Ripple recently released its Q3 2024 XRP Markets Report, discussing the performance of XRP and metrics affecting its price, volatility, and trading volumes.

The report, based on data from top sources like Bloomberg, CCData, and Refinitiv Eikon, reveals a detailed look at the XRP market amid a quarter of major price movements and a rise in Bitcoin dominance.

XRP Trading Volume and Market Activity

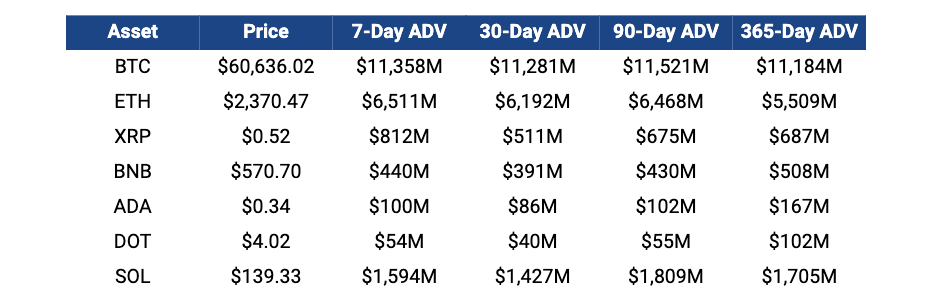

According to Ripple, XRP’s average daily volume (ADV) on top exchanges ranged between $600 million and $700 million, confirming a growth in market interest despite prevalent price struggles.

The ADV chart confirms that XRP’s trading volume trails behind Bitcoin and Ethereum. XRP boasts a 7-day ADV of $812 million, with the 30-day 90-day and 365-day figures respectively sitting at $511 million, $675 million and $687 million.

Although XRP’s ADV outpaces other tokens such as Binance Coin (BNB), Cardano (ADA) and Polkadot (DOT), it still lags behind major assets like BTC and ETH. This indicates room for XRP’s market presence to expand further.

One of the noteworthy developments in the previous quarter was the 27% increase in XRP price against Bitcoin. This growth occurred even as Bitcoin dominance rose by 3%, clinching a new cycle peak.

XRP Price Volatility Peaks and Stabilizes

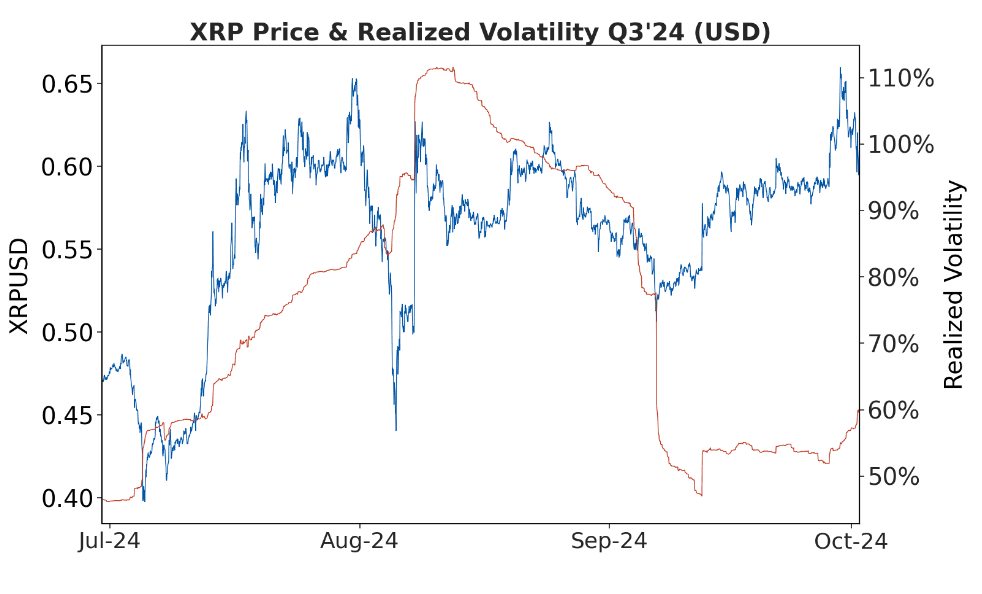

XRP experienced notable price volatility in the first half of Q3, with realized volatility surpassing 110% in mid-August. This volatility resulted from a rapid price surge, where XRP’s value oscillated between $0.40 and $0.65.

The increased fluctuation attracted traders, pushing trading volumes upward. However, the latter half of Q3 saw a decline in volatility, stabilizing around 60%, as XRP’s price remained more range-bound.

This switch from high volatility to a more controlled price movement suggests that the XRP market reacted swiftly to external conditions, but later entered a consolidation phase.

