- Chainlink scored 237.93 in RWA development, $LINK surged 24% monthly, hitting $24 mark.

- Avalanche, Stellar, and $IOTA trail behind, while $LINK eyes $29 resistance despite overbought signals.

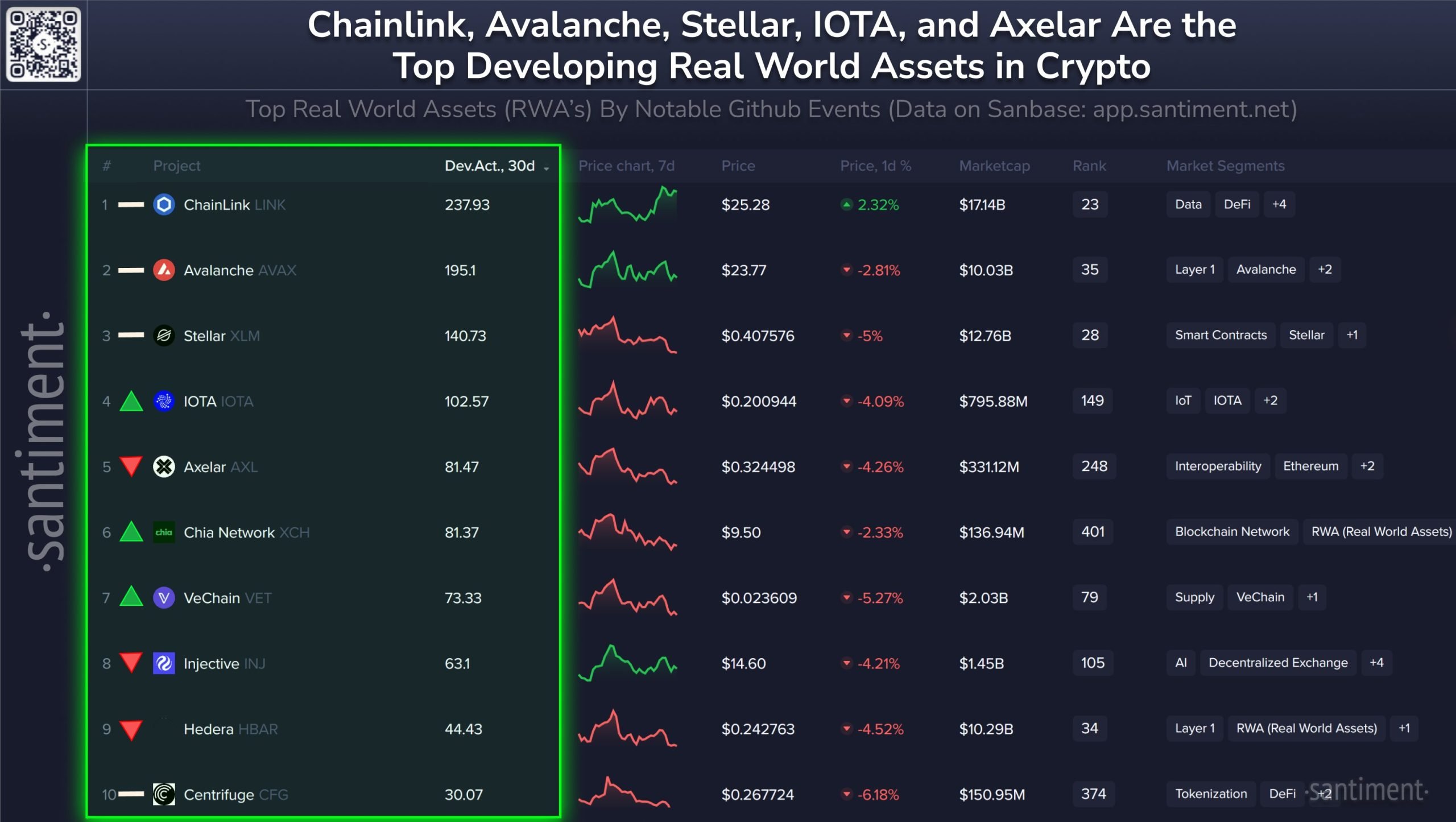

Chainlink has established itself at the forefront of real-world asset development activity, outperforming competitors with a score of 237.93 in the last 30 days, according to Santiment data. This figure outpaced Avalanche, Stellar, and $IOTA, which made up the rest of the top four.

The $LINK token gained 13.79% over the week and 24.41% during the month, climbing to $24. Market capitalization stands at $16.45 billion currently, placing 11th among global cryptocurrencies. The trend shows high resilience despite short-term pullbacks.

Today, $LINK momentarily reached $26.66 only to pull back at $24.44, which translated into a daily fall of 1.57%. Despite this, the breakdown through longstanding resistance in the region of $20-$21 earlier in the month sets a stronger bullish base with volume accompanying the rally.

Avalanche, Stellar, and $IOTA Hold Key Spots Behind Chainlink

Avalanche claimed second position in the development ranking with a score of 195.1. Its token AVAX dropped by 2.56% within the last 24 hours to $23.14, but the project has a nearly $10 billion valuation. Its placement within Layer 1 networks and interoperability underscores its function in scaling applications.

Stellar trailed closely in the third position, recording 140.73 in activity. XLM traded at $0.408 with a 0.16% daily increase, providing a $12.78 billion capitalization. The venture placed 13th globally, remaining keen on smart contract creation and network growth.

$IOTA secured fourth with 102.57 in development activity. Its token exchanged at $0.20, recording a 0.68% increase. The network maintained a market cap of $8.01 million and ranked 93. This positioned it below Avalanche and Stellar but among the RWA’s top performers.

Santiment ranking methodology of RWA projects reaches beyond core code commits, measuring major dev contributions by GitHub events. Such results illustrate how top projects persist in development despite volatile prices within the larger market.

Wallet Records and Whale Accumulation Strengthen Chainlink

Furthermore, Chainlink achieved its largest 2025 wallet activity during mid-August. On the 17th, over 9,800 wallets carried out $LINK transfers, which were followed by the creation of 9,6200 wallets on the following day. Such levels are the highest levels of the year, indicating growing end-user adoption.

Chainlink has remained a force among the altcoin pack, jumping above $26 for the first time in seven months. On-chain activity has been even more impressive than the price. 9,813 different $LINK addresses made at least one transfer on Sunday, and 9,625 new $LINK wallets were… pic.twitter.com/ePGjiBcSyl

— Santiment (@santimentfeed) August 19, 2025

Retail and institutional demand have been observed in on-chain activity. Whales accumulated 1.1 million $LINK, valued at $27 million, within a week. Top 100 wallets add 12% of holdings, noted Nansen, pointing out sustained accumulation trends within markets.

The technical indicators demonstrate $LINK’s trading with RSI close to 64 and Stochastic Oscillator of 87, which implies overbought levels. Resistance is in the range of $27.50 and $28, and $30 would be a significant psychological barrier, with support around $22.50 and $21.

Analysts believe there’s room for a rally towards $29 in the event of sustained momentum. But they warn a retest of $20 is possible should altcoin sentiment dips. Even with such risks, Chainlink’s standing as the top RWA project remains uncontested.