Binance Leadership Is Under Question

Now it is hard to believe that Binance was established in 2017 as in a short period of time Changpeng Zhao’s child managed to become the biggest crypto exchange in the world in terms of the daily transaction volume and was successfully holding this position for a while up to the recent point. According to the CryptoCompare’s report, Bithumb surpassed Binance by the trading volume, hitting $1.24B in November in comparison with the Malta-based exchange’s result of $641M.

If we have a look at another popular statistic resource, right now not only Bithumb is topping Binance but other exchanges like BitMEX, Coinbit and OKEx taking into account their reported volumes. Even judging by adjusted volume indicator, OKEx leaves Binance behind. So, considering that Binance has been continuously introducing new developments, naturally the following questions arise: what are the reasons that have made Binance to leave its throne, whether this situation is temporary or not and how much of the real state of affairs existing statistics actually reflect.

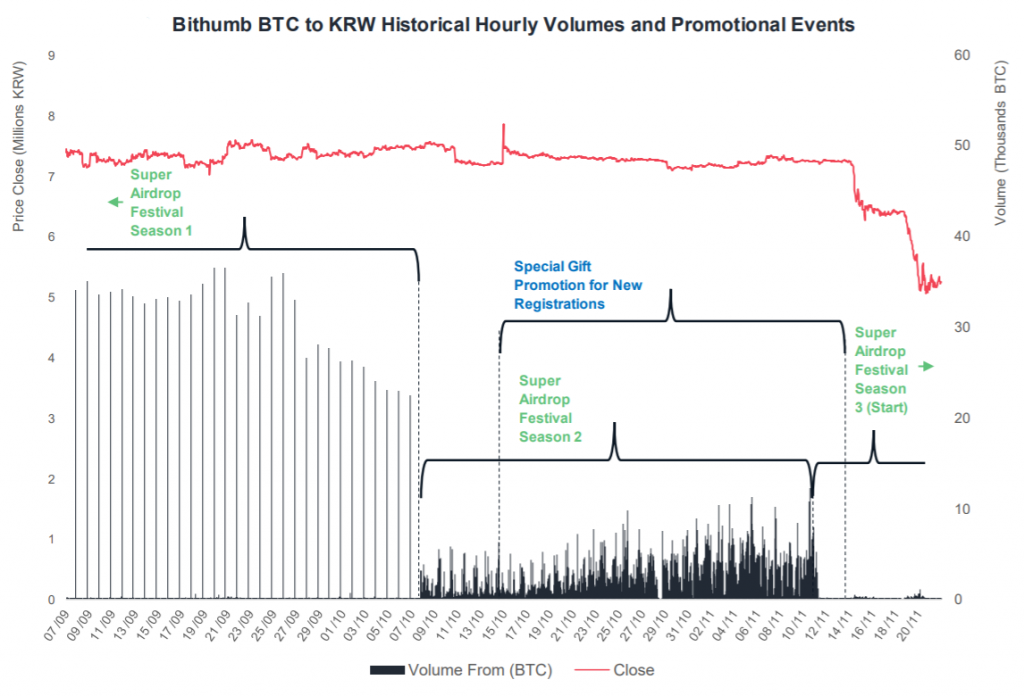

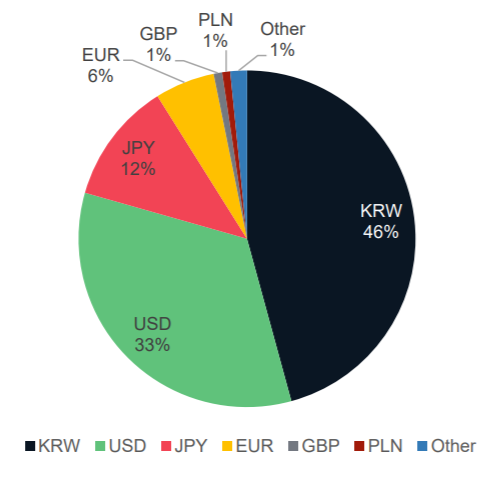

Regarding the above-mentioned report, Bithumb performed a 284% increase in the trading volume comparing to the September/October indicator mainly due to its acquisition by the BK Consortium, which implied additional funds invested in the exchange, that in turn allowed it to hold a series of airdrop competitions and raffles, offer different discounts and promotions to motivate users, including non-Koreans, to sign up to the exchange as well as to implement trans-fee mining, encouraging users to trade more actively for rewards. Moreover, the exchange is working out different mechanisms of interacting with their clients such as giving them an opportunity to vote for tokens they want to be listed.

From the chart above it arises that these marketing tools turned out to be quite effective since they did not only create the highest trading activity on Bithumb among other exchanges, but making Korean Won the most popular fiat for the BTC spot deals.

Our expert Seth LIM, who is the Founder of one of the Singapore blockchain-company, believes that incentive events for traders to do more trading such as temporarily reductions in trading fees or even a Tesla Model S giveaway to the trader with most volume transacted, which was once held by Kucoin, can lead to changes in the ranking of top exchanges, however these alterations are of a temporary nature. “In my opinion OKEx is the strongest competitor for Binance because of OKEx margin trading option”, - assumes our expert, continuing: “Margin trading is a more advanced trading option that allows traders to place orders of available digital assets with borrowed funds from OKEx, increasing the leverage or buying power compared to spot trading”.

