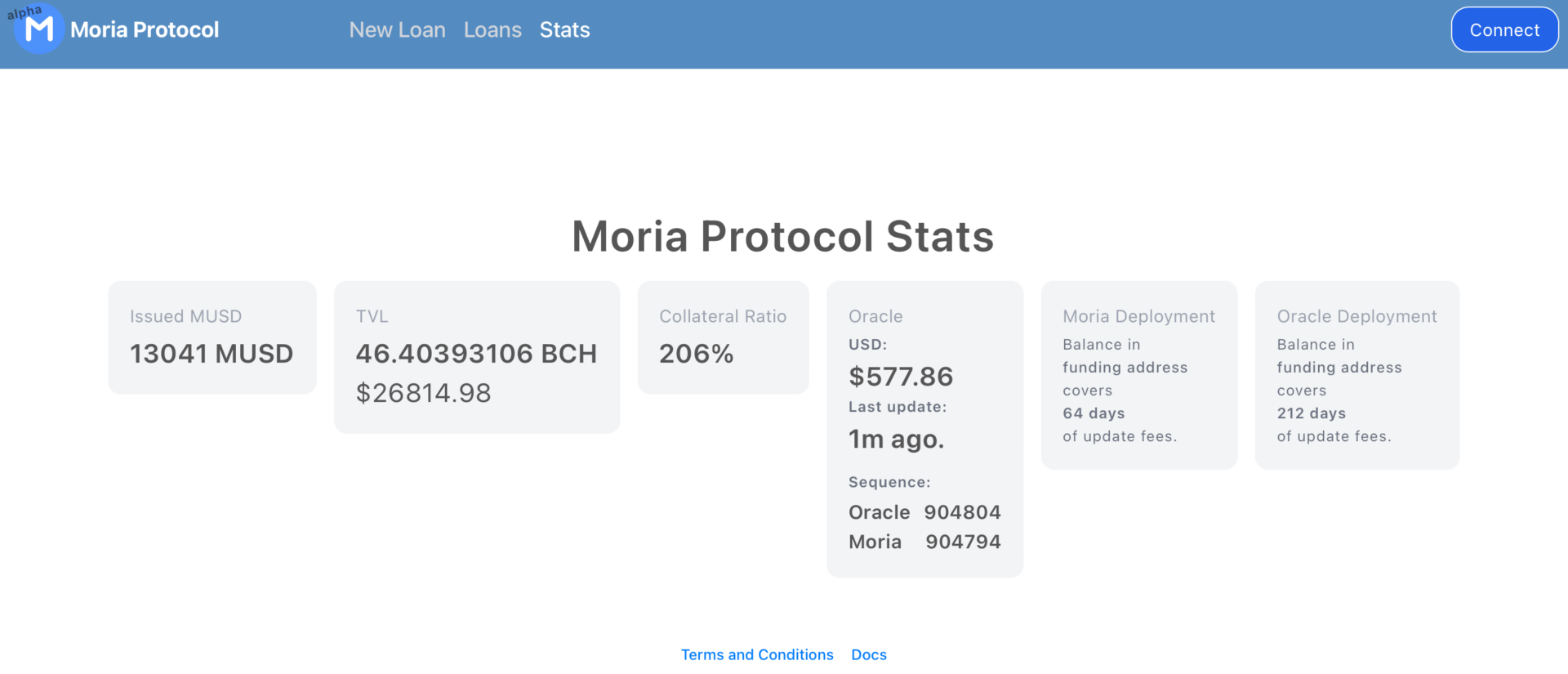

The Bitcoin Cash network now has an experimental, native-backed, over-collateralized stablecoin called “Moria” (MUSD). Within about one day, the decentralized, open-source protocol has seen over $25,000 locked on the network, with transactions occurring directly on-chain.

As Cryptopolitan previously reported, smart contracts comparable to Ethereum can now be executed directly on the Bitcoin Cash chain via the May 2023 CashTokens upgrade. This upgrade enabled UTXO (unspent transaction output)-based smart contracts for minimal fees. In everyday language, it means cheap transactions can be done on layer 1, and not on a “second layer solution” like the Lightning Network (with BTC) or Rollups (on ETH).

While development on the framework is still in the early stages, this functionality is something mainstream crypto has been sleeping on, and could become a fierce competitor to those entities currently ruling crypto markets, like USDT.

