You might also like

Tron’s Price Drops 8%, USDD Depegs Amid Huobi Turmoil

Stablecoin Wars Enter New Phase As USDT Demands Plummet

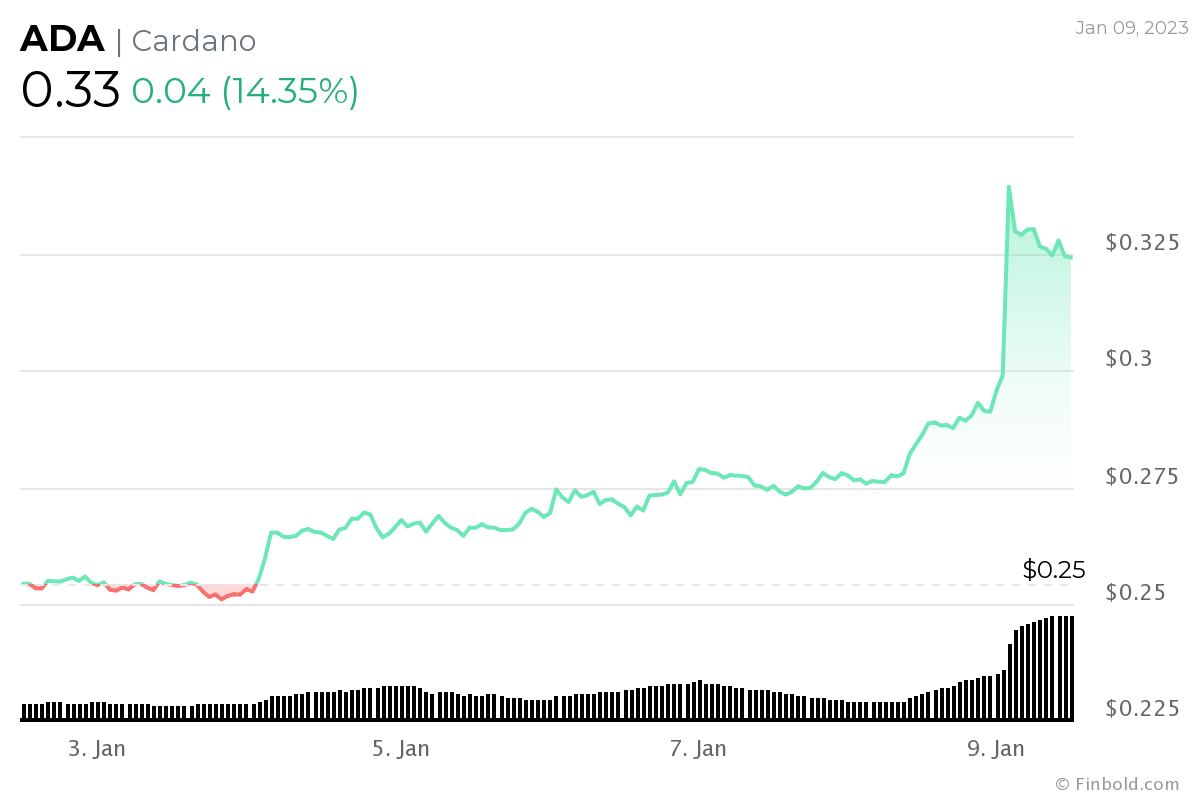

Cardano (ADA) has been experiencing a steady uptick in buying interest alongside a dramatic price surge independent of the broader crypto market.

Cardano’s market valuation was $11.31 billion at the time of publication, rising by nearly $1.56 billion in just 24 hours. Each day, ADA’s market value ascended until it reached $11.74 billion.

In response to this influx of capital, ADA’s price has skyrocketed, rising 14% in the past 24 hours to trade at $0.33 at press time. Cardano’s value has increased by more than 28% in the previous week.

Having broken beyond the $0.30 resistance level, this might be a vital support for ADA’s eventual recovery to $0.50. However, though there is still interest in the smart contracts asset, if investors start cashing out, the asset’s value might drop.

ADA’s rally triggers

ADA has generally followed the rest of the cryptocurrency market in the past, so the reasons for its recent, dramatic surge remain vague. However, the market’s recent short-term gains have contributed to today’s upward trend.

