High-value traders, not retail investors, are behind Binance Smart Chain’s rapid growth, according to a report published Wednesday by the blockchain data firm Nansen.

Nansen drew the conclusion from blockchain data, including the active addresses labeled as big traders by Nansen and stablecoin transactions by value on BSC.

For example, the value of stablecoin transactions worth at least $1 million counted for over 90% of total stablecoin volume in April when popular decentralized exchange (DEX) PancakeSwap saw a flurry of activity. As late as August, these crypto deep pockets still composed about 30-40% of total stablecoin trading volume.

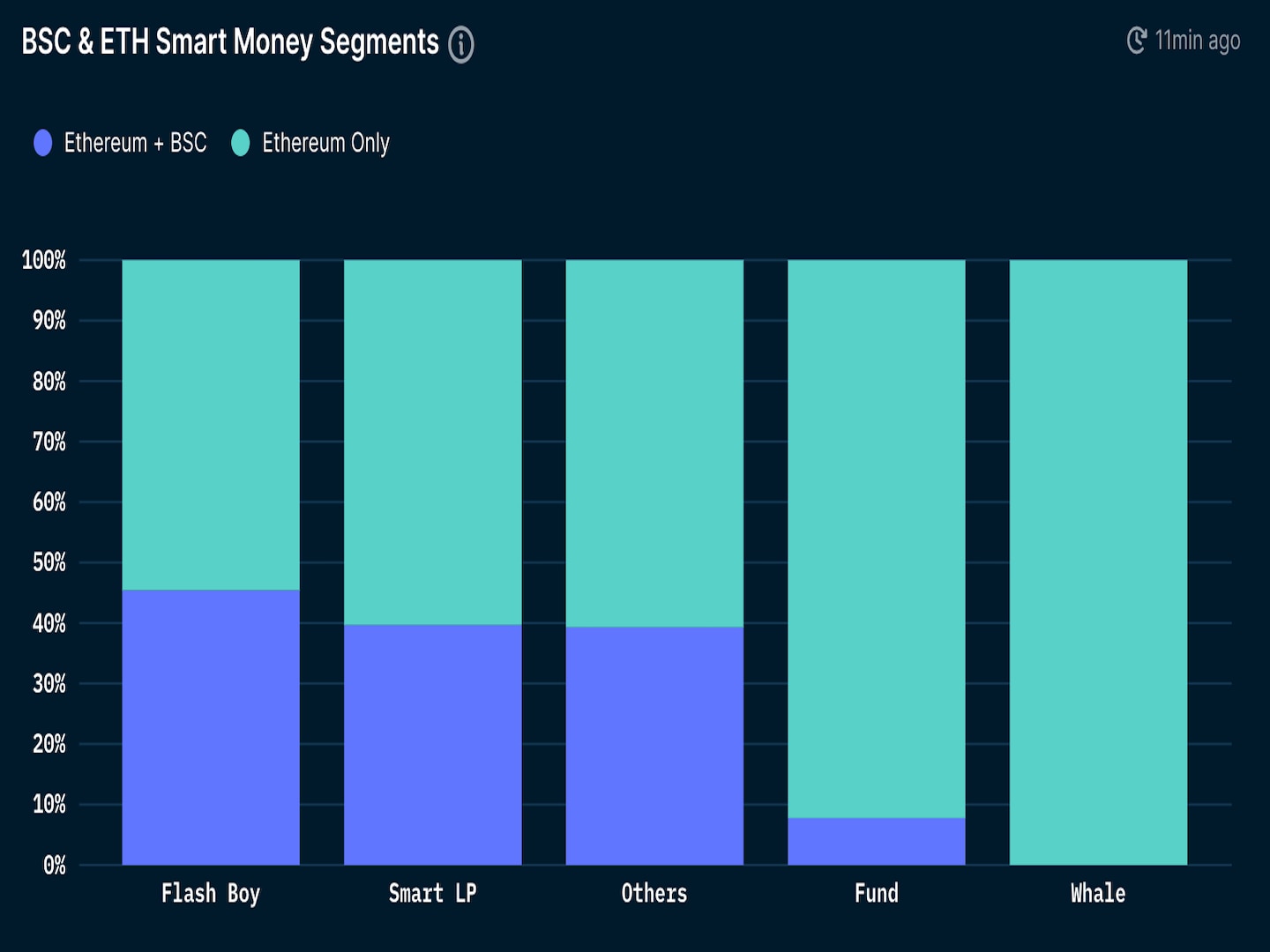

“Smart money interaction is one of the possible positive indicators of a certain project or protocol,” Nansen’s report said. “Interestingly, as much as how BSC is negatively looked upon by some, data shows that quite a sizable amount of smart money addresses have dabbled in both BSC and [Ethereum].”

Nansen’s findings counter popular belief that the huge success of BSC, the layer 1 blockchain supported by Binance, the world’s largest centralized crypto exchange by trading volume, has resulted from retail investors seeking lower transaction fees. By offering cheaper, faster transactions, BSC has gained traction against Ethereum, the most used decentralized application blockchain, as transactions on Ethereum have become more expensive.

As layer 1 blockchains, both Ethereum and BSC specialize in smart contracts, which allow software developers to run codes that can automatically process financial activities such as lending and trading.