Native-backed stablecoin experiment launches on BCH

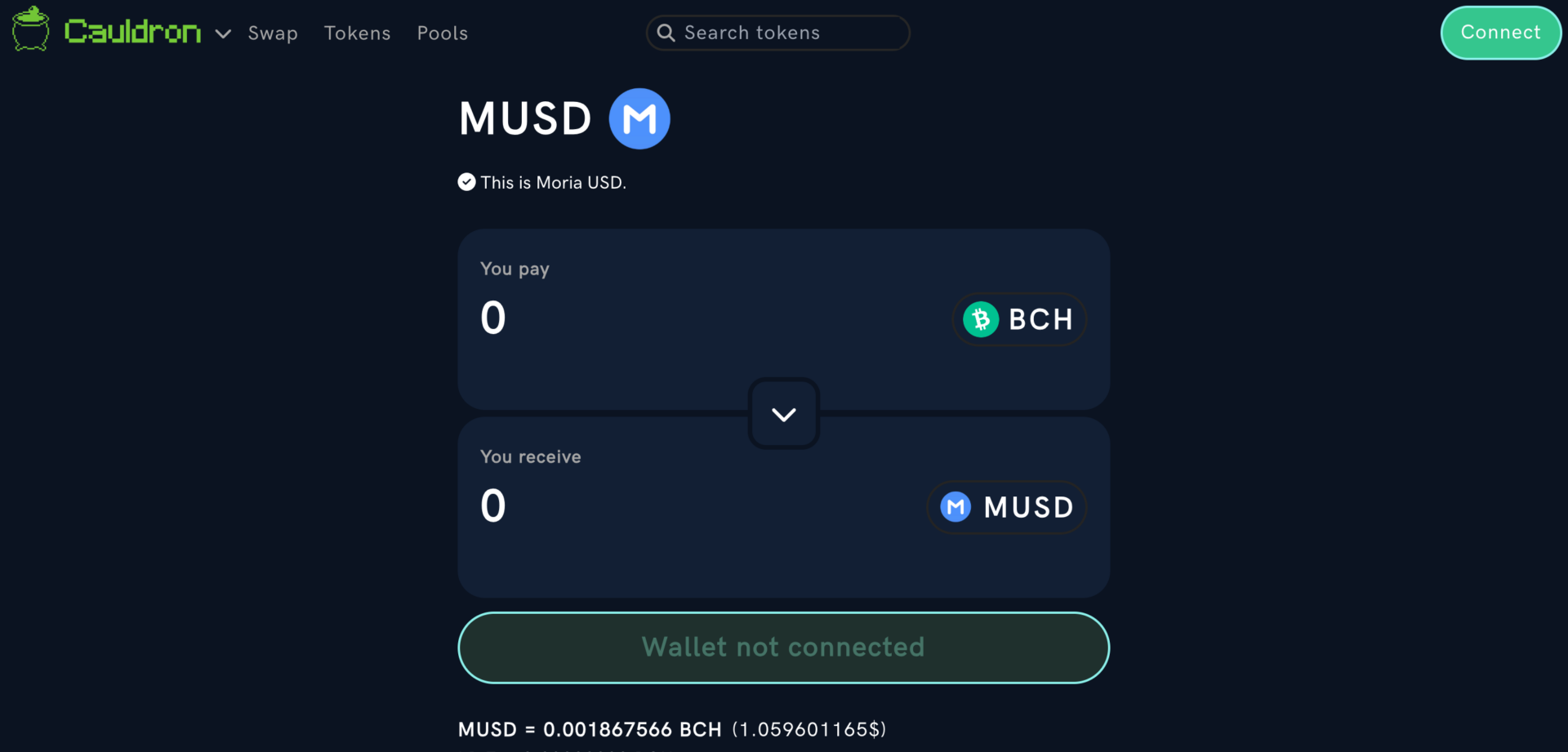

Just yesterday, bitcoin cashers got their first taste of the stablecoin world via the 2023 upgrade, with the launch of a token called “Moria” (MUSD) on December 4. Moria was created by Riften Labs, the company behind the Cauldron DEX (decentralized exchange), also made possible by the aforementioned upgrade.

“The Moria Protocol is an experimental DeFi platform built on the Bitcoin Cash blockchain, enabling users to mint decentralized stablecoins backed by BCH,” the Test Run #1 Overview notes, emphasizing: “This test run will end no later than May 2025 and will conclude with a sunset mechanism.”

In essence, users can mint the asset by depositing BCH via the contract, resulting in MUSD tokens which are over-collateralized by BCH, and tied to the US dollar’s stability. “The test aims to evaluate whether MUSD can maintain a price stability close to that of USD,” the overview notes. This way, bitcoin cash can be effectively moved around with less worries about market volatility.

Riften Labs specifies that “When a loan becomes undercollateralized due to market swings—such as a drop in the BCH price lowering the value of the collateral—all loans in this state become available for liquidation by other users,” continuing, “Liquidators repay the loan using MUSD, unlocking the collateral, which is then released to the liquidator.”

“To avoid liquidation, users must maintain a healthy collateralization ratio above the required threshold of 110%,” the overview cautions.

Moria is just one of many experiments currently being undertaken permissionlessly via the CashTokens upgrade. It should should be reiterated, as noted on the protocol exchange that the current version of MUSD is highly experimental. The overview describes the end of the run, and next steps, detailing: “Upon completion, the protocol will transition to a new test run or into its finalized deployment, using the same ticker, while the current ticker will be renamed “MUSDv0.”

Moria vs Tether’s USDT

The world of stablecoins has exploded in the last ten years, with controversial behemoths like Tether (USDT) massively shoving the crypto market this way and that. So, what’s the difference between Tether and this new experiment? Well, for one, more transparency via open source code.

As S&P Global Ratings recently noted: “USDT’s smart contract source code is not open source, unlike that of most other stablecoins.” Further, the stable is backed by bitcoin cash (BCH), the native asset of the chain, and not a mixed bag of U.S. Treasuries and other investments shrouded in mystery and murky legalese. Finally transactions via the Moria protocol aim to be censorship resistant and fully auditable, whereas Tether centrally freezes addresses flagged by governments.

Still, not everyone in the BCH community thinks a stablecoin is necessary, and many view the idea of trying to peg to the violence-backed USD as harmful. Moria’s $26,000 in TVL (total-value locked) will likely be scoffed at by fans of the $135 billion-dollar USDT juggernaut, but the key point they’d be missing is that now anyone and everyone can build on BCH as on Ethereum, but for much less in terms of transactions costs thanks to the UTXO efficiency advantage.

cryptopolitan.com

cryptopolitan.com