The latest developments in the European banking sector pushed bitcoin north once again, with the asset surging past $28,500 for the first time since June 2022.

A few altcoins have marked notable gains as well, with Solana leading the race.

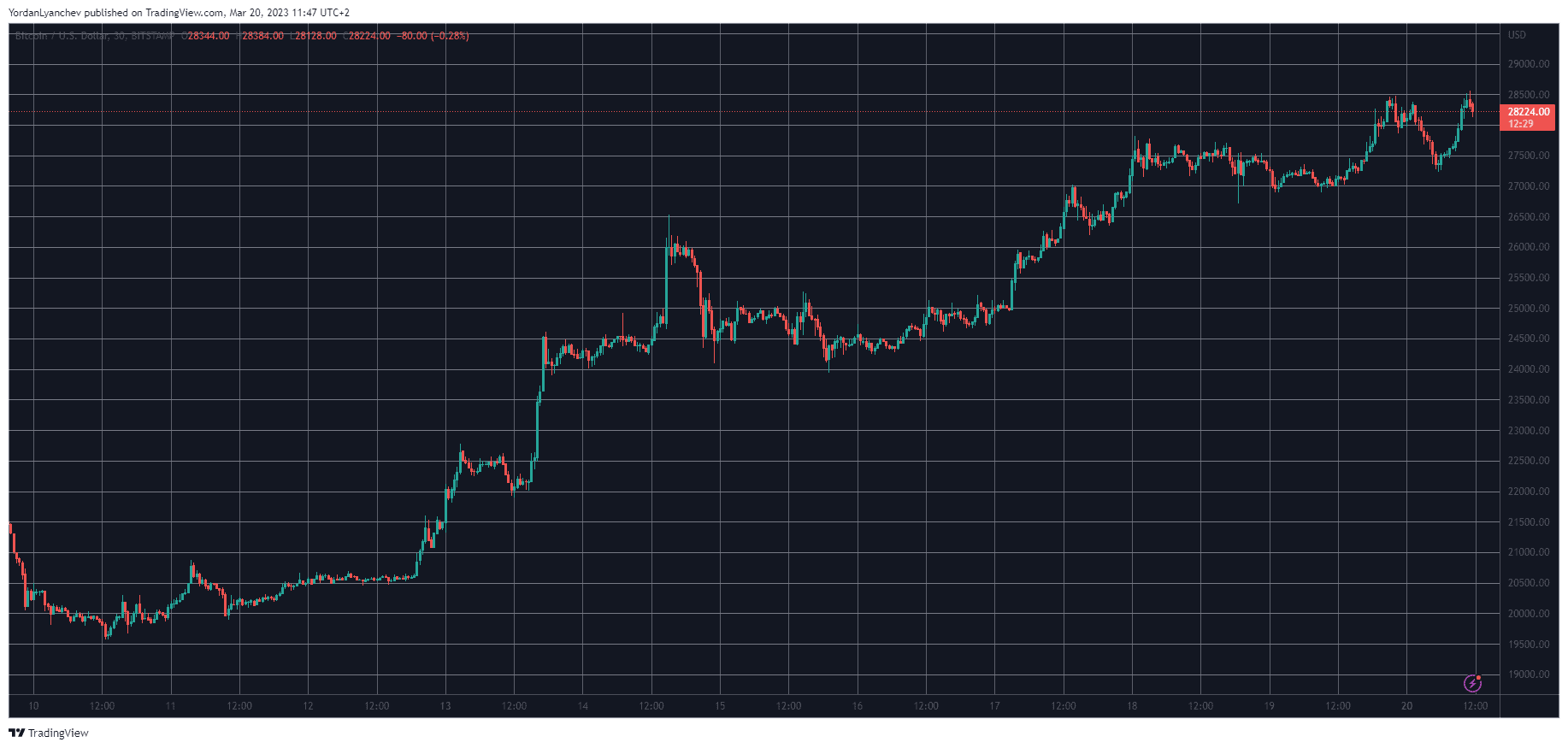

Bitcoin’s New Local Peak

Bitcoin finished one of its best weeks in a while after it surged from $20,000 to around $28,000 within the past seven days. This came amid the growing banking issues in the US, which later extended to Europe.

One of the Old Continent’s largest banks – Credit Suisse – announced being acquired by Switzerland’s biggest bank – UBS – in a deal worth $3.25 billion (60% less than what the former was worth last week). Both parties claimed that the goal of the deal was to “secure financial stability and protect the Swiss economy.”

Bitcoin reacted positively to the news, surging past $28,000 for the first time in nine months. It went to a new local peak of $28,500 before it retraced by $500 and has since bounced off once more.