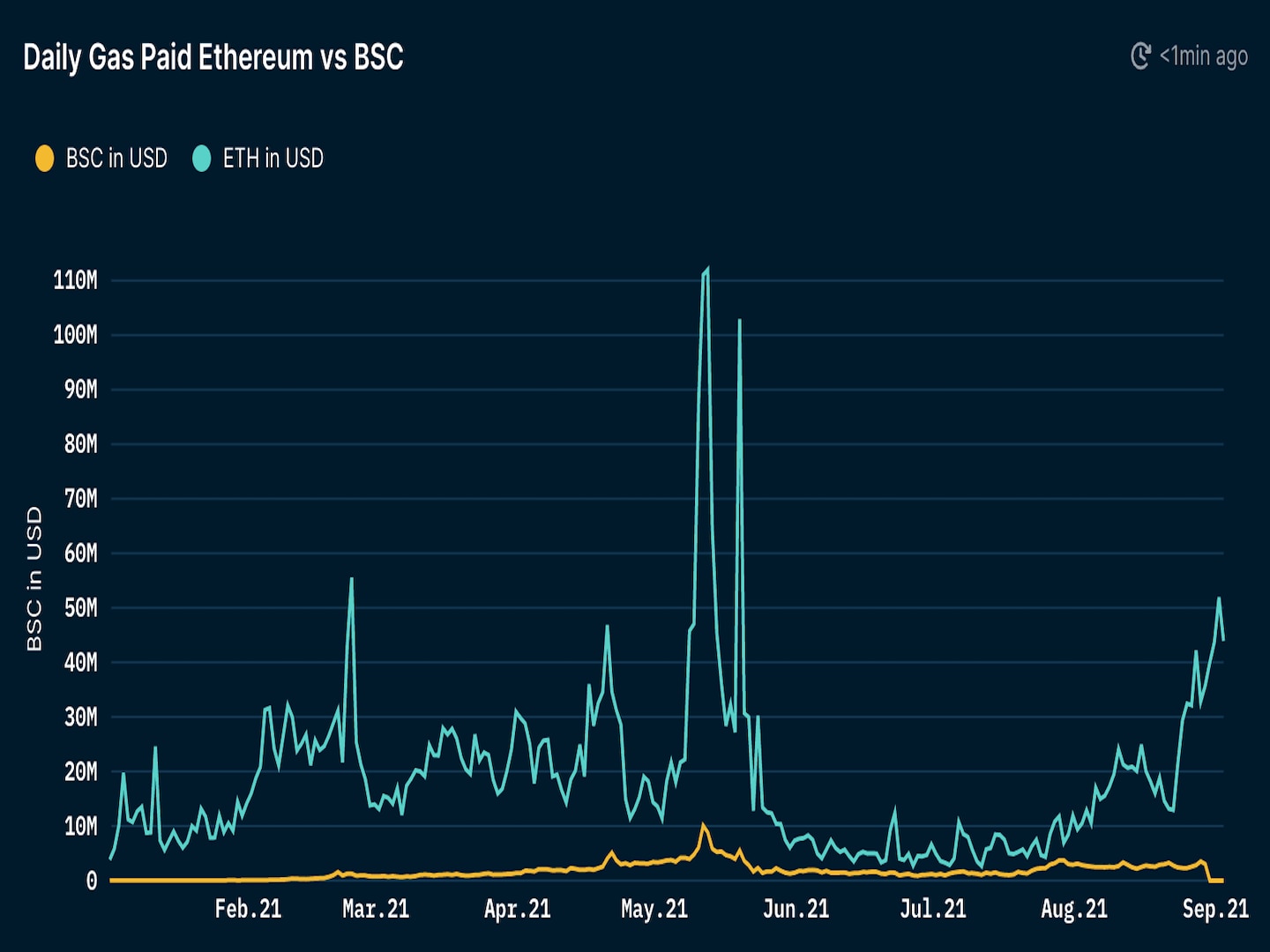

“On average, the gas price on BSC is only 10%-20% of that on Ethereum,” Nansen said in the report. “This is what made BSC so attractive, especially to the retail market with a smaller wallet or fund size as well as developers who do not need to worry about high transaction fees affecting adoption.” Gas fees refer to the cost of transactions on blockchains.

gas fee on BSC vs. Ethereum

While highlighting the role that high-value investors have played in BSC’s success, the Nansen report also questioned how BSC will “evolve and work on strengthening their position in the market,” as layer 1 blockchain competition intensifies,

Market participants said institutional investors have become more attracted to layer 1 newcomers, including Solana, Terra, Avalanche and others that have received funding from top venture capital firms.

BSC also has received criticism for being less secure and decentralized due to a growing number of “rug pulls” or exploits on BSC, as CoinDesk reported. BSC’s security algorithm, known as Proof-Of-Staked-Authority (PoSA), is controlled by only 21 node operators versus Ethereum, which currently runs thousands of active nodes.

“There is a trade-off between more decentralization versus speed, so we thought that 21 nodes run by the community is probably enough,” Binance’s CEO Changpeng Zhao said in an interview with CoinDesk previously.

coindesk.com

coindesk.com