After the price of the popular meme-inspired cryptocurrency Shiba Inu (SHIB) rose by more than 80% in a week, many crypto market participants began to wonder — what's actually next?

While no one can give an exact answer to such a question, due to the chaotic and unpredictable nature of the environment surrounding cryptocurrency, we can try to dig up some guidelines in this murky water. For example, data on the actions of the largest investors, often referred to as whales, can provide somewhat of a guideline.

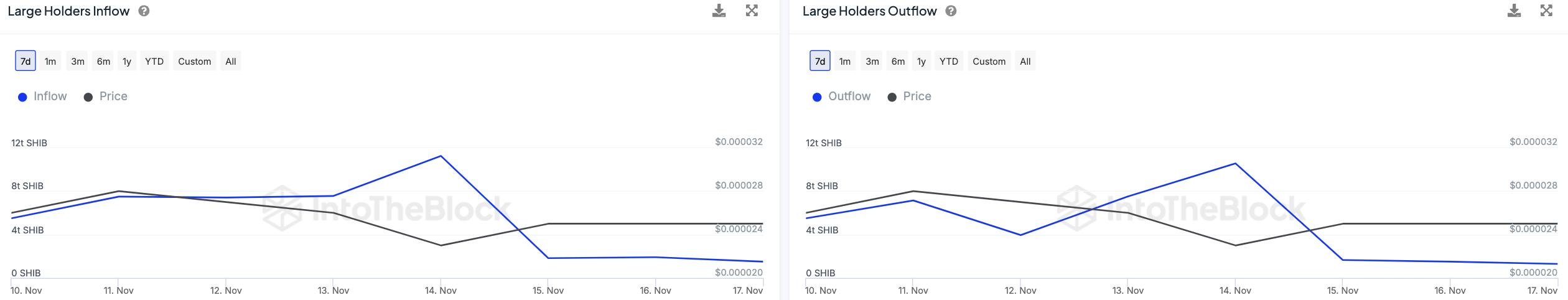

According to on-chain data from IntoTheBlock, whales have decided to lay low for now. As the metric of Shiba Inu token inflows to wallets that hold at least 0.1% of the token supply shows, it dropped by 400 billion to 1.51 trillion SHIB over the past 24 hours.

However, the same applies to outflows, which decreased by 210 billion tokens during the period under review and reached 1.3 trillion SHIB. It follows that the value of the net flow remains positive and the direction of flow of cryptocurrencies to whale wallets is still more incoming than outgoing. However, activity has noticeably decreased on both sides.

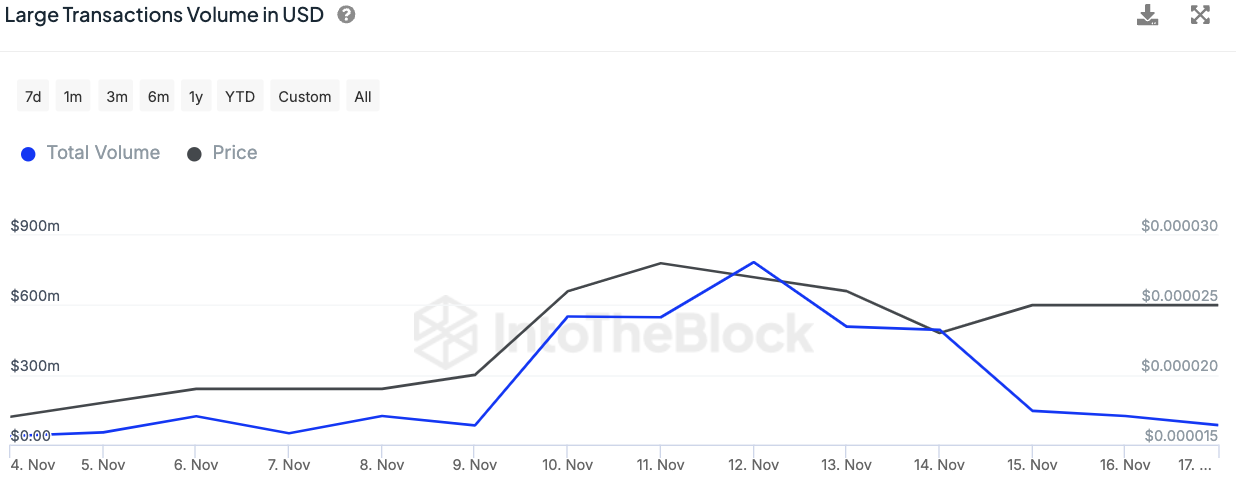

The same trend is confirmed by the data on the volume of large transactions with the Shiba Inu token. According to the data, over the past day, transactions equal to at least $100,000 in SHIB equivalent fell by a third to a turnover of $84.22 million per day, or 3.4 trillion tokens.

That is still a lot more than before the wild price pump earlier in November, but against the backdrop of that pump's peaks, it is clear that volumes are deflating. From this, we can conclude that Shiba Inu whales now prefer to sit on their hands and neither acquire nor sell SHIB.

u.today

u.today