- Chainlink is powering Bitcoin DeFi by providing essential tools for interoperability.

- BTCFi aims to unlock Bitcoin’s dormant liquidity and support a broader range of DeFi applications.

Bitcoin DeFi (BTCFi) is gaining momentum as decentralized finance applications integrate Bitcoin’s liquidity into the DeFi ecosystem. Through Chainlink, BTCFi is all set to generate a plethora of financial opportunities on the Bitcoin network due to its role in offering critical data and bridge solutions. The Taproot upgrade that happened in 2021 allowed DeFi on Bitcoin, thus enabling the BTCFi developers to build complicated dApps on the network.

The trillion-dollar BTCFi opportunity is here.#Chainlink is at the forefront of this industry trend, providing essential infrastructure to leading BTCFi platforms.

Watch BTCFi pioneers discuss what's needed to unlock Bitcoin liquidity ↓

— Chainlink (@chainlink) November 13, 2024

The shift to BTCFi solves one of the main problems with Bitcoin – most of it is in cold storage and is not used in the financial system. BTCFi proponents envision a way to unlock the vast liquidity of Bitcoin, increasing the cryptocurrency’s functionality and creating new income streams. To meet the requirements of BTCFI, Chainlink’s decentralized oracle network provides data, computation, and cross-chain integration for accurate information and safe transactions.

The BTCFi use cases are also emerging in the same way as Ethereum-based DeFi, such as borrowing, lending, DEX, and staking services. These functions are backed by Chainlink’s CCIP and PoR mechanisms to ensure that all the wrapped Bitcoin (including 21BTC and dlcBTC) are secure and transparent across different blockchains.

Additionally, the BTCFi lending and borrowing platforms enable users to pledge their BTC to obtain other cryptocurrencies. Thus, Chainlink’s services are vital for these systems to work with real-time pricing data and verify the reserves.

Chainlink’s Infrastructure Expands Bitcoin DeFi’s Potential

Chainlink’s involvement with BTCFi does not only stop at providing data. Additionally, Its tools also help with the creation of Bitcoin-native assets, which makes it possible to issue both fungible and non-fungible tokens on Bitcoin’s mainnet or layer-2s.

Furthermore, BTCFi can be a possible solution to the long-term funding problem of Bitcoin security. Given that the inflation rate of Bitcoin reduces through the halving process, it is anticipated that transaction fees will become more important in sustaining the network. BTCFi could help generate the transaction fees required for securing Bitcoin by driving more activity on Bitcoin through DeFi transactions.

In related news, Chainlink recently announced that PumpBTC, the leading Bitcoin asset issuer, will integrate Chainlink’s CCIP, Proof of Reserves, and other features to increase the utility and usage of its liquid staking token.

