Virtual world Sandbox’s SAND token is witnessing a surge in price over the month ahead of its token unlock scheduled for Feb. 14.

Token unlocks, which are usually considered bearish events, appear to be having little effect on the price of Sandbox’s SAND token in the lead-up to releasing more supply. The project will be releasing 12% of the token’s supply, equivalent to around $273 million worth of SAND, to seed and strategic investors, according to Token Unlock, with half of the 12% going to investors, according to a report from Kaiko Research.

SAND is the utility token used on The Sandbox’s ecosystem as the basis for transactions and interactions. Its price has increased 90% since the start of the year and is now trading at $0.74, according to data from Messari. Notably, however, the token is still 90% down from its all-time high of $8 reached in November 2021.

Token unlocks refer to the process of releasing tokens blocked under the terms of the project's funding rounds or fundraising efforts. They have often been considered bearish events, given that they release more supply of the asset into the market. However, more recently, unlocks seem to have undergone a change in narrative, with tokens that have upcoming unlocks rallying ahead of them. Rallies in tokens such as Aptos (APT) and Axie Infinity (AXS) ahead of recent unlocks are two examples.

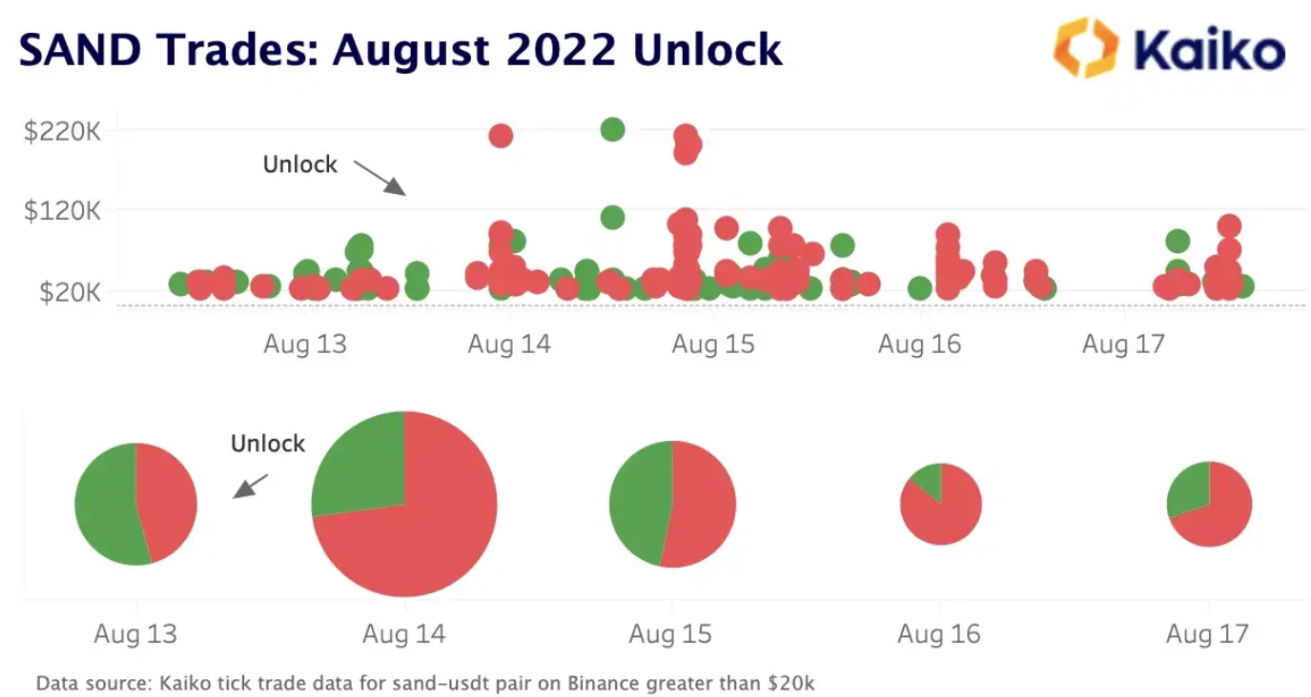

“The thing to watch with unlocks is % to investors: if [around] 50% expect heavy sell pressure,” wrote Conor Ryder, a research analyst at Kaiko Research. In a report looking at Sandbox’s previous token unlocks and price movement, Ryder concluded that given that the token allocation for this upcoming unlock is similar to the August 14th one, there will be similar underperformance for SAND as sell pressure picks up.

“The day after the unlock on August 14th, nearly 75% of all significant trades were sell orders as investors looked to cash out of SAND. That sell pressure continued in the days after the unlock as sell orders dominated buys,” wrote Ryder.

“The allocation of SAND unlocks is skewed towards investors and the token performance has suffered during unlocks as a result,” he added.

The Sandbox has an unlock schedule which is due every six months until 2025 with the same allocation to investors. Therefore SAND holders could look to face serious headwinds until then, according to Ryder.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

coindesk.com

coindesk.com