World Liberty Financial ($WLFI)’s $USD1 stablecoin has surpassed a $2 billion market capitalization.

The milestone comes amid a significant expansion in the stablecoin sector, with experts predicting it could surge to $2 trillion in the coming years.

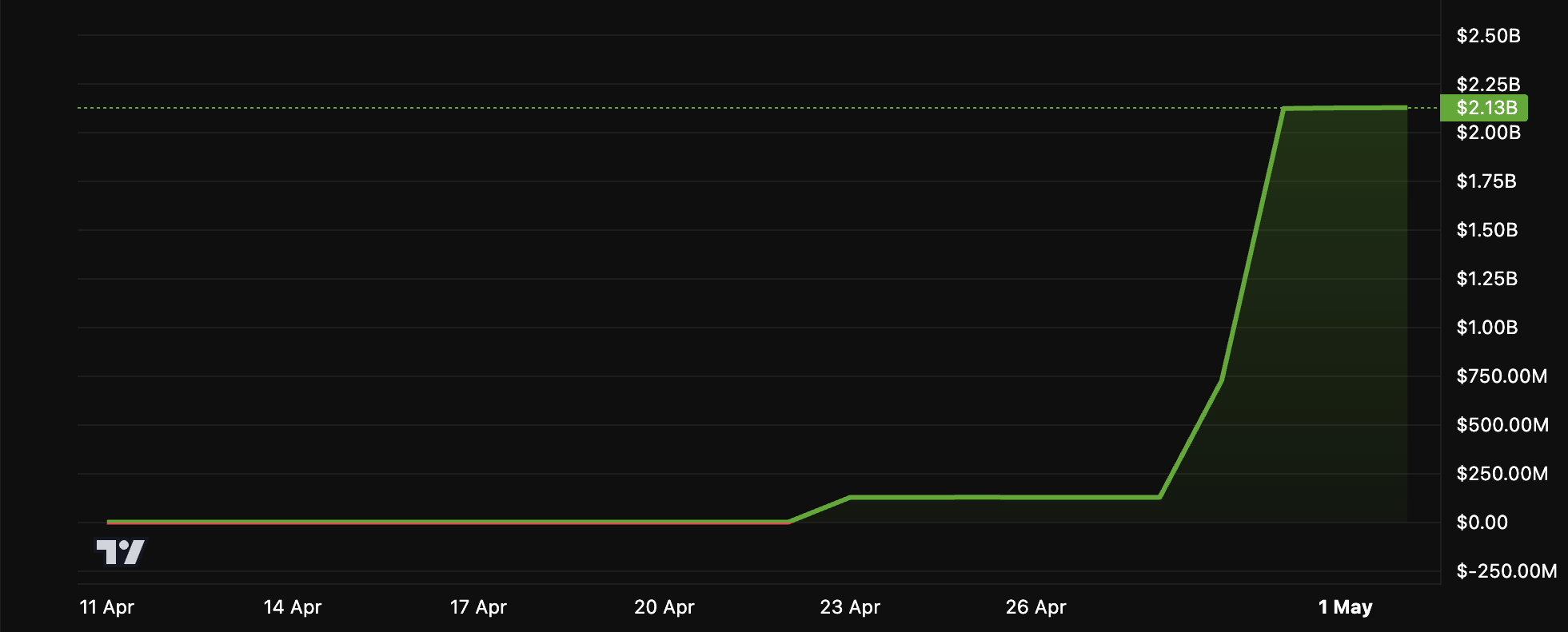

$USD1 Stablecoin’s Growth: From $128 Million to $2 Billion

$WLFI co-founder Zach Witkoff shared the development in the latest X (formerly Twitter) post.

“Proud to announce that @worldlibertyfi $USD1 stablecoin has officially crossed $2 billion in market cap. Proud of the team, onwards!” Witkoff posted.

Data from BeInCrypto shows that $USD1 experienced significant growth over a short period. On April 28, its market cap was $128 million. However, by the next day, it surged to $1 billion.

“Congratulations to the @worldlibertyfi team on $USD1 reaching a $1 billion market cap,” BitGo wrote on X.

That’s not all. By April 30, the market cap doubled to $2.1 billion, ranking $USD1 57th among all cryptocurrencies and 7th among stablecoins. It overtook established players like PayPal USD (PYUSD) and First Digital USD (FDUSD).

In fact, the surge has also solidified $USD1’s standing on the Binance Smart Chain, where it now ranks as the second-largest stablecoin.

This highlights the increasing adoption and trust in $USD1. The ascent positions it as one of the fastest-growing decentralized stablecoins in the market since its launch in late March.

Data from Dune’s blockchain analytics platform provides further insight into the factors driving this expansion. A series of minting events in the last week of April catalyzed the stablecoin’s market cap increase to over $2 billion.

These minting activities align with $WLFI’s strategic efforts to expand the token’s circulation. Earlier this month, the DeFi project proposed a $USD1 airdrop to early supporters. As BeInCrypto reported, the airdrop is intended to test the on-chain distribution system, reward adopters, and enhance visibility ahead of a full-scale deployment.

$USD1’s rise, however, has not been without scrutiny. The project has drawn attention due to President Donald Trump’s involvement, raising concerns among lawmakers about potential conflicts of interest.

Despite this, $USD1’s market performance indicates strong investor confidence. The stablecoin’s rapid growth suggests it may continue to play a significant role in the digital asset market. However, its future will likely depend on both market dynamics and regulatory developments.

beincrypto.com

beincrypto.com