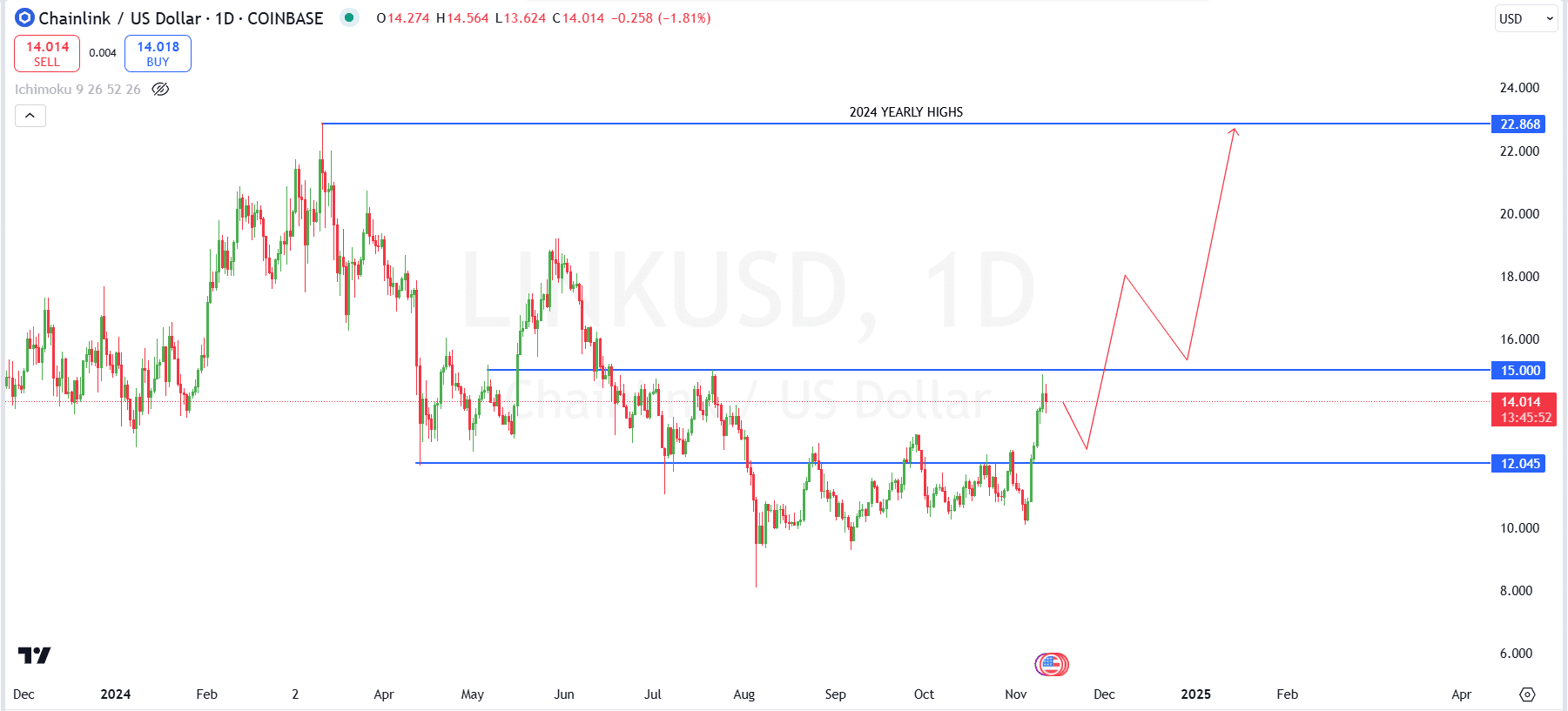

Price Trends Signal Potential Breakout

LINK’s recent performance has depicted a gradual increasing trend. The token is currently trading at around $13 after recovering slightly from a 6% surge on Sunday.

LINK is likely to encounter the first hurdle at $15, and if it breaks through this level, it may challenge the 2024 high of $22.87. The price is above the key support level of $12.04 as the bulls are still very much in control, but a loss of ground can be limited.

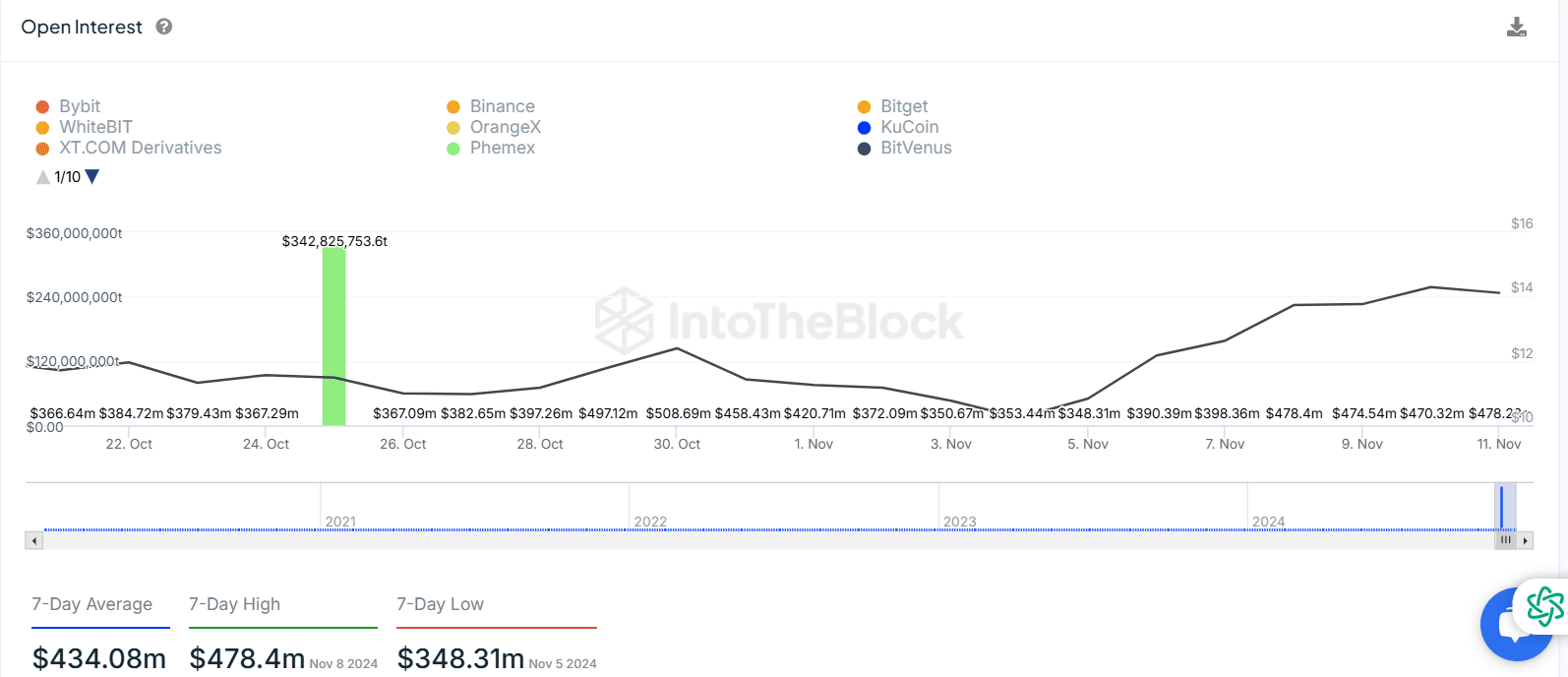

The recent statistics on LINK’s open interest point to increasing trader optimism. As of November 11th, the open interest was $434.08 million with the recent spike on November 8th, with the open interest reaching $478.4 million. This is in line with the demand for LINK as a utility token and is indicative of investors’ expectations of its growth in the year 2024.