Every Statement of Dr. Doom Against Crypto Can Be Easily Defeated — Here Is How

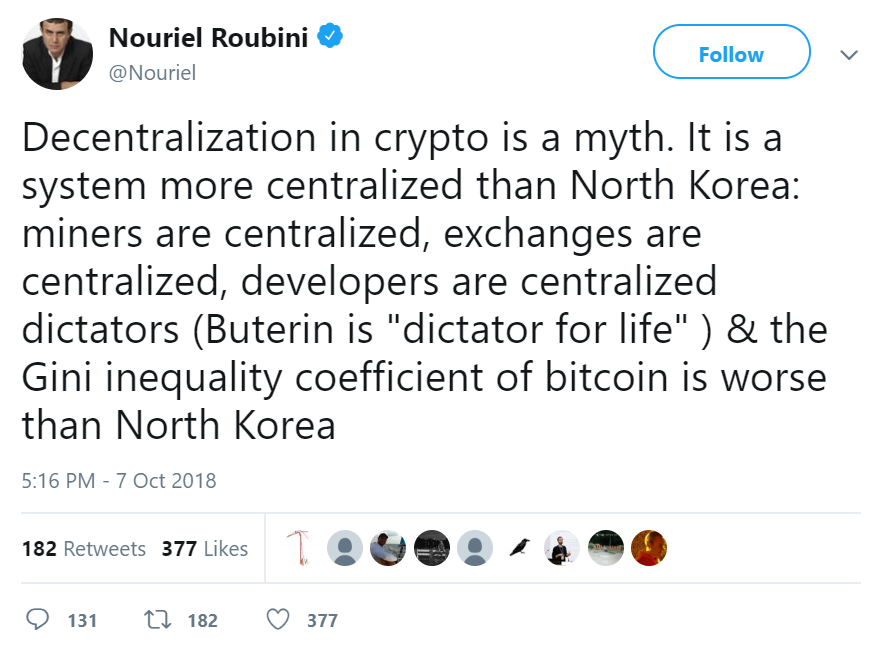

In a recent tweet made by Nouriel Roubini (who is better known as Dr. Doom due to his generally pessimistic predictions) about the traditional financial system which he claims is going to face a severe recession we don’t even have the tools to fight against. He also made even stronger statements about crypto:

“Partially, Roubini is right, as regulators really try to push all new decentralized system in an old one and control it as much as possible,” says Nikolay SHKILEV, PhD, Blockchain expert and Top ICO/STO Advisor. “The new powerful player is independent, and this is unprofitable to financial bigwigs of old system.” Indeed, it depends on a point of view. Nevertheless, if we examine the statements made by Roubini, we can easily find them inaccurate at best case scenario. Let’s do it step by step.

“Decentralization in crypto is a myth. It is a system more centralized than North Korea”

As a matter of fact, any person, corporation or government can send bitcoins from anywhere in the world to anywhere else, as long as both parties have internet connection, whether that is landline or mobile. Crypto is surely a decentralized system in such a way that any person, legal entity or government body can transact with it regardless to their political view, religious background, their beliefs, or adoption of any thoughts whatsoever. The comparison is poor. The situation in North Korea is nothing close to this, nor the situation in the western democratic world. If we check the list of countries which can’t use SWIFT to make international transfers, we will find out that the list is not short. Decentralization provides such countries to transact with the rest of the world, regardless of their political views.

“There is a set of solutions, projects, products, the exchanges which are completely decentralized already. You can be in contact with any spot on the globe and receive any sums of money in cryptocurrencies in five seconds. Without sanctions, control, not depending on banks, bad laws and regulators. Try to make international payment in USD and you will understand what I am talking about — it takes 3 to 5 days to get payment, after you have answered a hundred questions from bank and provided dozens of documents,” Nikolay SHKILEV shares his views on the benefits of decentralized system, with no myths about ‘North Korean dictatorship’ in sight.

