Recently, Io.net (IO), a project focusing on the decentralized physical infrastructure network (DePin), announced its staking program. Within just a week, the newly launched program has successfully garnered around $1.5 million.

The staking program is a critical component of Io.net’s strategy to enhance network security and efficiency. It requires GPU and CPU suppliers to lock in a specific amount of IO tokens based on their device’s capacity and contribution to the network.

Why Io.net Introduced Staking?

According to data from Solscan, this initiative, designed to incentivize Graphics Processing Units (GPU) providers through staking, has secured approximately 654,940 IO tokens.

The program has set the minimum stake per card at 200 IO. For devices with multiple GPUs, the staking amount scales with the number of units and their respective earning multipliers.

Read more: What Is DePIN (Decentralized Physical Infrastructure Networks)?

For example, a device with eight H100 GPUs, each with an earning multiplier of 10, would require a substantial stake of 16,000 IO. Conversely, a device with four 4070s GPUs, each with a multiplier of 0.25, would only need to stake 800 IO.

“Requiring suppliers to stake IO allows us to encourage long-term commitment to our platform. It also allows us to create an incentive for good behavior,” io.net explained.

Additionally, each supplier’s device operates under a dedicated smart contract, ensuring that staked IO tokens are secure. Furthermore, block rewards are distributed fairly and transparently. These rewards are accrued to the Solana wallet address linked to the supplier’s account and can be claimed periodically.

Unstaking introduces a 14-day cooldown period, during which IO tokens are no longer counted towards the minimum staking requirement for block rewards. This cooling-off phase is crucial for maintaining network stability and integrity and preventing potential exploitation of the reward system.

The DePin platform Io.net has also implemented a rigorous security protocol, including a slashing mechanism for suppliers who engage in actions like spoofing or data compromise.

“Slashed IO is subject to a one-month reconsideration process. If you notice your device stake is slashed, you can open up a support ticket. IO support will present technical evidence that proves why the device was identified for spoofing or other malicious behavior,” io.net said.

Supply Shock?

Deebs DeFi, a pseudonymous DeFi analyst, commented that the staking update could cause a supply shock. He suggested that it could reduce 10% of the circulating supply of IO tokens. Based on Deebs DeFi’s calculation, GPU providers could bring a purchase volume worth nearly $17 million.

“This is based on the assumption that all providers buy and stake the minimum IO they need,” Deebs DeFi noted.

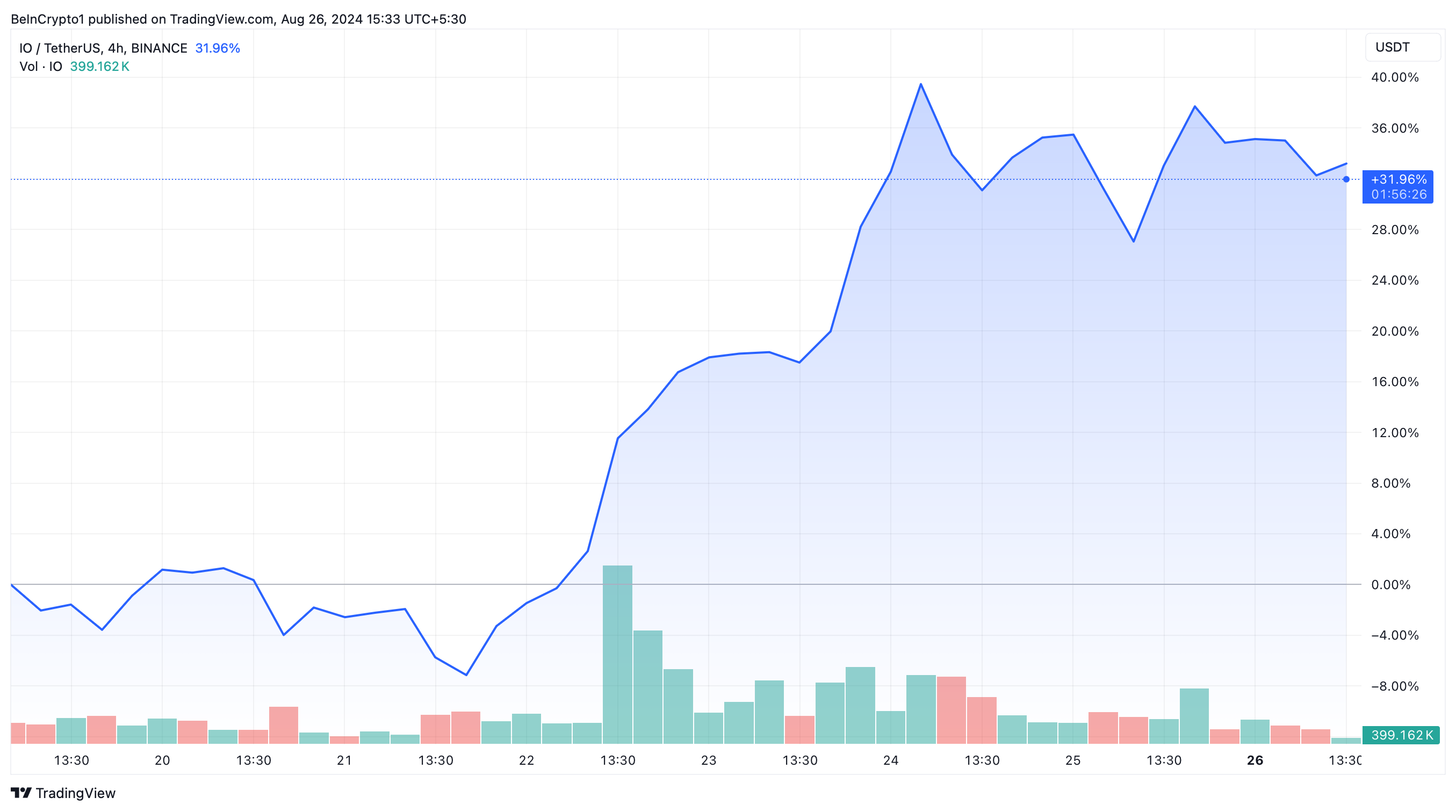

The price action of IO tokens reflects this bullish outlook. As of this writing, IO is up over 30% in the past seven days. Furthermore, the upcoming Nvidia quarterly report on August 28, which could impact AI and DePin tokens, adds another layer of anticipation.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, the DePin token itself has faced challenges, shedding about 65% of its value from its peak in June. Additionally, there are concerns about potential sell-offs as new supply enters the market. While the circulating supply of IO tokens is just 95 million, its maximum supply stands at a whopping 800 million.

beincrypto.com

beincrypto.com