Blockchain – the gold rush or a dotcom bubble?

Coming crash of cryptocurrency has been discussed almost since its emergence. These talks are caused by extremely big profits which are made very fast and quite often by chance, as well as incredibly high volatility.

The current situation – bitcoin's fall in price and probable split into two coins in August certainly don't make more people trust in virtual coins. What will happen next – is the open question. The fall may be followed by a growth or a deeper decline. But even if we imagine that cryptocurrency as we know them will collapse soon – is this phenomenon going to leave without a trace?

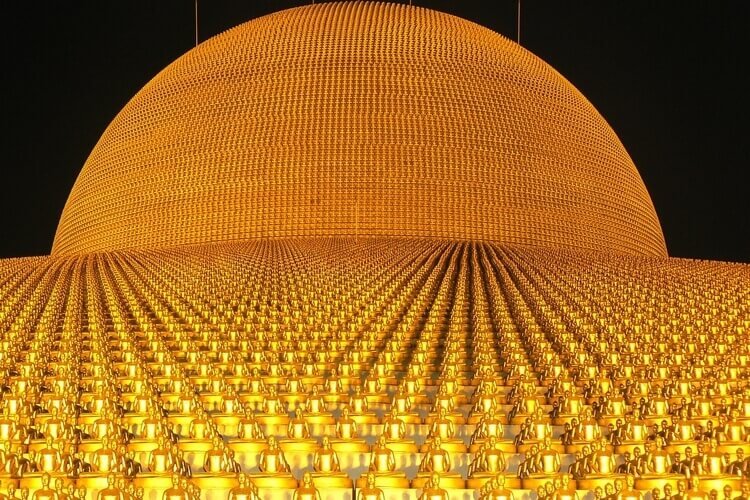

Cryptocurrency rush

It's not the case. Blockchain as a technology of distributed database with information allocated in the blocks, will never disappear. It is blockchain that makes a basis for bitcoin and other cryptocurrency. However it is applied not only in the sphere of digital money. It's hard to imagine that such significant advantages as decentralization and transparency wouldn't attract new users.

But how many – that is the question. "Fashion for blockchain will come to an end sooner or later, and it will remain only as one of the technologies for the use by specialists," warns Evgeny Sidorov, technologies director at "Sibrus". He compares its enormous popularity to the Gold Rush: only those who served it finally won.

Alexander Kuptsikevich, financial analyst at FxPro compares the current situation at the cryptocurrency market with notorious dotcom bubble. As expert says, both cases witnessed the emergence of a technology that had a significant impact on economy. But this craze has led to a crash.

Serious matter

There is one important sign showing that blockchain is here to stay – states and business are interested in it. It's not a secret that more and more countries are getting concerned with creating bitcoin-legislation – Japan, India, Australia. Russia doesn't seem to be left behind. Some kind of compromise has been worked out following intense debates. In the next 1-2 years it will become a reality in shape of a draft legislation.

Banks led by Sberbank are paying more and more attention to cryptocurrency and blockchain respectively. Head of Sberbank German Gref has repeatedly spoke out about great potential of digital currency. And on the sidelines of the Saint Petersburg International Economic Forum Vitalic Buterin, Russian-Canadian founder of Etherium even had a meeting with Vladimir Putin.

Some steps to exploration of blockchain has been made in Ukraine – back in 2016 it signed an agreement on use of online-actions within a public procurement system. There also some discussions about creation of "cryptohryvnia" – the first national cryptocurrency.

As for megacorporations, Microsoft has become a leading member of Enterprise Ethereum Alliance, which unites more than 150 companies including MasterCard and Cisco Systems. Even financial giants like Goldman Sachs are getting interested in this technology. However it's not only about big business.

Smart contracts

"In the future blockchain will even replace traffic-lights," believes professor Roman Beck, founder of the European Blockchain Center. As he says blockchain is divided into three generations – the third one however exists only hypothetically and rather means a possible progress. The first generation was used only for financial transactions. The second one is the generation of Ethereum, cryptocurrency created by Vitalic Buterin.

It helps for example to track the authenticity of the products which can be replaced by a cheaper surrogate – cold-pressed olive oil or a fish. Here comes one of the main advantages of this technology – majority of network users store this data, that is why counterfeit is impossible.

This kind of verifications may take place in every sphere – for example when it comes to documents: for private property, education, tax payments... Even online gambling and casinos are on the list. It's all may be united by a common term – "smart contract”. Deals that were signed by using this system don't require participation of a notary – obligations of all the parties and the following actions take place automatically.

However using it in these spheres is not so perfect as it seems – there is still a risk of providing false information at the initial stage. Another problem are unscrupulous producers refusing to work with these systems. They will hardly want to deprive themselves of the excess profit from a "limited series" of expensive watches that can be made 10 times more than it was declared.

So blockchain is unlikely to conquer the world... at least too soon. Of course, the huge funds invested in technology, attracts those want to make easy money – a lot of unreliable ICO is a clear evidence. But in fact all this is nothing more than attempts to lim it the sphere of application of perspective development. "At the very beginning of this technology development, there has been no efficiency benchmarks and clear prospects for using it. That is why it's easy to "sell" your fantasies on its development to non-specialists," believes writer Kirill Nikolaev from "Bitcoin VIP", author of the book "Intellectual stroke". But soon this sphere will be finally occupied and it will mark a period when blockchain becomes a part of a daily life for million people.