How Bitcoin Crash Can Trigger a Network Collapse

The recent dust attack on the bitcoin network reminded about themselves when crypto wallets started to receive microtransactions in $0,045 (0,00000888 BTC). Possible deanonymization caused a violent commotion among the users, but everyone forgot somehow about the main threat of such attacks for the entire bitcoin network.

The history of dust attacks began in 2015 when spam from tens of thousands of tiny microtransactions filled all the blocks completely. However, the developers were aware of this danger much earlier. So how dangerous is the actual threat of a dust attack for users and what is a global damage from it throughout the bitcoin network?

Dust attack as a threat to wallets

The recent bitcoin spam on traders’ wallets has made the crypto community remember about such threat as dust attacks. Crypto wallets immediately took advantage of this news to remind users of their privacy protection methods, strongly recommending to ban the “dust bitcoins” with UTXO-marks received from an unknown sender to avoid their accounts deanonymization.

Recall that UTXO as unspent transaction output actually is the basis of bitcoin network, which provides a mechanism for payments accounting. And each new transaction stores information about all previously moved UTXO-marks. According to the blockchain specialist of the international cybersecurity company Ilya OBUSHENKO, such labels have long been used by experts to build a graph of communication between wallets: ”However, we can not say that this directly leads to a loss of funds, since anonymity is affected by a huge number of other factors: the mention of the wallet on the forums, cooperation with exchanges, communication with other traders offline". According to the expert, dust transactions can help an attacker to link different bitcoin addresses, but it can’t provide access to the anonymization without additional entry points.

But instead of thinking about the real consequences for the whole network, everyone calmed down to learn that the attack was just a marketing ploy of a bitcoin mixer offering dust newsletters as advertising. Why did no one remember the damage these attacks caused to the entire bitcoin network in the recent past?

Dust attacks - stress tests for bitcoin network

Back in 2014, developers began to think about the shortcomings of the original genesis block of bitcoin and its capacity in 1Mb, when Mike HERN introduced the first hardfork in the history - Bitcoin XT. His plans were to increase the block size to 8 MB and throughput to 24 transactions per second. The need for such a solution was confirmed by Bitcoin Core developer Gavin ANDRESEN, publishing a network and client scaling plan BIP101. And although hardfork didn’t gain the support of miners majority, it has got the followers in the community who decided to show the vulnerability of the network. They chose to make the need of immediate upgrade obvious by using quite costly provocations.

At the end of June 2015, the British mining company CoinWallet decided to conduct a stress test by launching a dust attack on 10 servers with a total volume of microtransactions of 200MB. As a result, the fee increased from $0.4 to $0.6 per 1Kb, and the waiting time for confirmation of transactions with normal fees increased from 1 to 87 blocks. The test cost the company about $ 26 040 (105 BTC), but according to its representatives, it was only 15% of the target volume, after which the network completely fell down.

And in a couple of weeks, in July 2015, the network was again attacked on a large scale. As a result - transactions filled in all the new blocks. At the time when the attack started, an anonymous user wrote “RIP Bitcoin” in the chat of bitcoin developers, - this fact says it was intentionally planned. During the 14 days of the attack, the network was overflown so much that the confirmation of the transaction took about 14 hours, and the average fee increased to $0.45 to $0.7. To avoid the disaster, the developers have released a new update - Bitcoin Core 0.11.0 with a microtransaction filter of $0.003 (0.00001 BTC).

Until now, analysts argue whether it was another attempt to find the limits of the network or there were the attackers behind it, who tried to destroy the bitcoin at all. But the first dust attacks were an example of how an increase in transactions amount could cause the network to collapse.

Greed tests and network crisis

The company CoinWallet was no accident associated with the followers of the blocks increasing. In order to prove the inability of the existing system to withstand the growing transactions flow and the need to switch to BIP101 once again, the company announced a new stress test for September 2015. According to the plan, 20 servers were to forward 750,000 microtransactions to each other in the amount of $0.03 (0.0001 BTC), which would increase the queue for payments with the standard fee to 30 days. But just a day before the launch, the company canceled the test and as a reward “for concern” gave users several hundred keys to wallets with a total amount of 200 BTC, that was almost $47,500 (according to the rate at that time: 1BTC = $236.5). And the greed test “paid it off”: thousands of users rushed to import these keys. Obviously, the company decided to get rid of criticism, provoking users to generate a dust attack.

The new UTXO anti-record of 100 000 unconfirmed transactions queue took place on may 6, 2017. The attack involved only one wallet, which sent itself more than 176,000 transactions. The attack cost the spammer 18 BTC, which at that time was about $28 530 (according to the BTC rate of $1 585). And although the ultimate goal was not clear, this example showed that the network collapse can be triggered even by modest costs.

But a glitch in the bitcoin network was not only influenced by the artificially created dust attacks: in February 2016 blocks was suddenly full to overflowing, with the result that the transaction threw only with the great fees of approximately $1.90 (0.0044 BTC) for 1Kb. This has exacerbated the crisis of the existing system and made clear that even small changes in transaction volumes and random factors in mining started to have a significant impact on the throughput of the bitcoin network.

