Neutron, launched as a cutting-edge interchain technology, is envisioning to grow within the Cosmos ecosystem. In May, Neutron underwent an on-chain vote in favor of its launch on the Cosmos network.

Neutron became the first smart contract platform on the Cosmos network. The consumer chain based on Replicated Security (RS) has had a lot happening within two months of its launch.

How Neutron Came to Be

As the newly launched chain celebrates its first milestones, BeInCrypto got a chance to speak with the general manager of Neutron. Avril Dutheil is an entrepreneur and investor in various blockchain projects, including Ethereum and Polkadot.

He provided us with some insight into Neutron’s next objectives and latest initiatives.

Neutron recently launched an AEZ Accelerator & Builders’ Fellowship program in partnership with ATOM Accelerator and LongHashX. The 12-week program promises to support early-stage applications built on Neutron and Cosmos Partner Chains. It includes providing builders with the necessary funding and networking opportunities.

According to Dutheil, the accelerator program serves two primary objectives. Firstly, it aims to enhance the quality and usability of applications within the Neutron ecosystem. This makes it easier for developers to create secure and efficient dApps. Secondly, as a consumer chain closely associated with the Cosmos Hub, Neutron envisions a collaborative trade zone within the Atom Economic Zone.

The executive emphasized that the accelerator program aims to foster privileged integrations, collaborations, and relationships among Cosmos Hub and consumer chain projects.

Dutheil also tells us that the accelerator program will initially fund five teams of builders working on the Neutron network. He explains that the program offers funding and ensures participants are ready to successfully launch their applications in the market.

Meanwhile, Binance Labs and CoinFund co-led a $10 million funding round for Neutron weeks after it went live on the mainnet.

Can Neutron Drive Collaboration in Cosmos?

Neutron is also looking to build a team of its own with the recent funding round. The developer earmarked $10 million to ensure the platform’s ecosystem thrives and the development of the protocol remains independent of a single team.

He also underlined a significant need for stability on Neutron as teams commit to developing the protocol in the coming years. Dutheil told us,

“The money is a resource that we’ll be using in order to ensure that the design itself gets developed and improved over time, as much as possible and in a decentralized manner.”

He also highlighted that Neutron’s smart contract project could distribute voting power and liquidity on the platform without human intervention. In this regard, the executive said, “I think it is pretty interesting. It made Neutron one of the most liquid assets and one of the most liquid chains in the ecosystem from day one.”

This achievement positioned Neutron as one of the most liquid chains in the ecosystem from its inception. Although the number of applications on Neutron is still growing, Dutheil signaled the emergence of compelling DeFi possibilities.

Read more: Cosmos (ATOM) Price Prediction 2023/2025/2030

Hitting Milestones Just Two Months In

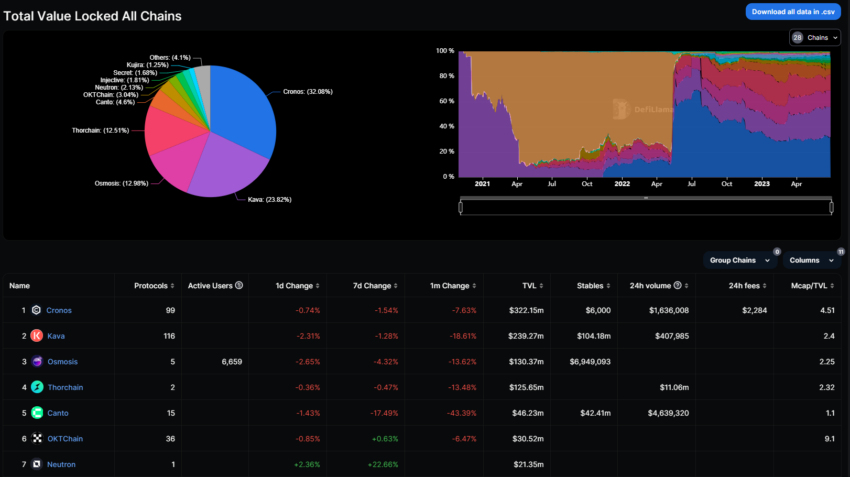

According to DeFiLlama, Neutron is the seventh largest chain on Cosmos while housing one protocol. At press time, it has over $21.35 million in dollars locked. Cronos, Kava, and Osmosis remain the top three chains on the network by total value locked (TVL).

However, the figures alone don’t ensure Neutron’s profitability and, in turn, its sustainability.

