While Shiba Inu has the potential to reach greater heights despite the current tokenomics, only one factor is capable of catalyzing a rise to more ambitious targets.

Some of these ambitious targets include the $0.001 and $0.01 goals. Notably, the major reason these ambitious targets have garnered attention recently is Shiba Inu’s history of astronomical surges.

Optimism Among Shiba Inu Investors

For instance, a CoinGecko report from last May confirmed that a $12 investment in Shiba Inu yielded $1 million within a year. This made SHIB one of the most successful crypto assets despite launching just over four years ago.

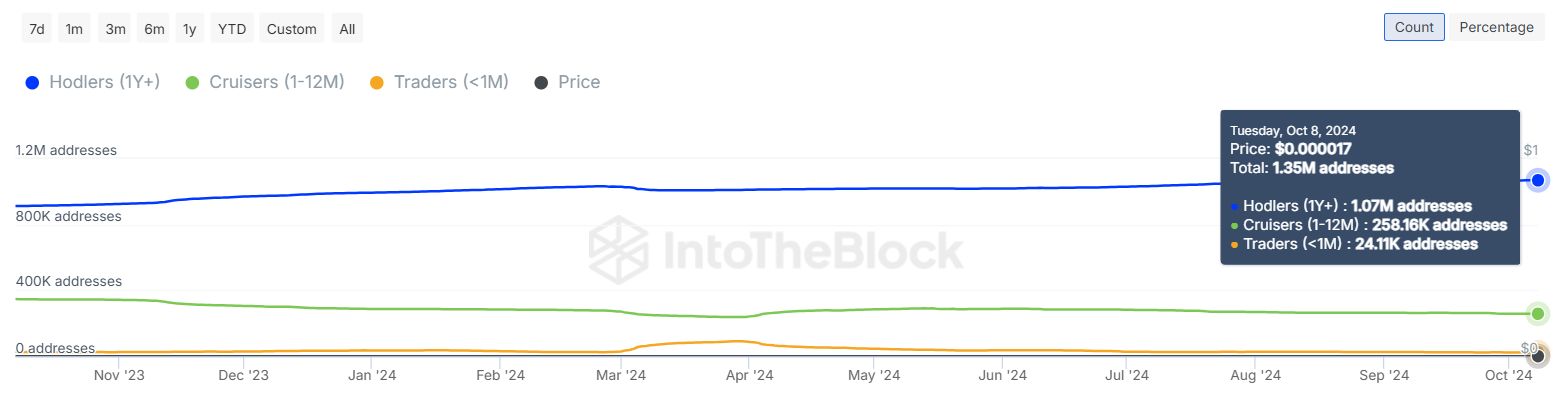

Expectations of a repeat of the success have attracted more investors. IntoTheBlock data confirms that Shiba Inu’s addresses have grown to 1.35 million at press time. Notably, this figure represents an addition of over 30,000 addresses this year.

Amid the network growth, lofty predictions have kept hope alive. Last month, market analyst Krao predicted that SHIB was on the verge of reaching the $0.001 level. In July, market commentator Luis Delgado said a Shiba Inu rise to $0.01 was a certainty.

However, while Shiba Inu is capable of reaching lower goals, such as the ATH of $0.00008 and the $0.0001 region, despite current market conditions, its ability to claim loftier targets like $0.001 and $0.01 would depend on a change in tokenomics.

Only Factor That Allows SHIB to Hit $0.001 and $0.01

This change would involve a drastic reduction in its circulating supply, which currently stands at 583.5 trillion, per data from Shibburn. With this much supply, there is not enough money in the market to sustain the market cap that these ambitious targets could produce.

For instance, due to its 583.5 trillion token supply, a price increase to $0.001 would push Shiba Inu to a valuation of $583 billion. While this is possible, the Shiba Inu market would require an influx of a massive amount of new capital from multiple sources, including a spot ETF.

Meanwhile, with the 583.5 trillion tokens in circulation, a surge to $0.01 would skyrocket Shiba Inu’s market cap to $5.83 trillion. This valuation is not feasible even in the next decade. Nonetheless, a decrease in circulating supply through token burns can help soften the resulting market cap.

Notably, if Shiba Inu’s circulating supply is reduced by 95%, this would leave 29.15 trillion tokens in circulation. At this figure, a $0.001 price would lead to a market cap of $29.15 billion, while a $0.01 price would result in a $291.5 billion valuation.

However, as the ecosystem team noted, such a massive burn might not be possible without community cooperation. Notably, no individual is capable of arbitrarily controlling the Shiba Inu supply, as it is currently inaccessible.

As a result, holders of the token would need to contribute to burns. One way the ecosystem team calls for cooperation is through the use of Shibarium, a layer-2 solution that burns SHIB with portions of its base transaction fees.

thecryptobasic.com

thecryptobasic.com