Decentralization Theory VS Decentralization Reality

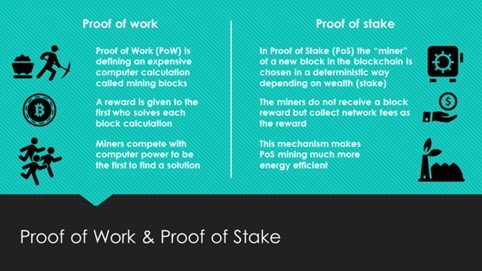

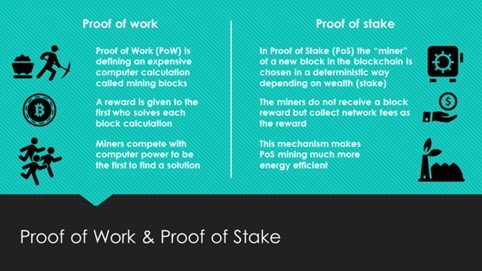

The Proof-of-Work (PoW), famous for its high electric consumption rate is used to validate transaction for Bitcoin, Ethereum, Bitcoin Cash, Litecoin, etc. In 2016/2017, you could easily buy a computer and GPU or ASIC processor to mine in your house and get paid. As the processor price increased and the consumption of electricity skyrocketed, it became less profitable for one single person to validate a block. The answer to this situation was the creation of a mining pool in cold geographic areas in order to concentrate the power and increase the chance to be profitable. So it occurred that today PoW is under the control of big players such as Bitmain which is the biggest mining company in the world. The result is the decrease of the individual node numbers and unfair distribution hash power over the cryptocurrency landscape.

The Proof-of-Stake (PoS) is at the opposite of PoW, where computer power is not required as it is based on the number of tokens held by the staker. You must keep your wallet online to have the chance to be chosen, and therefore there is some cost to the process of validation. And here comes the trick. Unlike PoW and hashing power, the cost does not scale if you own more of the coin. More wealthy individuals have a much larger incentive to validate in PoS and will also accumulate more coins at a faster rate. This leads to the concentration of voting power in the hands of the rich people or a lucky one who bought huge amount when tokens were cheap.

So we come to one conclusion:

The cryptocurrencies are far from being decentralized in reality, being quasi-decentralized at best.

Nevertheless, lots of massively advertised cryptocurrencies are rather centralized than decentralized. Here is a list of popular cryptocurrencies from TOP-20 with extremely high centralization.

- NEO is permissioned and non-trustless, controlled by 7 nodes, 5 of which are owned by NEO Foundation.

- TRON could hardly be more centralized. 98.5% of TRX circulating supply is held by one entity with 1% of TRX burnt and 33.25% locked up by TRON Foundation until 2020. Yet, they say at TRON ‘Decentralize the Web’.

- Stellar is permissioned and non-trustless with 81.7% of XLM owned by Stellar Foundation.

- Ripple is permissionless but non-trustless. 55% of XRP is in escrow of Ripple Labs, which puts it in control. However, 20 billion XRP are reportedly were awarded to Ripple co-founders.

Bitcoin, Ethereum, Bitcoin Cash, Nano, and Cardano have better decentralization. Their hashing power of Bitcoin, Bitcoin Cash, and Ethereum is rather evenly distributed between mining pools with no one’s share exceeding 20% as of November 2018. And they are all permissionless and trustless. Another cryptocurrency from TOP-10 Cardano is well decentralized. It is permissionless and trustless, and it is run by 70 nodes reportedly owned by more than 20 entities. Nano is yet another cryptocurrency with decent decentralization. Nano is permissionless and trustless and is run by around 600 voting nodes with no entity having absolute voting control even though the top 4 entities have above 50% of voting weight.

What does it mean for us in five bullet points?

- Trustlessness minimizes the amount of trust required from any single actor in the system. Distributing trust among different actors via an economic game incentivizes them to cooperate.These actors are independent and don’t trust each other. Permissionless is when you don't need permission usually from a central authority to host a node that contributes to the blockchain.

- Transaction validation looks like the standard financial world — hashing process is not really decentralized as it is now under the control of huge mining pools. Some pools will prefer to hash specific cryptocurrencies that are more profitable than the others that could represent a good project in the future.

- The number of nodes is not sufficient to get a true decentralized power. It can be reduced by non-profitable mining situation or due to low community number (User adoption).

- Development and upgrade are still under the power of a small community: Bitcoin Cash war is a sad example of community developers who fight each other and split the rest of the community in trouble (Roger Ver who supports Bitcoin Cash ABC and Craig Wright defending Bitcoin Cash Satoshi’s Vision (or SV).

- Token distribution is not evenly distributed at the early stage of the ICO. This creates whales that can easily manipulate dumps and pumps in the market.

Conclusion:

Just be prudent with the promises projects deliver. Always do your research and keep in mind that the technology is just in its early stage.

Image: Shutterstock

About the author:

Hugo Jacques is writer, speaker and Bitnewstoday contributor. He is the Founder of Block Chain Impact (Funding – Crowdfunding STO / ICO — Token Economy — Marketing — Exchange listing), CMO & Co-founder of SmarTransitMedia (Smart city solution for commuters).