In this article we delve into the crypto Sora AI and Fetch.ai, both linked to the artificial intelligence sector, reporting the most relevant news and analyzing the price action in the cryptographic market.

Let’s talk about two coins and two extremely different projects, with separate technological infrastructures and communities with different scopes.

Sora AI is indeed a much smaller project compared to Fetch.ai, which has already established itself on several occasions as one of the main leaders in big data and machine learning.

Let’s see everything in detail below.

Summary

Crypto and Artificial Intelligence: Sora AI and the art of imitation

Since OpenAi released ChatGPT in November 2023, the attention of crypto investors towards everything related to the world of artificial intelligence has grown significantly.

Thanks to the exploits of the graphics card manufacturer Nvidia, all cryptographic tokens related to AI have recorded a momentum as protagonists.

One of these, namely the community token Sora AI, has recorded a decent success despite not being in any way connected with the latest text-to-video model developed by the OpenAI leader, with its release scheduled for the second half of 2024.

Actually this cryptocurrency, while publicly admitting to not having affiliations with Sam Altman’s company, constantly publishes on X contents that suggest a connection with the new model of artificial intelligence that generates realistic images based on a text prompt.

This is a rather misleading marketing, where newcomers could be misled into thinking that the token is an official resource of OpenAI

Welcome to the world's very first decentralized $SORA community token:

— Sora AI Community (@SoraAIToken) February 20, 2024

0xb8a87405d9a4f2f866319b77004e88dff66c0d92

Join us and become a SORANIAN pushing behind the forefront of innovation:https://t.co/ezGU05adMw https://t.co/OQqMQG27iE

In other contexts this token could be marked as scam, but in the midst of the hype madness for the AI sector, Sora AI has still managed to reach the milestone of 6,000 holders with a market capitalization of 4 million dollars.

The currency is also listed on several second-tier centralized exchanges.

It goes without saying that most likely this project will cease to exist and its investors will be left holding the candle.

Latest news for Fetch.ai: Chainlink integrated with BlockAgent

Speaking instead of a legitimate project, we report the latest updates at Fetch.ai, with very interesting news on the horizon.

The protocol, which aims to connect blockchain, AI agents and big data around a machine learning network, has recently incorporated Chainlink with the BlockAgent toolkit.

Quest’ultimo monitora le funzioni blockchain nel mondo reale, raccogliendo ed organizzando dati in base alle richieste degli utenti utilizzando la tecnologia Ai Agent di Fetch.ai

BlockAgent hits the news again 💯

— Fetch.ai (@Fetch_ai) May 20, 2024

Track #blockchain activity for market insights with our new tools👇

AI Agent tech and blockchain were made for each other!

Now with @chainlink integration.https://t.co/akSqIulOT4 pic.twitter.com/i2jjdvCgHy

The integration of the Chainlink oracle with BlockAgent allows to obtain reliable price feeds of a wide range of cryptographic assets, relying on the track record of the project belonging to the Ethereum, Polygon, and Arbitrum networks.

In this way Fetch.ai users have the opportunity to organize their own set of data accurately and reliably, with the veracity of the information entrusted to Chainlink, and the automation of outputs (notifications, alerts, various interactions) in the real world entrusted to BlockAgent.

The use cases that emerge from this implementation are multiple, such as the creation of marketplace NFT, tracking on-chain of a long set of data, the implementation of decentralized copy trading contracts and much more.

Other use cases include initiating effective trading on decentralized exchanges, monitoring governance activities related to DAOs, and providing real-time records to comply with established rules.

Very likely with the growth of the Chainlink protocol and the expansion of the world of verifiable data from the oracle, opportunities for connection with the outside world will also grow and use cases related to the AI BlockAgent will also multiply.

The limit in this case is only the imagination.

Analysis of the prices of the crypto Sora AI and Fetch.ai

Let’s now see how the two tokens, Sora.AI (SORA) and Fetch.ai (FET) behave graphically in the cryptocurrency market.

Let’s start from the assumption that in addition to the technical side, these two resources are extremely different also in terms of capitalization and market share in the artificial intelligence sector.

In this sense SORA is much smaller and less known compared to FET, which ranks in the top 100 of the CoinMarketCap ranking.

