An acclaimed crypto researcher on X has recalled the infamous events surrounding the LUNA crash a few years ago that exposed many crypto users to significant losses. Introducing his thread, the researcher described the incident as a LUNA crash that shook the crypto world. He considers it a classic case of the risks associated with algorithmic stablecoins.

$LUNA crashes from $115 to $0, shaking the crypto world.

— ardizor 🧙♂️ (@ardizor) October 26, 2024

~$60 billion vanished from the market's value.

The largest individual loss hit nearly $10 million!

Let's remember this story and discuss the risks of crypto 👇🧵 pic.twitter.com/M7nlJJLSFO

According to the researcher, LUNA suddenly crashed from $115 to $0, wiping out $60 billion from its market value. One individual lost nearly $10 million, highlighting the extent of the potential risks associated with crypto investment.

Related: Terraform Labs’ Bankruptcy Hearing: Impact on LUNA, LUNC, USTC Prices

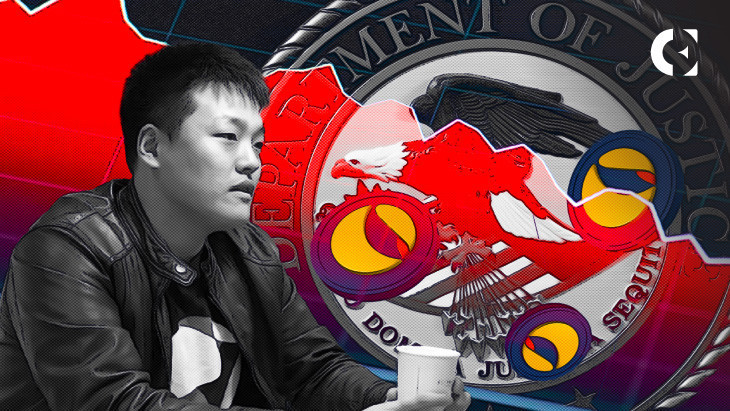

Recalling the LUNA scandal, the researcher described Terra, the infrastructure behind LUNA, as a blockchain protocol and payment platform designed for algorithmic stablecoins. Terraform Labs, co-founded by Do Kwon and Daniel Shin, launched in 2018 and was renowned for UST, its Terra stablecoin, and the associated LUNA reserve asset.

Terraform’s innovative approach attracted several investors. The stablecoin solution did not rely on the traditional pattern of having physical assets as its backup. Instead, the UST sustained its value through complex algorithms and market mechanisms. Over time, Anchor Protocol, a DeFi solution built on the Terra Blockchain, became a cornerstone of the Terra ecosystem, offering up to 20% annual return on UST deposits.

Related: Montenegro Supreme Court to Review Do Kwon Extradition Ruling

Anchor’s solution became attractive and attracted a significant UST portion. The protocol accounted for 75% of the stablecoin’s supply but sparked worries about its long-term viability. The protocol realized such fears in May 2022 after whales withdrew over $2 billion in UST and sold on the market. That triggered a de-pegging of the stablecoin, with the price crashing to $0.91.

UST’s de-pegging led to a massive FUD in the Terra ecosystem, leading to a LUNA selloff and subsequent delisting of LUNA and UST by crypto exchanges. Considering those setbacks, the Terra blockchain paused its operations, triggering an ecosystem collapse that resulted in a $60 billion loss and significant legal implications for the parties involved, including Voyager, Celsius, and Three Arrows Capital.

Other events following the TerraUSD collapse involved the arrest and imprisonment of Kwon amid ongoing extradition procedures between South Korea and the United States. The researcher underscores the UST fallout as a crucial lesson for investors regarding the risks associated with algorithmic stablecoins and the allure of high yields.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com