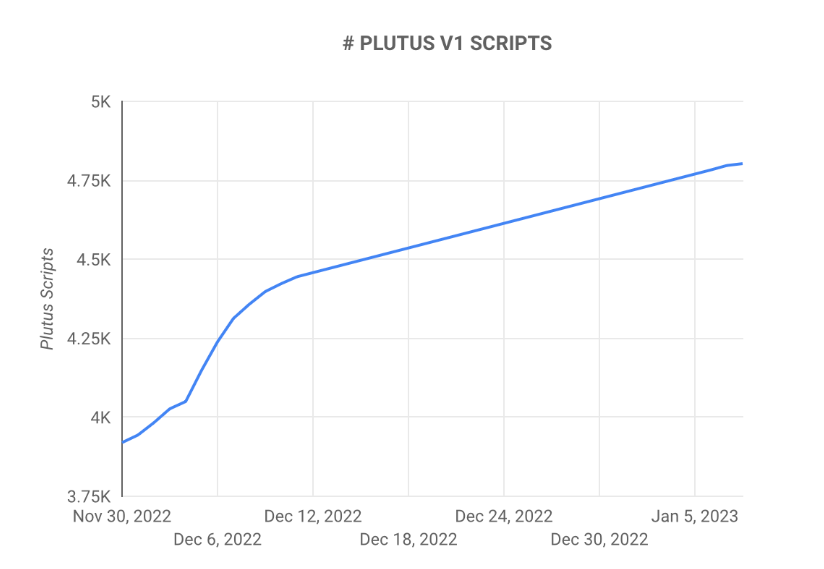

Several reasons have contributed to ADA’s recent success, but expanding its supporting networks has become crucial. For instance, smart contracts continue to see significant growth on the platform. For example, as of January 8th, there were 4,803 Plutus smart contracts, an increase of 780 over the previous month.

Cardano hopes to continue the upward trend seen in the core network’s activities in 2022. Similarly, there has been a rise in the number of ADA “whales” or extremely wealthy investors placing large bets on the token’s price increase shortly.

Additionally, more development efforts will likely accelerate ADA’s potential growth. In this vein, the network anticipates launching two stablecoins in the first three months of 2023.

Hydra, a solution for Layer-2 scalability that aims to increase transaction speeds with low latency and high throughput without sacrificing the cheap gas charge, is also awaited by the community.

ADA technical analysis

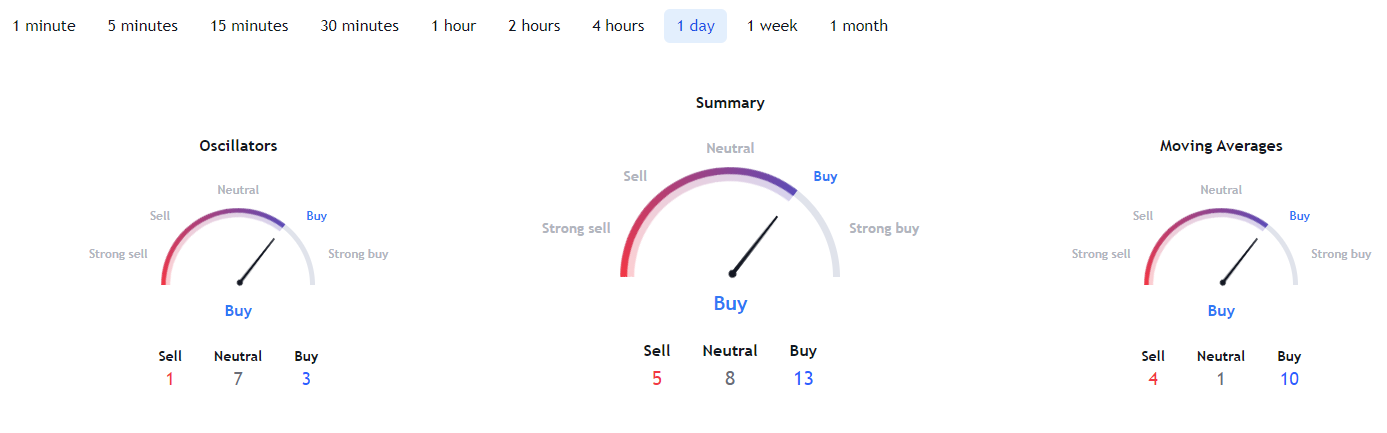

TradingView’s technical analysis of ADA is positive. According to many daily indicators, the ‘buy’ sentiment is currently at 13. The moving average gauge is for ‘buy’ at 10, and oscillators align with ‘buy’ at three.

Until then, gloomy forecasts persist for ADA despite the token’s price recovery. According to PricePredictions’s machine learning algorithm, the token may be worth $0.2756 on January 31st, 2023.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. You are strongly advised to conduct your research and bear your own investment risk.

coinculture.com

coinculture.com