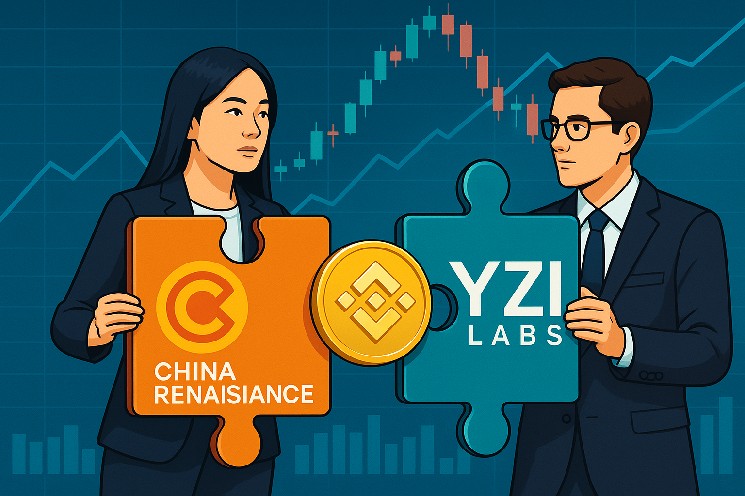

- China Renaissance and YZi Labs’ $600M $BNB fund that could mark a turning point for institutional adoption of Binance Coin.

- Despite its near-term price dips, $BNB’s ecosystem strength can still position it as one of the most resilient assets in the market.

Beijing investment bank China Renaissance is reportedly in talks to raise about $600 million for a U.S.-listed vehicle that would buy and hold $BNB, with YZi Labs also known to co-invest, as both groups are expected to put in roughly $200 million together. The plan would create a public digital-asset treasury that is focused on building a $BNB position at scale.

Previously, CNF revealed that YZi Labs launched a new fund aimed at providing builders on the $BNB Chain with both capital and hands-on technical support. According to a Bloomberg report first published on October 13, 2025, stated that:

YZi Labs, the family office of Binance Co-Founder Changpeng Zhao—who was himself released from federal custody in the US last year—plans to invest in the deal alongside China Renaissance, according to people familiar with the matter. Together, they will invest $200 million in the deal, the people added.

Moreover, it builds on an August 22 memorandum of understanding (MoU) between China Renaissance and YZi Labs aimed at the promoting some of the $BNB adoptions, including potential listings on regulated Hong Kong exchanges.

In addition, some recent integrations like Bitget’s $440 million BGB token migration to $BNB Chain (with half burned for deflation) underscore for the network’s maturing liquidity rails.

Market Implications for Binance Coin ($BNB) Price

If the fund materializes, it could catalyze a significant rally for $BNB, injecting fresh institutional capital into an already buoyant ecosystem. Analysts project a potential 20–30% upside in the short term, pushing prices toward $1,500–$1,600 as the treasury’s buying pressure ramps up. So far, according to Bloomberg also noted that:

$BNB has been on a tear, more than doubling this year and repeatedly testing record highs in recent weeks. Its rise has coincided with the launch of a bevy of $BNB-focused treasury companies.

As in for the longer term, this move legitimizes $BNB as a tradfi-grade asset, potentially drawing ETF-like products and mirroring Bitcoin’s corporate adoption surge. However, volatility still risks remaining like, for example a broader crypto sell-off or U.S. regulatory scrutiny could cap gains.

As of now, according to CoinMarketCap’s live feed, $BNB is trading at about $1,201.33 USD, reflecting however, a decrease of 12.16% in the past day and 4.49% over the past week. See $BNB price chart below.