Its market capitalization has increased to well beyond $530 billion, while its dominance over the alts has further soared to 46%.

SOL Soars by 8%

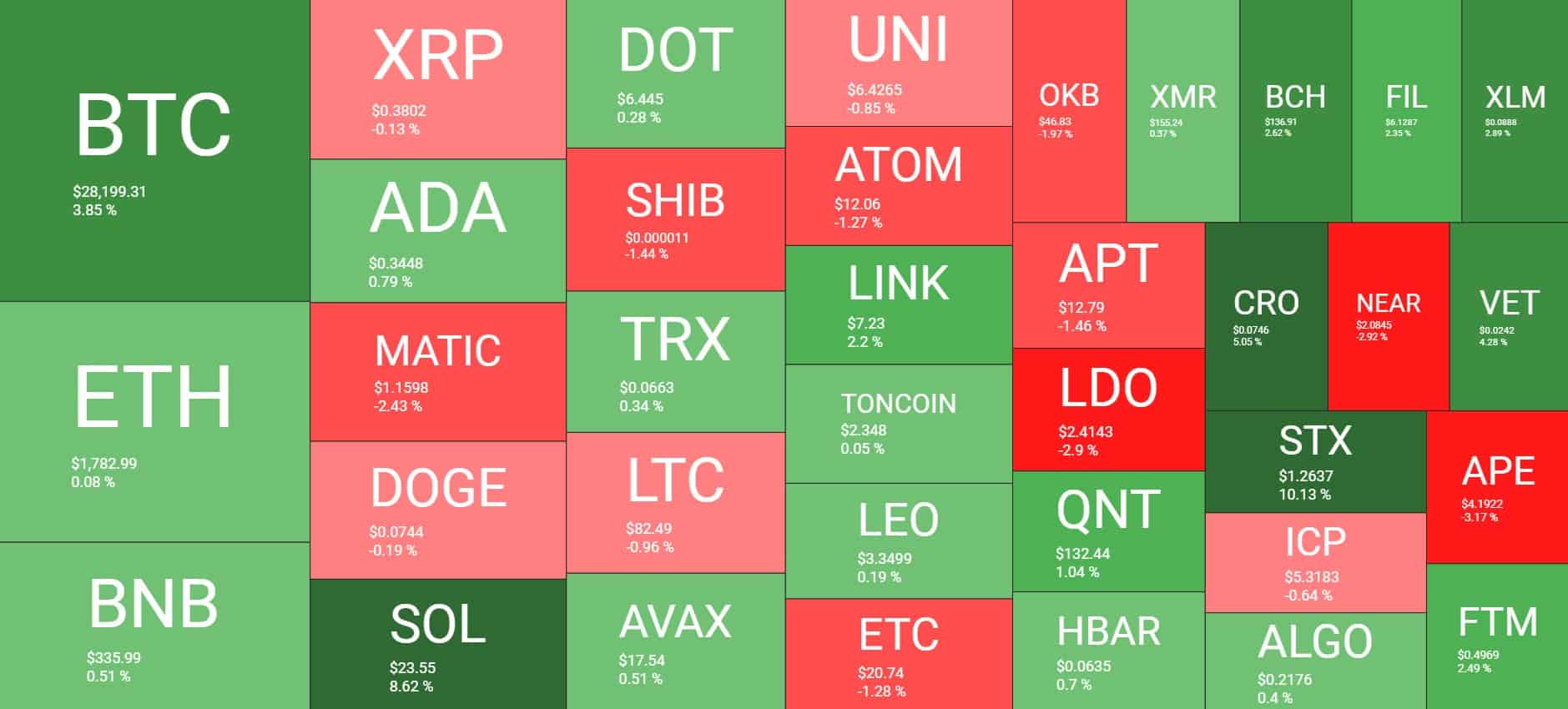

As the BTC dominance chart demonstrates, most alternative coins have been recently outperformed by bitcoin. The past 24 hours are yet another example, even though most alts are still in the green.

Solana is among the few exceptions with a massive daily surge. SOL is up by 8%, which has helped it reclaim $23. The other notable gainers from the larger-cap alts include CRO, VET, and STX.

In contrast, Ethereum, Binance Coin, Cardano, Polkadot, Tron, and Avalanche have painted insignificant gains. MATIC, Ripple, Dogecoin, Shiba Inu, and Litecoin, on the other hand, are with minor losses.

The total crypto market cap has added almost $20 billion in a day and is back at $1.180 trillion.

cryptopotato.com

cryptopotato.com