Besides spot trading with margin and leverage, OKEx is also developing its derivatives. Already having its own futures option, the exchange recently launched a perpetual swap, that enables users to speculate the direction of the price of cryptocurrencies, which is an attractive opportunity for traders especially in the conditions of the current highly volatile market. Conceptually it is similar to futures contracts, except it has no expiry date while settlements are proceeded on the daily basis, which allows users to make a quick score.

This diversification of its offering together with support for the Vietnamese dong and business expansion in 20 more states the US cannot but attract new clients to OKEx, which can be a reason for it topping Binance. However, another expert Hussain ABOAZIZ, the Brand Ambassador of a blockchain payment platform, claims that besides spot trading OKEx calculates transactions with its futures and slippage passive orders in its reported trade volume, providing no data source to “anybody to recreate the calculations”, and therefore there is no sense to compare its performance to Binance: “exchanges calculate daily volume by different ways and these ways are not reliable”. Moreover, earlier this year, when OKEx was rated as number one exchange by trade volume, it was already accused for fabricating 93% of its trade volume.

“Most cryptocurrency ranking/tracking sites such as Coinmarketcap, MyToken, CoinGecko use a methodology via the API of crypto exchanges to report on the last price and 24h volume of each cryptocurrency being traded. However, it is entirely up to exchange operators to uphold ethical standards of presenting an accurate snapshot of their daily volumes through their APIs”, - points out Seth LIM. The expert insists that the data accuracy issue can be solved simply by implementation of an algorithm in the tracking API to verify the authenticity of the reported data as it is all just pure statistics: “For example an API that uses a trade algorithm can omit volume on cryptocurrency pairs that have less than 50 daily transacted buy/sell orders. Another example would be a detection algorithm to prevent trade bots from building up fake volume. The detection will trigger when too many buy/sell orders have a similar range in size in a short period of time”, - suggests our speaker.

Binance was also investigated for fake volume, but in its case no suspicious activities were found, which might indicate about the exchange’s transparent report and thus quite a natural decline in its trade volume in the conditions of the increased bearish mood on the market. However, are there other reasons for its worse performance besides competitors getting stronger and the overall market going down?

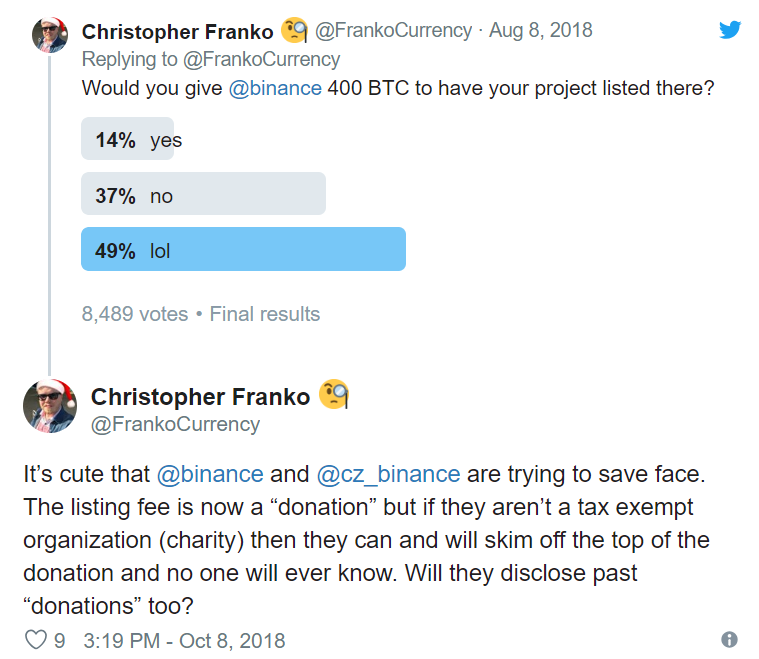

Hussain ABOAZIZ notes the recent rumors about Binance listing fees: “they list any project that can pay the fees regardless whether the project is good or not”. After submitting a listing request to the exchange in August the Co-founder of blockchain platform Expanse Christopher FRANKO was informed about charges of 400 BTC, which was equivalent to $2.6M at that moment, according to his words. Afterwards Binance announced that the company would no longer dictate the fee amount, nor its minimum and all listing fees would be called donations and be transferred to charity organizations, though mainly to its own Blockchain Charity Foundation, which gives the company an opportunity to return money from its in-house charitable arm.

Taking into account that Binance has already listed more than 160 coins, there is a chance that the operator accepts shitcoins too in case they have enough money, which could undermine users’ trust to the exchange.

Binance popularity could also suffer from the recent critiсal assessment by Weiss Ratings, a research and analytical company, since it considered the exchange not suitable for institutional investors, who Binance is striving to attract by its new sub-account feature. Analytics insist that the exchange does not correspond to institutional grade standards as its operation has not been examined yet by any auditors. Despite the fact that Binance moved to Malta and earlier this autumn new laws came in force, requiring blockchain projects to go through audits and receive a license, the government is likely to create the most favourable conditions for Binance to work on the island so that it will boost Malta’s further development into an international blockchain hub.

These problems together with the overall growing competition among the crypto exchanges, which is always a good sign of the industry development, could be the reasons for Binance to be left a little back, although there is still lack of instruments for accurate estimation of the operators’ performance and therefore leading positions may not be very indicating in terms of power distribution.