Cross-chain bridge protocol Stargate Finance’s native STG token has surged 13% over the past 24 hours following its announcement that it was teaming up with Avalanche-based decentralized exchange Trader Joe to unlock omnichain fungible tokens.

STG has recently climbed from roughly $.60 cents a day ago to $.92 cents. According to crypto data aggregator CoinGecko, it has risen about 50% in the past seven days and 150% this year, outperforming most altcoins in the current broader digital asset rally.

The partnership with Trader Joe means that Stargate will support the increasingly popular JOE token, without requiring Trader Joe to maintain a liquidity pool on the platform. On Monday, Trader Joe announced its integration with LayerZero, making JOE a multichain token to be natively sent between blockchains.

STG’s climb also follows the Stargate DAO’s passage of a proposal to reissue the token and airdrop it to all STG holders. The community had been raising concerns about protocol-owned liquidity (POL) and STG holder security stemming from its entanglement with Alameda Research, the trading arm of disgraced crypto exchange FTX.

The Stargate DAO stated in the proposal that Alameda purchased 10% of the total STG supply from the Stargate Community sale on March 17, 2022 and then committed to lock up all these tokens until March 2025. But following FTX’s meltdown, recent on-chain transfers from known Alameda wallets revealed that "Alameda does not have full control of its wallets and that a malicious actor or hacker is misappropriating Alameda’s funds,” the Stargate DAO said.

“Without a token re-issuance, a malicious actor with access to Alameda’s private keys could claim the Stargate tokens from the contract as they vest and misappropriate them as they seem to have with other funds,” the proposal read. Stargate will reissue STG tokens on March 15.

In addition, a short squeeze over the past 48 hours has pushed STG’s price higher. Data sourced from crypto futures data platform Coinglass showed that traders liquidated some $342,000 of STG short positions versus around $126,000 of STG long positions.

Elsewhere in markets

Layer 1 blockchain NEAR Protocol’s NEAR token also rose double digits over the past 24 hours. NEAR was recently changing hands at $2.72, a 9% gain since Tuesday, same time. The price pump followed the protocol’s announcement that it was collaborating with New York University to start a Web 3 learning workshop. SAND, the token of metaverse game The Sandbox, was down 2%, its recent momentum after an announcement earlier this week that the Saudi Arabia Digital Government Authority would be partnering with the platform.

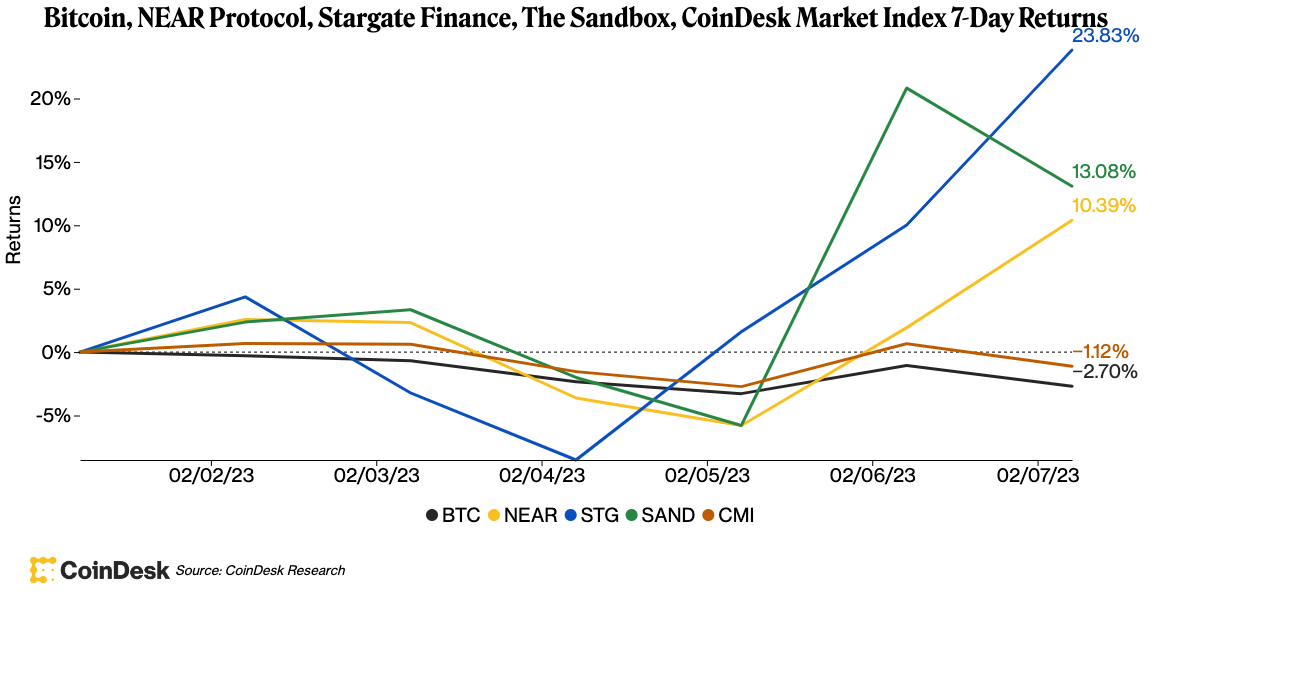

Bitcoin, NEAR Protocol’s NEAR, Stargate Finance’s STG, The Sandbox’s SAND, CoinDesk Market Index 7-Day Returns (CoinDesk Research)

Meanwhile, the two largest cryptocurrencies by market capitalization, bitcoin and ether were recently down roughly a percentage point to hold their most recent support. Bitcoin (BTC) was trading just below $23,000, while ether (ETH) was changing hands above $1,650. The CoinDesk Market Index which measures the overall crypto market performance was also down 1.4% for the day.

coindesk.com

coindesk.com