“Miners are centralized”

Any person can purchase a mining equipment to mine any cryptocurrency, whether that is Bitcoin, Ethereum or any other coin, through an ASIC, GPU or FPGA. Indeed, some miners have smaller equipment while others have made huge investments in mining facilities. But even those huge mining facilities mostly end up leasing their mining power to end users as this turns out to be a much more profitable scenario than mining the coins for their own profit. They hook the end users this way with a one year or multi-year contract where they can secure certain fixed revenue regardless to the volatility of cryptocurrencies. Until now, there were no centralized “management” of cryptocurrency, and none there ever will be.

“Exchanges are centralized”

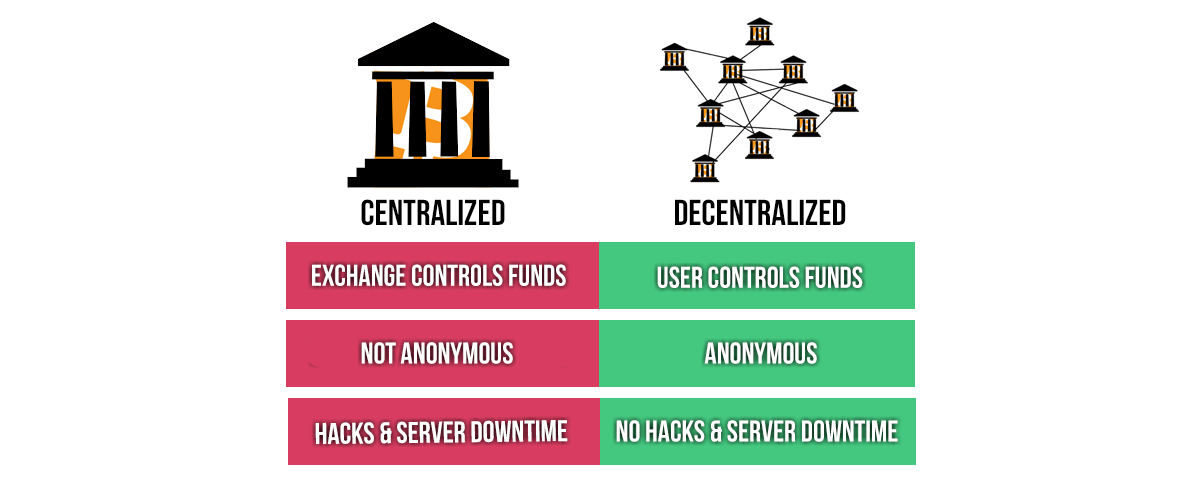

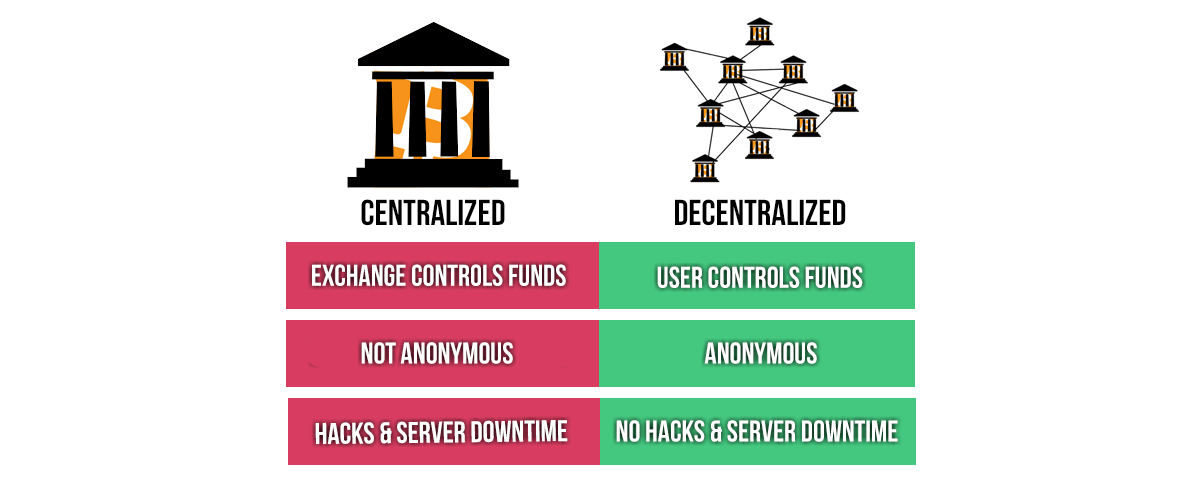

First of all, having a centralized exchange is actually healthy for the crypto industry, because this insures that no illegal activities like money laundering, terrorism support and drug trade will be conducted on such exchanges. In turn, this will encourage regulators to welcome cryptocurrencies and integrate them within the current financial system. Still, there are decentralized exchanges already like Bitsquare & Bitshares, and those who are not yet decentralized like Binance, which becomes decentralized as early as next year. The below diagram compares centralized and decentralized exchanges and sheds some light on major differences between both:

The future of exchanges lies in decentralization as well.

“Developers are centralized dictators (Buterin is dictator for life)”

Vitalik Buterin is neither the CEO of Ethereum blockchain, nor can he individually decide to do certain implementations on Ethereum blockchain. Yes, he is the co-founder and his views are well respected for a very good reason. However, there is a democratic voting mechanism where all participants from all over the world who hold ETH can vote for or against any proposal. Also, all changes are 100% transparent, they are all available on GitHub, where anyone from anywhere in the world can view and criticize them, and suggest a better solution if they have one. Until today, there has been no such cases like in North Korea where a single party has taken a one-sided decision and implemented a change based on an order given by a dictator. The truth is that all changes have followed a fully transparent and democratic voting mechanism.

“The Gini inequality coefficient of bitcoin is worse than North Korea”

In best case scenario, Roubini has totally miscalculated the Gini Index for Bitcoin, and in a more rational scenario this index does not even apply to Bitcoin and here is why:

