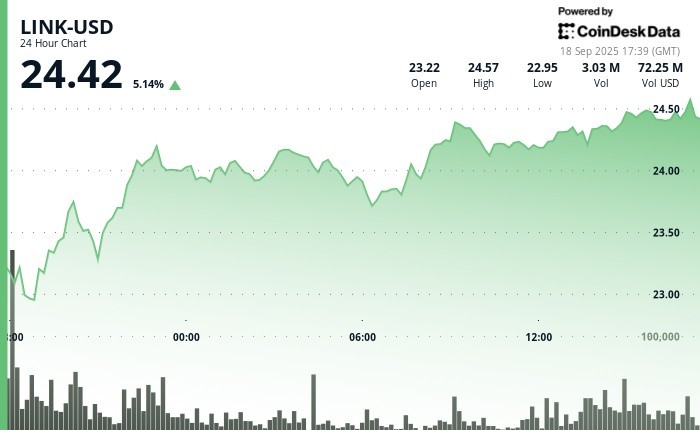

Oracle network Chainlink's ($LINK) native token surged 6% over the past 24 hours crossing $24.5 on Thursday as crypto prices climbed higher with altcoins outperforming.

The price action happened as large-cap altcoins led crypto markets higher in anticipation that spot-based ETFs could hit the market soon with the SEC approving general listing standards.

That could include Chainlink's $LINK, too, with several applications filed earlier this year and $LINK futures being traded on U.S.-regulated exchanges like Coinbase Derivatives.

Caliber (CWD), a public wealth management firm that adopted a Chainlink treasury reserve asset initiative, said on Thursday it bought $6.5 million worth of tokens as part of its digital asset strategy.

The Chainlink Reserve also purchased on Thursday another 43,000 $LINK ($1.05 million) as part of the initiative to buy tokens using revenue from protocol integrations and services, similar to public companies' share buyback programs.

Since August, the reserve has accumulated a total of 323,116 tokens, worth $7.9 million, data shows.

Technical Analysis

The technical indicators underscore $LINK's gaining momentum, according to CoinDesk's Research's technical analysis data.

- Robust support established at $22.82 with high-volume confirmation of 5.56 million units, significantly surpassing the 24-hour average of 1.48 million.

- Multiple resistance levels breached including $24.16 and $24.42, demonstrating sustained purchasing pressure.

- Ascending low formations throughout the recovery phase indicating consistent upward momentum.

coindesk.com

coindesk.com