Bitwise has taken another step in bringing altcoin exposure to mainstream investors. The asset manager filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a proposed Bitwise Chainlink ETF, an exchange-traded product designed to hold Chainlink’s native token, $LINK.

If approved, the fund would trade on a U.S. exchange under a ticker yet to be disclosed, offering investors regulated exposure to $LINK without the need to custody tokens directly.

The ETF is structured as a Delaware statutory trust. Its primary objective is to track the price of Chainlink by holding $LINK tokens in custody, with its Net Asset Value (NAV) tied to the CME CF Chainlink–Dollar Reference Rate (New York Variant), a benchmark administered by CF Benchmarks.

Shares will be created and redeemed in blocks of 10,000, with authorized participants able to transact in either $LINK or U.S. dollars. As with other crypto ETFs, secondary market trading may result in premiums or discounts relative to NAV.

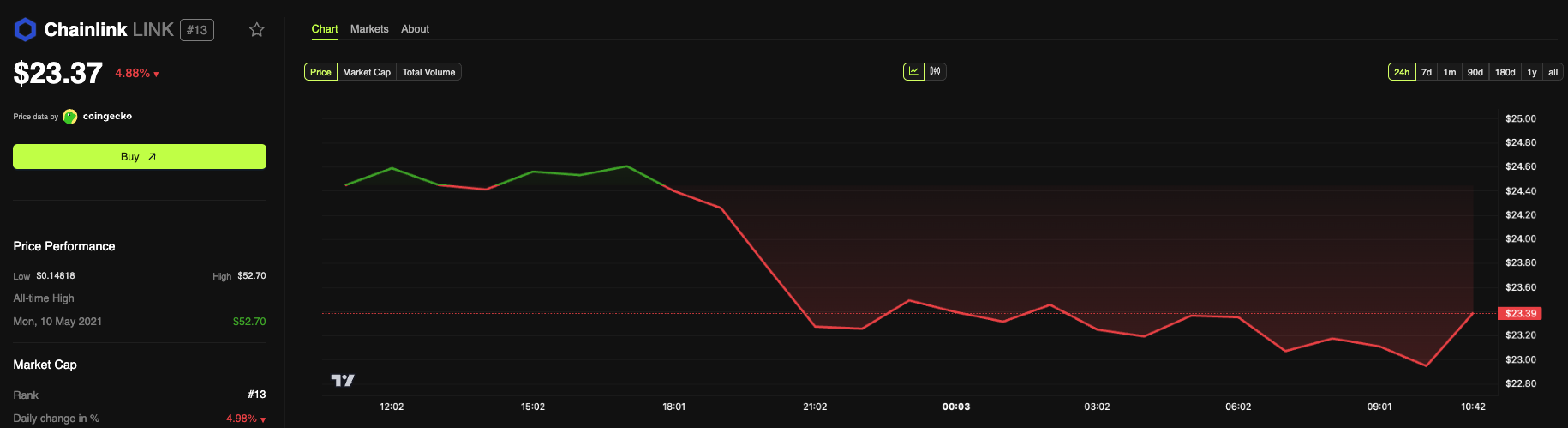

Despite the ETF filings, $LINK tokens still remain around 5% down in the last 24 hours.

Bitwise has appointed Coinbase Custody Trust Company, LLC as custodian, responsible for safeguarding $LINK reserves. Assets will not be FDIC-insured, but Coinbase Custody maintains private insurance policies.

The post Bitwise Files S-1 for Chainlink ($LINK) ETF appeared first on BeInCrypto.

beincrypto.com

beincrypto.com