With Over $1.4 Bln Raised in 2019, Are IEOs Replacing ICOs?

31 May 2019 11:42, UTC

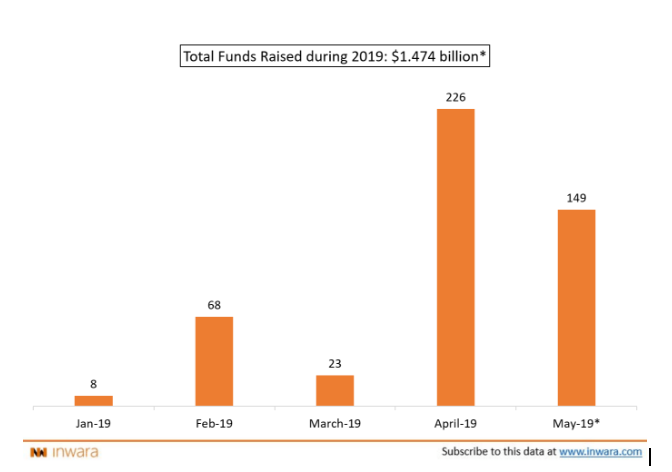

In May of 2019, the funds raised by IEO projects crossed the $1 billion mark with total funds raised by IEO projects globally reaching over $1.6 billion dollars with a majority of these funds, a majority of these funds ~$1.4 billion was raised in 2019 alone (source).

On the other hand, ICOs have raised ~$1.1 billion so far into 2019, so for the first time, funds raised by IEO projects have crossed funds raised by ICO projects (source)!

Funds Raised by IEOs during 2019

Source

*Total funds raised includes $1 billion raised by Bitfinex. Not represented in graph

With such large sums of money being raised by IEO projects in such a short time frame, the important question here is “are startups preferring IEOs over ICOs? If so, why?”

The Initial Exchange Offering model

12-03-2019 16:41:00 | Investments

A major factor responsible for the meteoric growth of the Initial Coin Offering model was the fact that it enabled access to a global investor pool very easily which is in stark contrast to traditional venture funding.

Traditional venture funding requires investors to prove a certain amount of wealth, in the US for example — one must have a net worth of at least $1,000,000, excluding the value of one's primary residence, or have an income of at least $200,000 each year for the last two years (or $300,000 combined income if married).

Given the technology and the low barrier of entry, these tokenized crowdfunding projects disrupted the venture funding space and carved out a space for its own.

14-05-2019 15:41:35 | Investments

Image courtesy of Medium blog