On Sunday, Sept. 29, 2024, market data revealed that the TON-powered crypto asset, hamster kombat (HMSTR), experienced a 14% drop against the U.S. dollar over the last day, just three days after its market debut. Initially trading at $0.009993 per token when it first hit major exchanges, HMSTR has since lost over 42% of its value.

TON-Powered Hamster Kombat Coin Reaches All-Time Low on Sunday

The numbers indicate that HMSTR, the native token for the TON-based Web3 game Hamster Kombat, still faces significant sell-offs. Bitcoin.com News previously reported a 30% decline in the token’s value on its opening day across top exchanges. On Sunday, HMSTR dropped to $0.005613, hitting a new all-time low, marking a 14% decline today.

Hamster Kombat, at its core, is a click-to-earn sensation hosted on the TON blockchain through Telegram. Players tap away at digital hamsters to rake in HMSTR coins, which can be used for upgrades, joining mini-games, and leveling up operations. The game spices things up with daily missions, social features, and even mining mechanics.

HMSTR, the game’s native token, was airdropped to dedicated players, rewarding their in-game achievements and engagement. At its current price on Sunday, hamster kombat boasts a $365 million market cap, landing it as the 193rd largest out of more than 10,000 crypto assets.

Currently, 64,375,000,000 HMSTR are circulating, and within the last 24 hours, the TON-centric token has seen $248 million in global trading activity, with Binance leading the pack as the most active exchange. According to tonscan.com, HMSTR has 12,498,400 holders and the max supply is one hundred billion HMSTR.

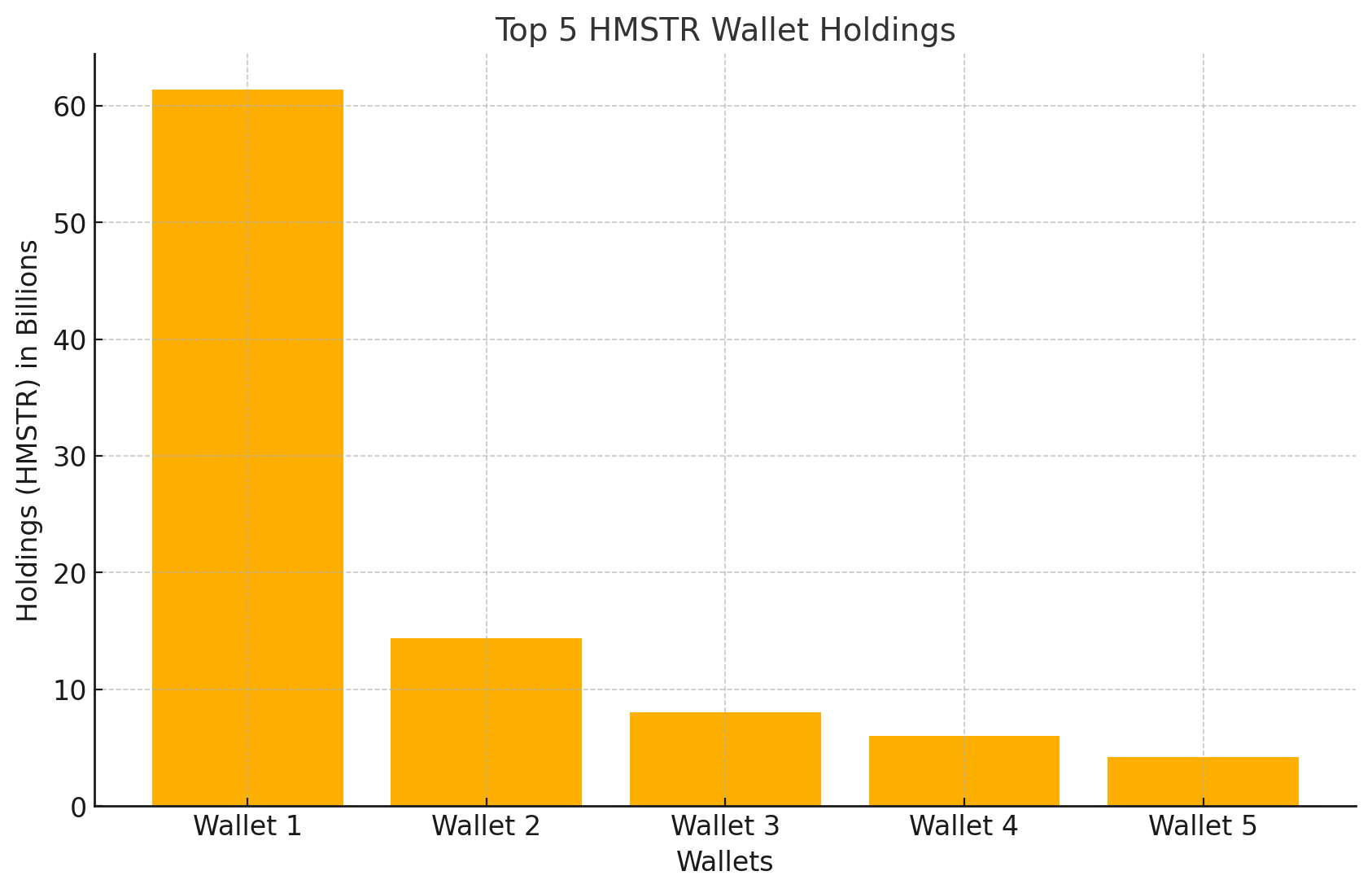

The top wallet controls a whopping 61,362,223,003 tokens, or 61.36% of the total supply. Following closely, Binance’s hot wallet ranks second with 14,356,128,737 HMSTR, holding around 14.36% of the total supply. A staggering 93.95% of the entire HMSTR supply is locked in the hands of the top five wallets, holding the lion’s share of the token.

Like most newly launched crypto tokens, HMSTR’s early market ride has been bumpy, hinting at potential hurdles for future stability and liquidity. Whether it can find solid ground will likely depend on broadening its holder base and keeping both new and seasoned players hooked on tapping away at digital hamsters.

What do you think about HMSTR’s losses on Sunday? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com