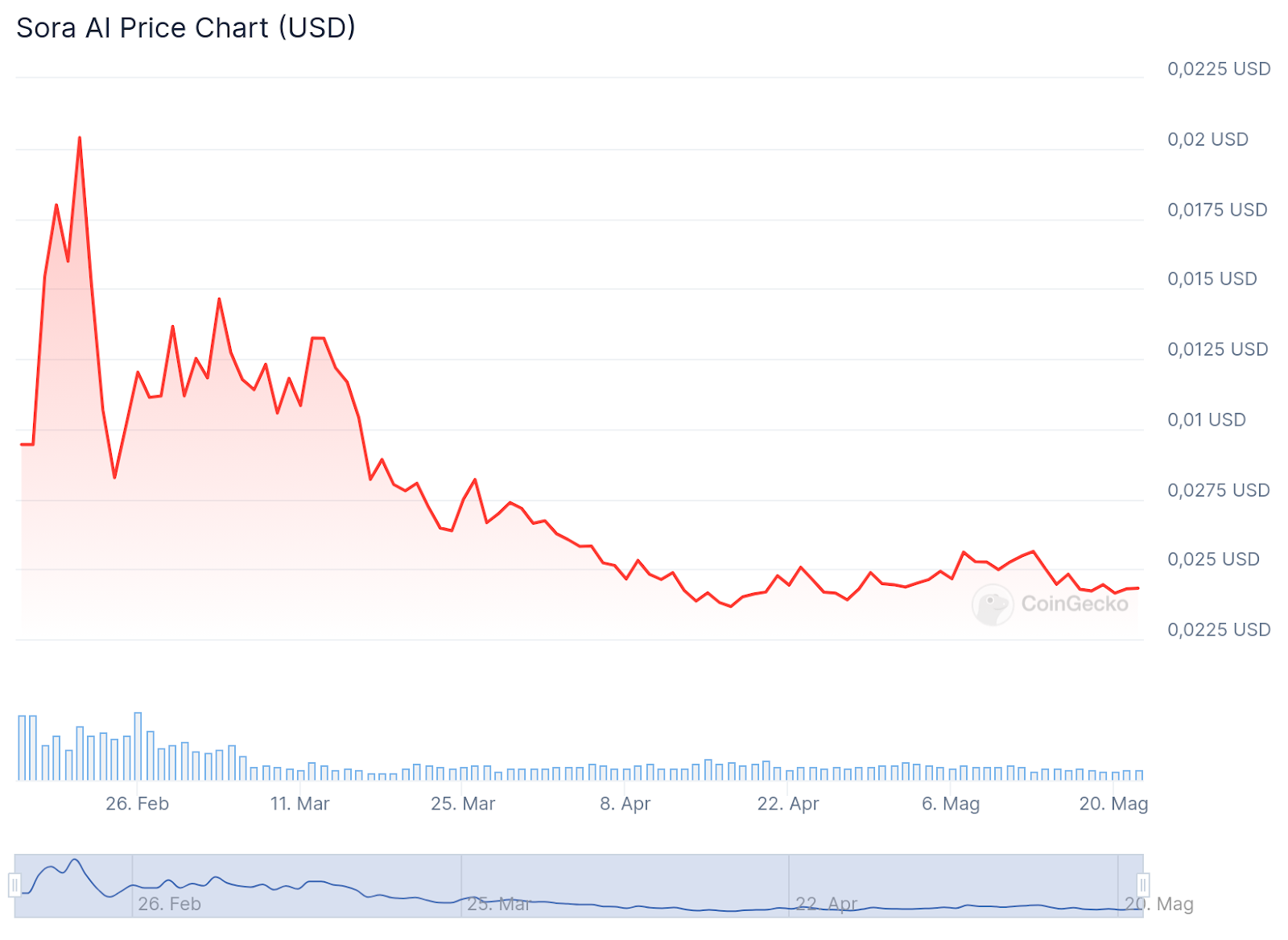

By analyzing individually the price action of these two crypto, we can immediately notice how SORA in just 3 months has lost about 80% of its value after reaching the all-time high around 0.02 dollars.

At the time of writing this article, this resource is priced at 0.004 dollars, highlighting a very strong selling pressure due to the presence of a large supply of tokens against a virtually non-existent use case.

Not even with the concomitance of the pump of ETH this coin managed to emerge, suggesting its decline and loss of public interest.

From March onwards, SORA investors have started to liquidate their positions pushing the prices of this crypto to its all-time lows.

Probably it will not be able to recover anymore and will end up losing several percentage points before disappearing definitively from the market.

Pay attention to these products, created ad hoc to push newcomers to invest and enrich its founders.

As for the Fetch.ai token, the price evolution tells a different story: the chart suggests a marked interest from investors, who in just one year of trading have pushed prices to grow by 10 times.

In the last 24 hours FET grows by 13%, approaching the historical high of 3.3 dollars and resuming the upward trend following a violent dip that characterized the entire market in the months of March and April.

The volumes are increasing and the currency is about to break the $2.6 resistance, thus canceling the last retracement and pushing prices towards much wider horizons.

In this case, the strong utility component of FET could help the project maintain a solid user and buyer base, thus keeping the prices of the cryptographic asset high.

However, it must be recognized how the speculation factor has driven the recent growth of FET and other AI-related tokens, pushing an irrational influx of capital into a sector that is still premature and lacking successful real-world applications.

The potential of Fetch.ai is enormous, but investors have already priced in the achievement of great milestones, without taking into account the setbacks and difficulties that the project could encounter in the coming years.

For this reason, despite the sentiment on FET at this moment is clearly bullish, and could support another price growth, we believe that this crypto is overvalued.

Most likely from here to year, even with the next integration with Ocean and SingularityNet, and with the consequent merger of the token in ASI, those who invest now in this product will find themselves with a strong loss in their portfolio in the coming years.

The narratives of the crypto world unfortunately, if entered late, end up being extremely harmful and dangerous for the finances of the portfolio.

en.cryptonomist.ch

en.cryptonomist.ch