PEPE is finally following in Dogecoin’s footsteps judging by its breakout in the last 2 days. The king of the memecoins had previously broken down into a massive rally and soared to new 2024 highs.

It was only a matter of time until PEPE and others in its cohort experienced a similar outcome due to liquidity rotation.

PEPE hit its previous all-time high (ATH) of $0.00001725 on 27 May but has since then struggled to maintain bullish momentum.

For context, its lowest price point so far this month was $0.00000771 on 4 November. It has since rallied by roughly 233% to a high of $0.00002597 in the last 24 hours at the time of writing.

This officially marked a new ATH for the frog-themed memecoin. PEPE exchanged hands at $0.00002224 at press time.

The latest rally was deeply overbought which means it may be sensitive to sell pressure.

Strong Demand for PEPE in Derivatives Market Preceded The Rally

The latest PEPE rally was characterized by robust demand in the derivatives segment. Futures open interest soared to $281.84 million in the last 24 hours. This was the memecoin’s highest ever recorded open interest.

The open interest surge has been playing out since September but its latest spike confirmed the surge in demand from the derivatives segment.

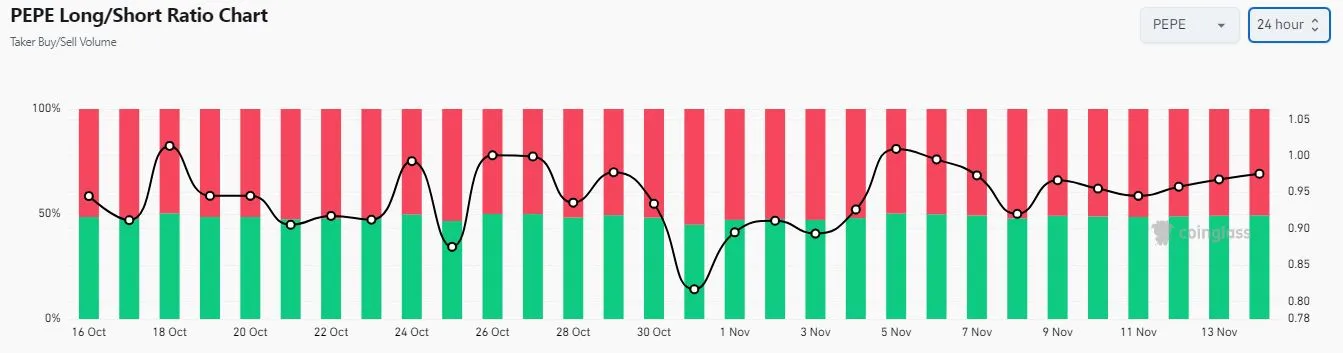

Now that PEPE’s price has achieved a new ATH, bearish expectations are making a return. Shorts remained dominant in the last 24 hours, confirming that a sizable number of traders anticipate sell pressure due to profit taking.

The memecoin had already retraced slightly in the last 24 hours. However, this does not necessarily mean that it may not push further up. Such an outcome could result in a surge in liquidations.

Speaking of, liquidations were almost evenly matched according to Coinglass. Long liquidations on all exchanges in the last 24 hours peaked at $1.43 million while short liquidations were slightly higher at $1.44.

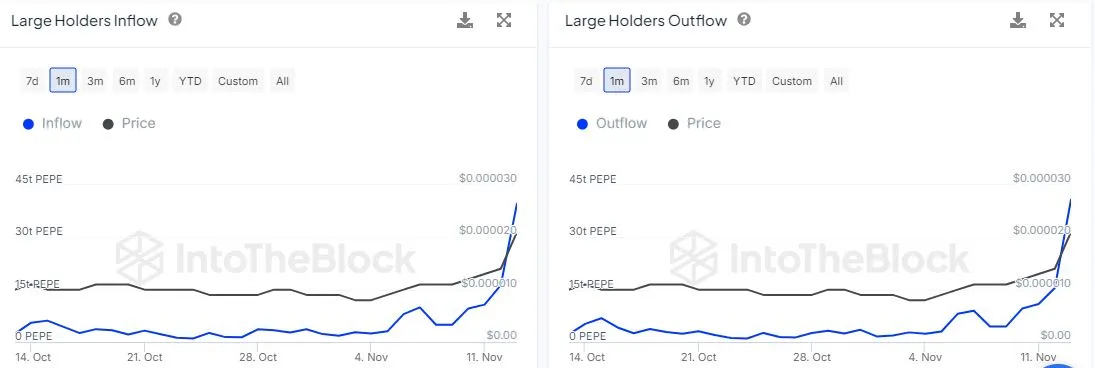

PEPE Large Holder Flow Profile

PEPE large holder flows revealed that whales have been very actively involved in the latest PEPE rally. However, they have also been playing both sides and could already be signaling the next move.

Large holder in inflows surged from 1.81 trillion PEPE on 2 November to 39.66 trillion PEPE on 13 November. Meanwhile, large holder outflows surged from 1.6 trillion tokens on 1 November to 40.77 trillion tokens on 13 November.

The large holder flow data revealed that more whales were taking profits in the last 24 hours than the level of buying pressure.

There was still a large amount of the token still flowing into large holder addresses. This indicates that we may continue to see more upside in the coming month especially as the bull market becomes more heated up.

thecoinrepublic.com

thecoinrepublic.com