-

In order to calculate the wealth distribution, you have to identify the audience first. How did Roubini do it? Did he take into consideration that there are few wallets which belong to huge exchanges or investment firms who represent hundreds of thousands of customers? Most probably he did not, since this is a private information and exchanges will never ever share such sensitive data with him.

-

Did Roubini take into consideration the thousands of totally empty wallets, semi-empty wallets, and those which has not been used for ages (most probably the private keys has been lost forever)? Such wallets will make the index look worse, although in reality they are totally irrelevant as they don’t represent actual ownership. Lastly, any person can connect to the blockchain and automatically generate thousands of wallet address through an automated program for testing purposes. Such numbers of wallets should not be taken into consideration for wealth distribution. However, no one can connect to a certain bank through an API and generate few thousands of bank accounts.

-

How about market adoption? We are still at the infancy stage, we don’t even have ETFs approved by the SEC yet. How can we measure wealth distribution when the public does not have an easy way to access such an instrument? Nor we have any regulation in place, most of the countries are still in the process of understanding the impact of blockchain, crypto & ICOs on the current financial system. This will take few years in the best case scenario where there is a global framework which regulates this sphere. Nikolay SHKILEV supports this criticism as well: “There are a lot of barriers to cryptocurrency and blockchain now in US, perhaps even more than in North Korea. But for the rest of the world, the mechanism is operating, it's a 'drink of freedom' and independence.”

-

How about wealth distribution in the US? “The richest 1 percent in the United States now owns more additional income than the bottom 90 percent," — the Oxfam briefing paper states. Roubini was referencing the wealth distribution in North Korea, while it seems the US is not much better.

Conclusion

So, it seems that the bold statements of Nouriel Roubini are not sufficient enough in his attempts to depreciate cryptocurrencies. More than that, this time his arguments and references look unprofessional, baseless, and more provocative than reasonable. Decentralization is not a myth, it is a reality in its early stage. Too bad for a respected economist to deny the immutable changes which take place here and now.