Dutheil underlined that Neutron’s scalability and profit generation as a smart contract platform is closely tied to its ability to become a more useful and appealing platform within the Cosmos ecosystem. But the platform’s setup does help it to generate revenue.

While Dutheil says that the design makes Neutron profitable, it also puts significant effort into building a robust ecosystem to support successful applications.

In contrast to Osmosis’ success on Cosmos, Dutheil believes its profitability is limited due to the current economics of its token. He compared its liquidity incentives and staking rewards to Neutron’s model, which does not involve token inflation for staking rewards.

He noted, “Basically, there are no tokens being minted and spent on these staking rewards from Neutron.” Therefore, validators’ share in the revenue generated by Neutron makes it more sustainable.

Dutheil explains,

“One thing that’s pretty interesting about Neutron is that due to Replicated Security, the protocol doesn’t have a fixed cost. The protocol doesn’t produce money over time. It can only earn money through transaction fees and MeV (Maximum Extractable Value) and other value capture mechanisms. And that value is then shared with the Cosmos Hub.”

What is Neutron’s Strategy for Competition?

Detailing how Neutron’s model works, Avril explained that the Cosmos Hub (provider chain) enters into an agreement with Neutron (consumer chain). This is where the Cosmos Hub lends its stake and validator set to Neutron in exchange for 25% of the revenue generated by Neutron, the entrepreneur explained.

He reiterated, “Neutron is unlikely to be displaced from being the smart contract platform that the Cosmos Hub secures because, one, there’s no point for the hub to have two platforms doing the same thing.”

While he doesn’t see smart contract launches on RS in the near future, Neutron is targeting collaboration over competition. Dutheil said,

“I don’t think Neutron is threatened at all. In terms of like the wider security, like shared security models that are coming to life in the industry, Neutron can actually work with a lot of them.”

For instance, Dutheil cited that Neutron is compatible with Mesh Security. He explained that Neutron DAO could allow alternative mechanisms to use a portion of its treasury to provide security to other chains and earn staking rewards from them while creating mutually beneficial relationships.

Regarding other security mechanisms like Ethereum or staking, Avril highlighted the need for Cosmos to differentiate itself. He pointed out that Cosmos has to bring unique ideas to the market to avoid competition from Ethereum variants. He stated,

“I think that just boils down to the point of, we’ve made really powerful ideas and technologies in this ecosystem…And that’s one of the things that we’re trying to do with Neutron right.”

Dutheil noted that Neutron aims to allow building applications without reinventing the wheel. While its security model and focus on new applications position it well in the interchain smart contract space, can it move beyond DeFi to unlock its potential?

Platform’s Future Beyond DeFi

In response to the question about Neutron’s plans to extend its use case beyond decentralized finance (DeFi), Dutheil mentioned that it’s important for Neutron to evaluate its value proposition.

He said,

“We should approach what vertical we tried to serve. Let’s look at what we have and which types of applications are right. And if we want to expand into a new category, then we need to make sure that our value proposition actually fits this right.”

Dutheil emphasized that Neutron’s current strength lies in its security and the ability to perform cross-chain operations, making it suitable for DeFi applications. However, he noted other verticals, such as gaming, have different requirements and may prioritize performance over cross-chain functionality.

Highlighting further that if Neutron intends to expand into these verticals, it needs to ensure that its technology can meet the specific needs of those applications.

The executive also mentioned an interesting idea for the future of Neutron, which involves implementing application-specific rollups. By pursuing this direction, Dutheil sees Neutron catering to new verticals, like gaming.

Will Macro Crypto Factors Pose a Challenge?

Notably, the crypto sector is struggling with the FTX collapse, a nail in the bear market. According to PitchBook data, private funding for crypto startups reached its lowest level in Q1 2023 since 2020.

The research also found that VC funding for the industry decreased by 80% compared to last year’s period, falling to $2.4 billion.

While that happens, Dutheil mentions that the crypto market is currently facing challenges. However, he believes that what truly matters is building technologies superior to existing systems. And therefore, creating applications that genuinely serve users’ needs.

The future of interchain smart contracts holds immense potential in how decentralized applications interact and operate. Meanwhile, seamless interoperability has been a central theme of the market for a few years.

While that happens, Neutron’s general manager said he prioritizes three things — building a “very strong, very decentralized, very coordinated ecosystem that drives itself forward over time.”

beincrypto.com

beincrypto.com