The data from on-chain analytical platforms suggests that the whales have their eyes on two altcoins, namely Chainlink (LINK) and Maker (MKR).

For around a month, there has been a downtrend in the Bitcoin (BTC) dominance. However, the price of BTC has not fallen significantly. This suggests that the whales are rotating their funds from BTC to altcoins.

Is Chainlink (LINK) Again Becoming Whales’ Favorite Altcoin?

The data from Spotonchain shows that a whale wallet, 0x8ead, withdrew 136,146 LINK, approximately worth $2.05 million, on Wednesday from Binance. The platform further reveals that the whale withdrew a total of 348,007 LINK worth $5.58 million over the past nine days.

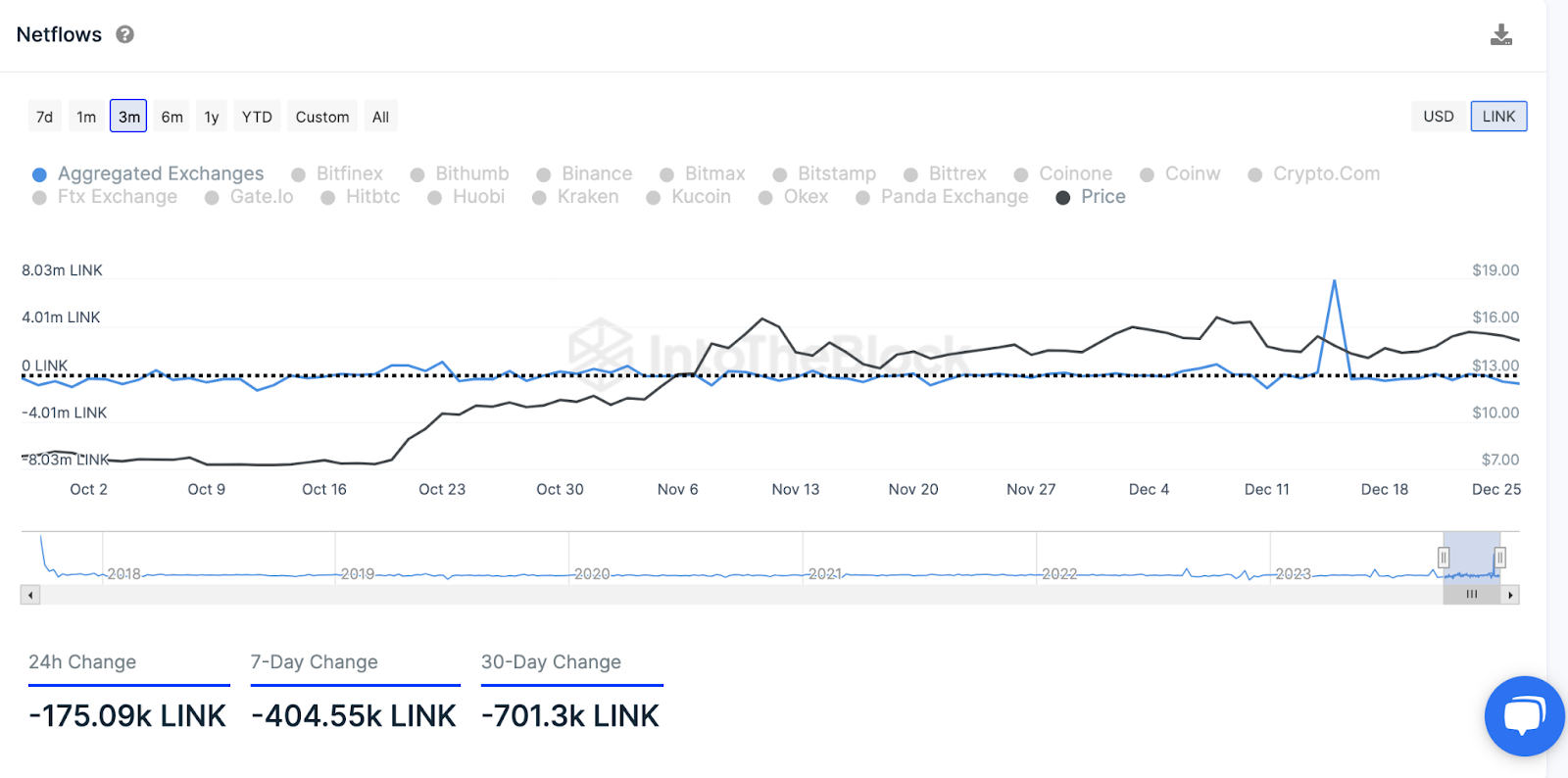

Finally, the screenshot below confirms that there has been significant whale accumulation of Chainlink. In the past 24 hours, the centralized exchanges’ LINK balance decreased by 175,090 tokens. Meanwhile, in the past seven days, the balance has been down by at least 400,000 LINK tokens.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

Chainlink (LINK) was one of the first movers during the bull rally that started in October 2023. However, for over a month, the price of LINK has been roughly consolidating between $13.6 to $16.6.

Will the renewed whale interest ignite a new rally for LINK?

Fresh Wallet Withdrew $4.6 Million Worth of MKR

A freshly created wallet, 0xe68e, withdrew 3,150 MKR tokens from Binance on Wednesday. As per the current market price, the tokens cost approximately $4.6 million.

Based on the seven-day timeframe, the screenshot below shows that the MKR balance on centralized exchanges has decreased by 2130 tokens. However, in the past 24 hours, the balance on the centralized exchanges increased by over 2,000 tokens.

The negative netflow indicates that the supply of the tokens is decreasing in centralized exchanges, and eventually, there will be less selling pressure. On the other hand, a positive netflow suggests that there might be more supply waiting to get dumped in the markets.

Read more: 8 Best On-Chain Analysis Tools in 2023

beincrypto.com

beincrypto.com