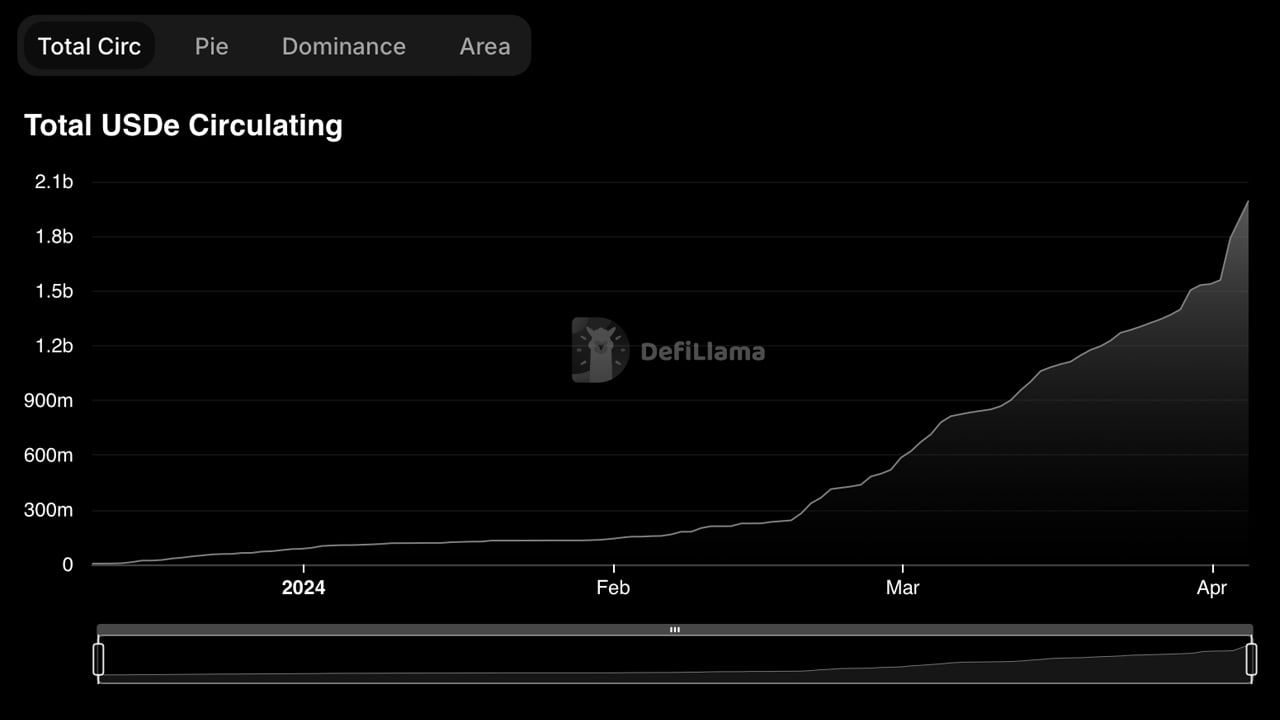

On Thursday, Ethena Labs unveiled its new strategy to back USDE with bitcoin, enhancing the stablecoin’s foundation. The stablecoin, known for delivering yields in the double digits, has rapidly ascended to become the fifth-largest stablecoin by market capitalization, now valued at over $2 billion.

USDE to Utilize Bitcoin as Collateral

An update shared by Ethena Labs on X reveals that USDE will adopt bitcoin ($BTC) as collateral to maintain its peg to the U.S. dollar. The transition to $BTC-backed positions will be visible on the Ethena dashboards by Friday, the team announced. Ethena pointed out that hedges currently constitute around 20% of ethereum’s open interest.

With $25 billion in bitcoin open interest at its disposal for delta hedging, Ethena envisions a potential for USDE’s expansion to more than double. “[Bitcoin] also provides a better liquidity and duration profile vs liquid staking tokens,” Ethena added. “As Ethena scales closer towards $10bn this provides a more robust backing, and ultimately a safer product for users.”

USDE has witnessed considerable growth in recent months, rising to the status of the fifth largest USD-pegged stablecoin with a market capitalization of more than $2 billion. In the last 30 days alone, the supply of USDE swelled by 156%. Currently, the yield stands at 37% annual percentage yield (APY), having previously risen to highs of more than 60% APY. Ethena, the entity behind USDE, also launched a governance token that now holds a market valuation of $1.29 billion.

However, its native token, known as ENA, experienced a decrease of 15% over the past 24 hours. The decision to back the stablecoin with $BTC coincides with the launch of Ethena’s second campaign, in which ‘Shards’ are substituted with ‘Sats.’ Ethena elaborated that the ‘Sats Campaign’ is designed to bolster this expansion. This initiative is slated to continue for five months, concluding on Sept. 2, or until the USDE supply reaches $5 billion — whichever milestone is achieved first, the team revealed.

Ethena’s rapid progress has attracted both scrutiny and buzz within the cryptocurrency realm, as debates heat up over the latest stablecoin. Yearn Finance and Fantom’s creator, Andre Cronje, weighed in on the matter via X, stating, “There is a new primitive that is gaining a lot of traction,” Cronje said. “and I am seeing it integrated into protocols I considered to be very low risk, but from my (perhaps incorrect) understanding, this new protocol is very high risk.”

In the midst of ongoing conversations, Cronje shared two significant comments regarding the potential perils at play. The temperature also started to rise within the corridors of Makerdao and Aave, especially after a suggestion from Makerdao to support $DAI with Ethena’s synthetic stablecoin asset surfaced. This move prompted Marc Zeller from Aave to propose a drastic reduction of $DAI’s loan-to-value (LTV) ratio to zero, citing substantial risks. Zeller described Makerdao’s moves as “aggressive actions.”

Extensive threads and analytical videos on X delve into the claimed advantages and alleged disadvantages of Ethena’s USDE compared to the previous offerings of Anchor before Terra’s downfall. Prior to the destabilization of Terra’s UST stablecoin, Anchor boasted a steady 20% yield on deposits, captivating billions in investment. Undoubtedly, USDE’s high yields are drawing significant attention and money from cryptocurrency proponents. Some have even labeled USDE as a “better version” compared to Terra’s Anchor.

What do you think about Ethena backing USDE with bitcoin? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com