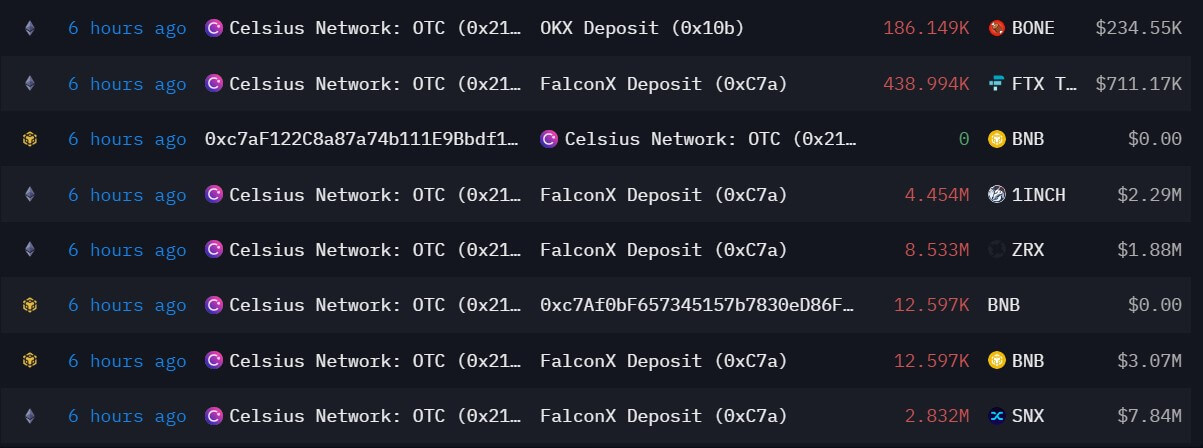

Bankrupt crypto lender Celsius Network sent around $24 million worth of altcoins to OKX and FalconX wallets during the early hours of June 17.

Data from Arkham Intelligence shows that the bulk of the funds were sent to the cryptocurrency brokerage firm, FalconX. The company received $8.46 million worth of Chainlink (LINK), $7.71 million in Synthetix (SNX), and $3.06 million BNB.

Other assets sent to FalconX include $2.1 million worth of 1INCH, $1.87 million in 0x Protocol’s ZRX token, and $718,000 worth of FTX’s native token, FTT.

Meanwhile, the bankrupt lender also transferred roughly $235,000 worth of ShibaSwap’s BONE to the OKX exchange.

The transactions were corroborated by blockchain investigator, Lookonchain, who added that FalconX was depositing the altcoins to Binance.

The transactions appear to be the on-chain evidence that the lender is looking to liquidate the digital assets for Bitcoin (BTC) and Ethereum (ETH) in line with its recent court approval.

Celsius still holds over $180M worth of altcoins.

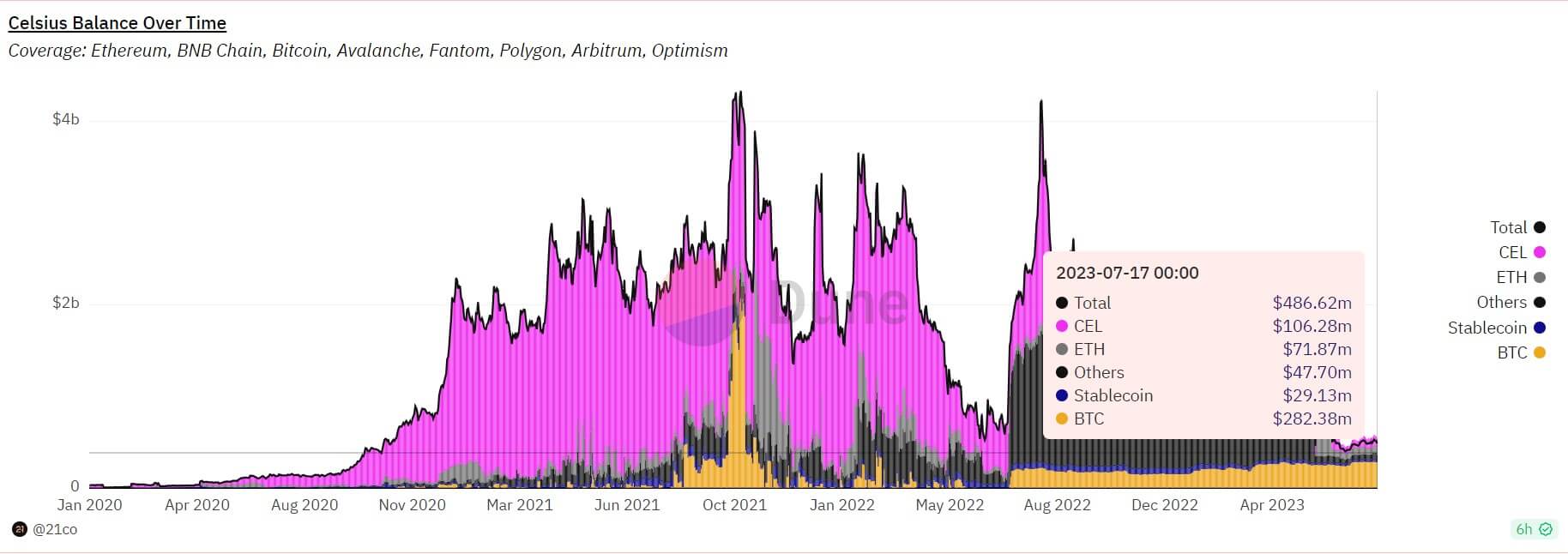

Following the recent transfers, Dune analytics data shows that Celsius still holds around $183 million worth of altcoins, including its CEL token, Polygon’s MATIC, Avalanche’s AVAX token, stablecoins, and others.

Celsius’s altcoin holding is dominated by its CEL token, worth $106.28 million at the time of writing.

On June 10, blockchain analytical firm Kaiko warned that Celsius could have trouble liquidating some of its altcoins because of liquidity issues. The firm highlighted how liquidity for CEL is almost non-existent and how the liquidations of other assets could exert pressure on the crypto market.

Meanwhile, the chart above shows that Celsius’s BTC and ETH holdings account for over $350 million of the total assets in its portfolio.

Celsius co-founder faces court battle.

Amid Celsius’s efforts to liquidate its assets, the bankrupt firm agreed to a $4.7 billion fine with the Federal Trade Commission (FTC) on July 13.

Meanwhile, Celsius co-founder Alex Mashinsky also faces charges from U.S. regulators, including the Securities and Exchange Commission (SEC), which alleged that he violated federal securities law. Mashinsky is out on a $40 million bail after he was arrested on July 13.

Other regulatory agencies, including the U.S. Department of Justice, CFTC, and FTC, also filed charges against him.

cryptoslate.com

cryptoslate.com