Mining on the verge: less energy, more dust

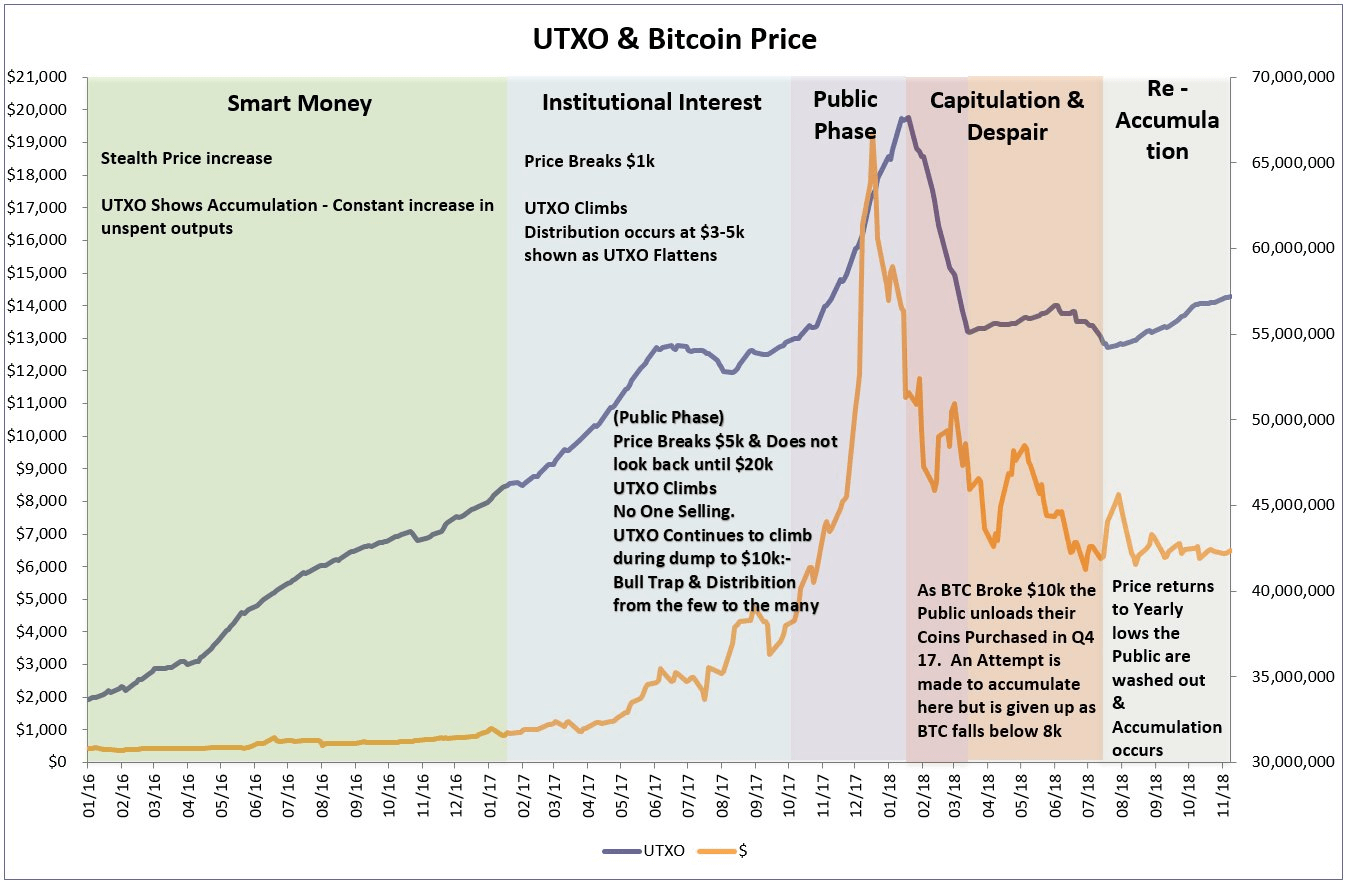

Nowadays there happened quite an ambiguous situation on the market, and several factors played the key role of several factors in the aggregate: the steep peak of bitcoin led to a panic situation when the shorters in the mass drain bitcoins and longers hold, while the complexity of the entire network has increased and made the work of miners unprofitable. As a result, they increasingly turn off their capacity and leave the market. The hashrate is falling, and the number of unspent transactions is growing. Thus this growing UTXO-dynamics shows a graph that was published in his Twitter cryptanalyst FlibFlib a few days before the critical fall of bitcoin: it reflects the correlation between the growing rate of unspent transactions and the bitcoin price.

What are the new dangers of this forgotten factor, is not clear yet. However, one cryptoanalyst and miner Ezra SALAZAR shared with Bitnewstoday.com opinion that mining is already on the verge of collapse, due to the increase of the flow at the network, the blocks are becoming more complex, and the costs of their production are unprofitable.

According to him, the network at this stage is very vulnerable to a dust attack, because it is enough just a few bitcoins to generate tons of dust. "To date, the fee in blocks reaches $1.30 per transaction, worth $0.17 (0.00002730 BTC). So using the blockchain this way is simply impractical when even the average fee of $ 0.063 (0.00001 BTC) transaction is $1.00, ” our expert says.

When transactions pass through a block, UTXO is added to the registry and complicate the structure of existing blocks, which in turn - weakens the entire network. According to Mr. Salazar, due to the loss of a significant part of the network capacity, now there is a new period of decline, when you can observe the transactions pushing through the block for an hour, while a normal average time is 10 minutes.

If the experts' forecasts come true, the current bearish trend of the market may indicate that the threat of UTXO accumulation in the network will soon become particularly acute. According to Ezra SALAZAR, unknown groups of people continue to flood the network with a bunch of tiny transactions of $1.85 to slow down their confirmations. We can only make the hypotheses whether the bitcoin network will face a new dust attack or blocks will suddenly overflow again for natural reasons due to the case when miners turn off their power. But there are definitely prerequisites for this. For example, if users decide to resort to advertising services of bitcoin mixers, then even according to approximate calculations, just ten customers are enough to make a dust attack on the basis of 75,000 people to make bitcoin network crashed again. After all, it is worth remembering that the current block size of the bitcoin network still ranges from 1 to 2 Mb.