges rather than being distributed across DeFi protocols, indicating shallow depth in decentralized markets. The token's 45% decline from its September peak reflects cooling speculative interest following the initial launch period.

Execution risk remains high, as roadmap progress depends on the team's ability to deliver functioning DeFi products beyond the branding and political narrative that drove initial interest.

Ecosystem Roadmap

World Liberty Financial has outlined several development initiatives beyond its current DeFi offerings:

- Debit card pilot program enabling $USD1 stablecoin spending

- Real-world asset tokenization covering commodities like oil, gas, and timber

- Expanding $USD1 liquidity across Solana and $BNB Chain networks

- Additional Cross-Chain Interoperability Protocol integrations

These plans aim to provide the project with utility beyond its current governance and trading functions, though implementation timelines remain unspecified, and execution risk is high given the project's focus on branding over technical development so far.

$WLFI Token Overview

$WLFI combines a high-profile brand with large-scale DeFi fundraising, offering governance rights, staking benefits, platform utility, and access to WLF's $USD1 stablecoin ecosystem across three major blockchains. The token achieved significant exchange listings and maintains active trading across more than 155 platforms.

The multi-chain deployment throughChainlink CCIP provides technical infrastructure for cross-chain operations, while the buyback and burn mechanism creates deflationary pressure on the circulating supply.

However, extreme concentration among insider wallets, declining total value locked, and dependence on political sentiment rather than protocol fundamentals create substantial risk factors. The token displays moderate retail distribution through 125,000 holder addresses, but very high top-holder concentration that skews governance power.

For users and analysts, $WLFI remains both a high-visibility project and a high-volatility asset, driven as much by narrative and politics as by technical or financial characteristics. The project's future depends on whether it can demonstrate real DeFi utility beyond its political connections and initial fundraising success.

Official Website:worldlibertyfinancial.com

X:@WorldLibertyFi

Sources

- CoinMarketCap - $WLFI price data, market metrics, and ecosystem overview

- Arkham Intelligence - $WLFI on-chain tracking and wallet analysis

- ChainLink - Multi-chain and Chainlink CCIP implementation

- Yahoo Finance - Buyback and burn mechanism, Trump crypto portfolio analysis

- BanklessTimes - $USD1 Solana expansion and network activity patterns

bsc.news

bsc.news