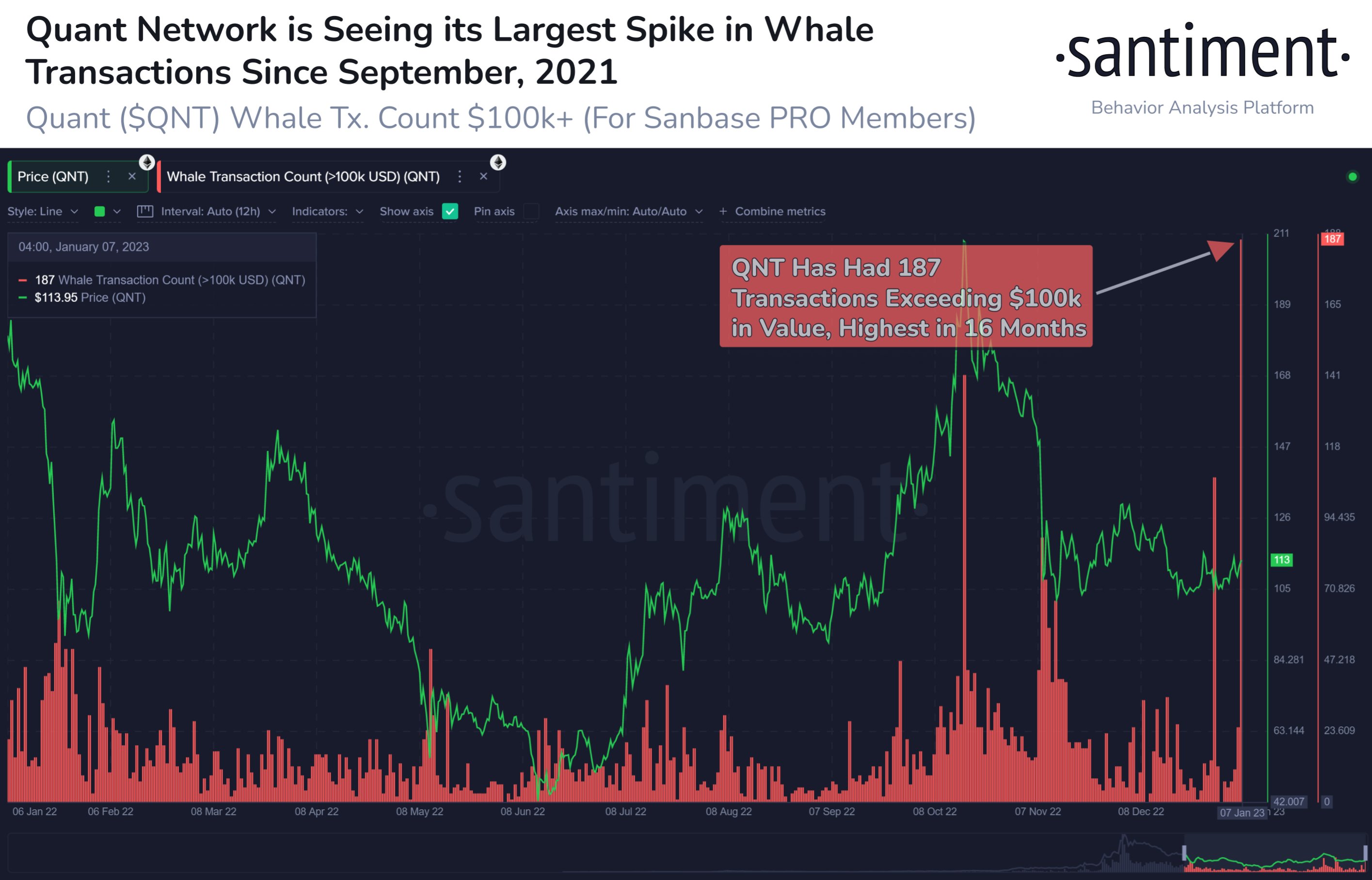

Crypto insights firm Santiment says that one Ethereum-based altcoin just experienced its largest surge in whale activity in almost a year and a half.

According to Santiment, interoperability blockchain Quant ($QNT) had 187 six-figure transactions on January 7th, the most since September of 2021.

“After its modest +10% price spike after its last whale activity spike on Dec. 30th, Quant has now shown a much larger amount of whale transactions on its network today. There are 187 $QNT transactions valued at $100,000+ today, its largest in 16 months.”

The Quant Network, powered by $QNT, is a protocol that aims to build connections between blockchains and provide real-world solutions that lower costs, enable new business and mitigate risk.

