As altcoin prices continue to rise, there are a few cryptocurrencies that have been at the forefront of the surge in value. One of them is Illuvium (ILV). In the last 30 days, the value of ILV has increased by 126%, according to CoinMarketCap data.

For context, ILV is the native token of the Illuvium ecosystem which is a fantasy battle game operating on the Ethereum (ETH) blockchain. Although not necessarily a new token, ILV is listed on Binance. However, the exchange only offered spout buying for the cryptocurrency.

According to the on-chain analytic handle on X, Lookonchain, Binance has now listed ILV on the futures market. This decision means traders can now long or short the token depending on the sentiment each trader has.

Binance has launched USDⓈ-M $ILV Perpetual Contract, just as we predicted in a tweet on Nov 9.

— Lookonchain (@lookonchain) November 11, 2023

An investor we shared before deposited 10,000 $ILV($916K) into #Binance after #Binance announced the launch of $ILV Perpetual.https://t.co/rLGUpr7Fye pic.twitter.com/qKHp7dzMJN

Shortly after the listing, an ILV holder deposited the token worth $916,000 into the exchange. Although the reason for the deposit remains largely unknown at press time, there was speculation that the investor was willing to long ILV.

Over the last 24 hours, ILV has continued to defy the odds, adding another 5% increase within the said period. According to the derivatives information portal Coinglass, the Open Interest around ILV has incredibly increased.

Open Interest measures the number of futures contracts open during a trading period. When the Open Interest decreases, it means traders are closing positions. But a surge in the metric, like in ILV’s case, implies that a lot of liquidity is being pumped into contracts linked to the token.

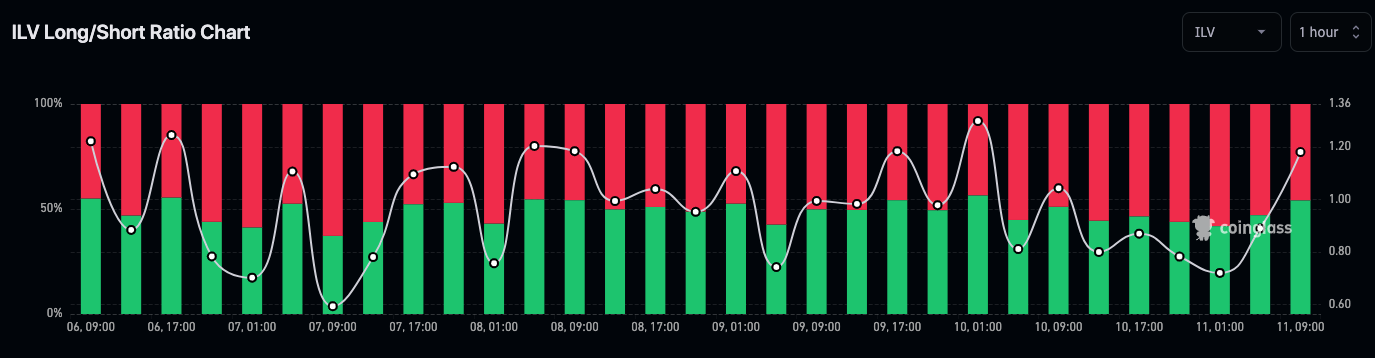

Data from Coinglass also showed that a bunch of traders are choosing to long ILV. Usually, if a cryptocurrency performs well as Illuvium has done, the next thing is for the price action to cool down. In this case, traders considered the token to be overheated.

However, the ILV long/short ratio revealed that traders are unperturbed by the “usual expectation.” At press time, the ILV 1-hour long/short ratio was 1.17. A value above 1 of the long/short ratio means there are more bullish positions than bearish ones.

This inference was reinforced by the long to short positions which were 54.15% to 45.85% at press time.

Considering the Open Interest discussed above, and the rising price action, it is possible for ILV to continue moving in the upward direction. Before a retracement occurs, ILV may retest $100 if the current momentum remains the same.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com