Exchange Volume Trends and Market Share

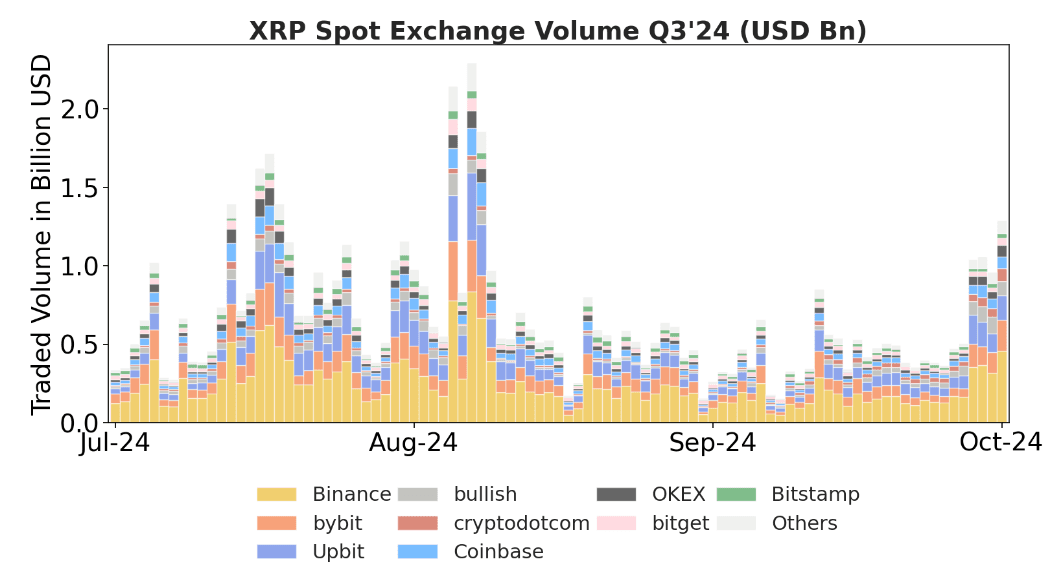

Ripple’s report reveals that XRP’s spot exchange volume remained strong compared to previous quarters, with Binance, Bybit, and Upbit capturing a significant share.

The first half of Q3 saw average daily volumes reaching $750 million, which then leveled off before spiking again towards the end of September.

While Binance retained the largest share of XRP trading volume, its market share slightly declined by 3 percentage points. On the other hand, Crypto.com’s share rose by 6 percentage points.

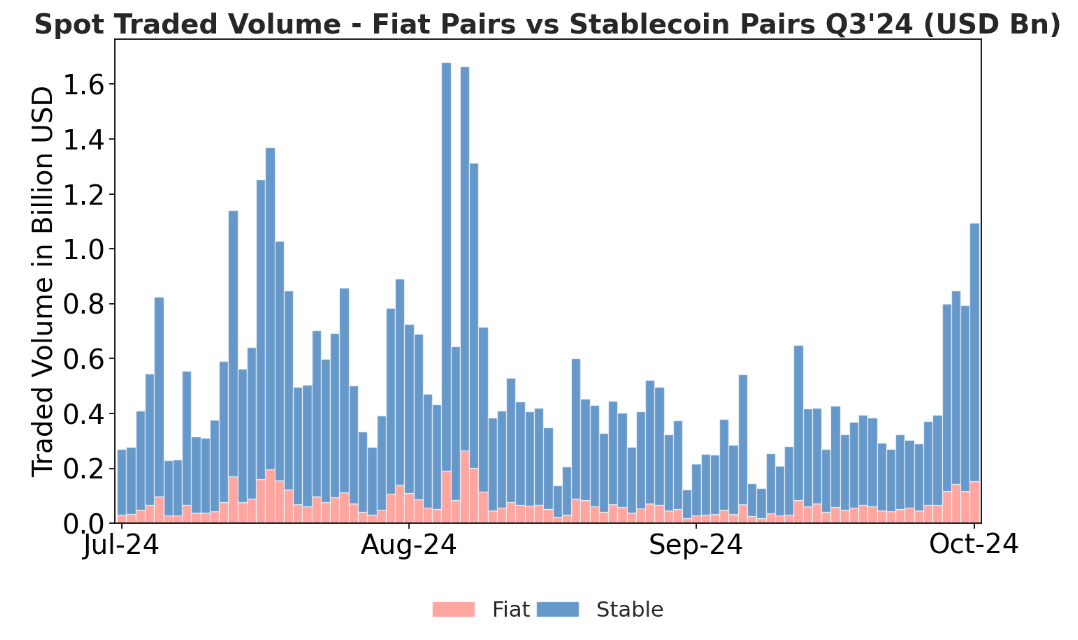

The data further confirms that XRP trading continues to be largely concentrated in USDT pairs, reflecting the stablecoin’s dominance as a trading base in the cryptocurrency market. Interestingly, fiat-paired trading for XRP also saw a rise, increasing from 10% in Q2 to 14% in Q3.

thecryptobasic.com

thecryptobasic.com