$QNT printed a green candle last week, putting in over 10% gains as the Ethereum-based token rallied from $105 on January 4th to $116 at time of writing.

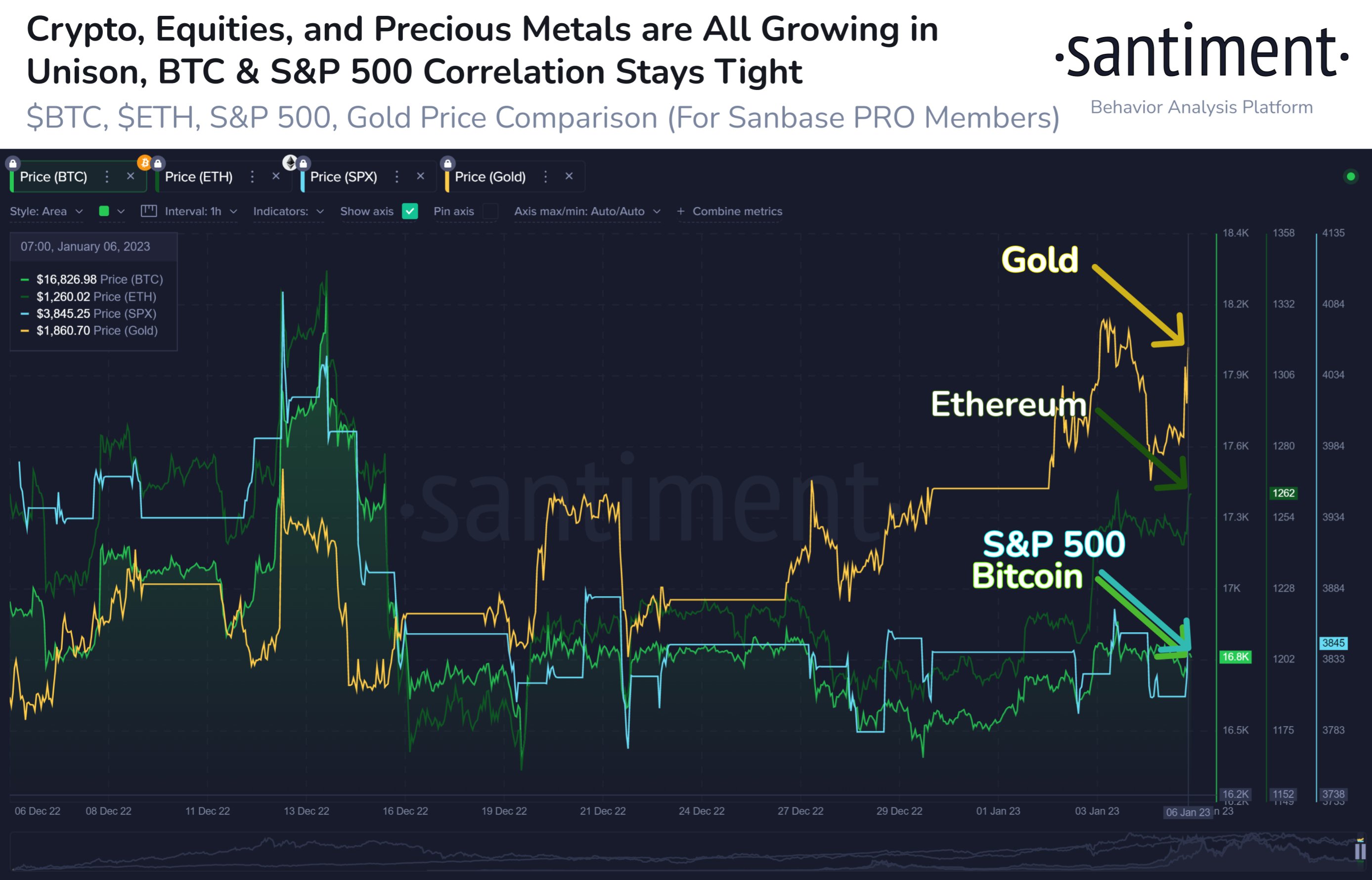

Santiment also says that while crypto markets are slowly recovering as 2023 unfolds, they remain tightly correlated to the equities market. According to the firm, a break of the link between the two markets would be positive for Bitcoin ($BTC).

“Crypto markets are continuing their steady 2023 recoveries, especially Ethereum & altcoins. After some separation between the SP500 & Bitcoin following the FTX implosion, the two remain very correlated. A correlation break would be good for $BTC.”

At time of writing, Bitcoin is trading at $17,187.

dailyhodl.com

dailyhodl.com