Blur.io ’s native governance token fell 87% after the Blur.io marketplace unlocked 360 million previously airdropped tokens.

At press time, BLUR had fallen over 80% to $0.63 from an all-time high of $5.01, reached just before the unlock.

Blur Admits to NFT Wash Trading

According to Ethereum News, some BLUR holders singled out Blur.io’s silence on the token’s tokenomics as the reason behind the collapse.

Blur later acknowledged the presence of wash trading on the platform, i.e., artificially inflating the value of a financial instrument by buying and selling it simultaneously. It said it had processed $1.2 billion in non-wash-trade volumes since its launch in October 2022.

The pro-NFT marketplace awarded BLUR tokens in care packages airdropped to traders and bidders in the last four months.

Blur.io airdropped its first round of care packages to early traders who migrated from rival marketplaces in Oct. 2022 and then airdropped packages to traders and bidders in the second and third rounds. Recipients of the latter airdrops received more tokens than earlier ones.

Users Can Look to Rarible DAO for Incentive Structure

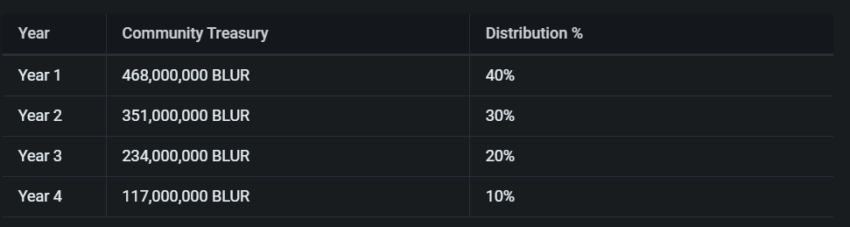

Despite user claims, Blur has published a schedule for unlocking a further 2.64 billion BLUR. The project will release 39% of BLUR to the DAO treasury within the next four years.

Ten percent of these tokens will go toward a budget for incentive programs, which may help to drive engagement according to a strategy used by a competitor Rarible.

Creator-focused Rarible, an early pioneer in the DAO-run NFT marketplace, encourages trading by awarding RARI to entities that bought or sold NFTs in the previous week. RARI holders can also lock their tokens in a locking contract to earn veRARI used for voting and perks

Initially, Rarible launched its RARI token as a governance token to enable users to vote on changes to the marketplace. A core group retains the prerogative on whether to execute any proposals.

Last year, Solana marketplace Magic Eden issued special passes to active users that used the platform in the previous month. The users could vote as part of MagicDAO on various issues, including which projects to feature on the homepage and how to manage DAO funds.

Again, Magic Eden’s team and community governed the project before token holders.

beincrypto.com

beincrypto.com